Crowdfunding in Spain: market history and current state

Spain’s crowdfunding market had to start without any clear regulation. Only in 2015, 5 years after the market launch, a clear regulation was adopted, according to which all platforms should have been registered with the CNMV, Comisión Nacional del Mercado de Valores, and the conditions were very restrictive.

All Spanish platforms registered with the CNMV had to follow rigid limits in terms of both the maximum sum permitted to raise, 1 mln EUR, and the maximum sum of investment for a project per investor, 3,000 EUR. In the case of lending-based crowdfunding, the Bank of Spain was assisting with controlling and supervising crowdfunding platforms.

Now that the ESCP entered into force on 10 November 2021 and became applicable to all the crowdfunding platforms willing to operate in the EU, Spanish platforms shifted to new regulations on 10 November 2023.

Per the new legislation, the maximum amount of funds that a project may raise per year will be increased to 5 mln EUR. Secondary markets can be implemented by allowing investors to obtain liquidity when needed, and the cross-border provision of services has become possible.

The history of the crowdfunding market in Spain

The first alternative investing platforms in Spain were launched in 2010. However, it was only in 2015 that the first regulation on crowdfunding was adopted.

Together with the Bank of Spain, CNMV introduced a specific legal framework for financial crowdfunding platforms that regulated crowdfunding providers’ and investors’ relationships. In a nutshell, CNMV implemented the following:

- introduced the CNMV FinTech Portal to attract people interested in crowdfunding;

- developed a legal framework for different crowdfunding types, e.i debt, equity;

- separated accredited and non-accredited investors, setting limits and requirements for both;

- designed administrative and financial requirements for new players;

- created consultation services to support the community.

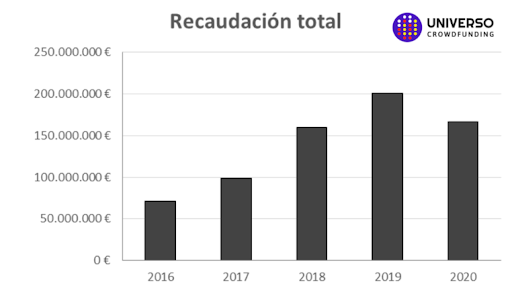

Even though the regulatory uncertainty was rather long, it didn’t stop the Spanish crowdfunding market from moving forward. So, in 2013, the number of funds raised was slightly less than 20 mln EUR, and just 5 years later, in 2018, this sum grew to 160 mln EUR, with lending, real estate crowdfunding, and investment crowdfunding platforms taking leadership.

With the introduction of the ESCP, the crowd-investing sector in Spain is expected to receive a new flow of investments and fundraisers. The industry is expected to continue its rapid growth as more platforms shift to the new regulation. Still, most Spanish platforms are registered with CNMV so far, and the limitations on fundraising and investing maximums are still valid.

Top crowdfunding platforms in Spain

Verkami

Barcelona-based Verkami, positions itself as one of the major platforms for crowdinvesting in Europe. It was indeed one of the first crowdfunding plaforms launched in Spain.

With over 12 years of experience, the platform focuses on funding projects with added value – books, films, art, and similar to help authors and creators to achieve their goals.

Verkami claims they have the world’s highest success rate, with over 70% of projects reaching their funding goals. For now, the platform managed to raise more than 50 mln EUR for over 10,000 of projects.

StockCrowd IN

StockCrowd IN connects investors with the most established real estate companies in the real estate sector. Its mission is to transform the way businesses interact with their communities.

On the one hand, it offers real estate developers an alternative financing channel, providing the necessary technology and legal framework to finance their projects. On the other hand, it offers private and institutional investors the possibility of investing in the real estate market, with a very strict opportunity selection process.

StockCrowd IN is authorized by the CNMV as a Participative Financing Platform with license number 24.

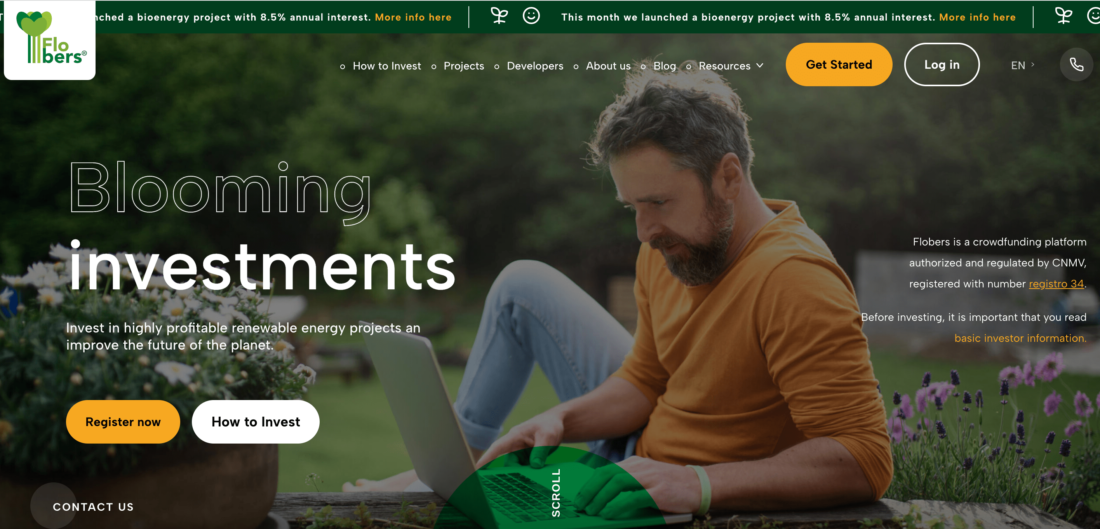

Flobers

Flobers is a crowdfunding platform authorized and regulated by CNMV that allows investing in green energy projects and aims to democratise renewable energy investment. The minimum investment starts with 1,000 EUR with an average returns of 6-8%.

The platform works with both accredited and non-accredited investors. However, only accredited investors can invest more than 3,000 EUR in a single project.

Foreign investors are also accepted, but to participate in offerings, they must receive an NIE (un Número de Identificación de Extranjero) and be residents of an EU country.

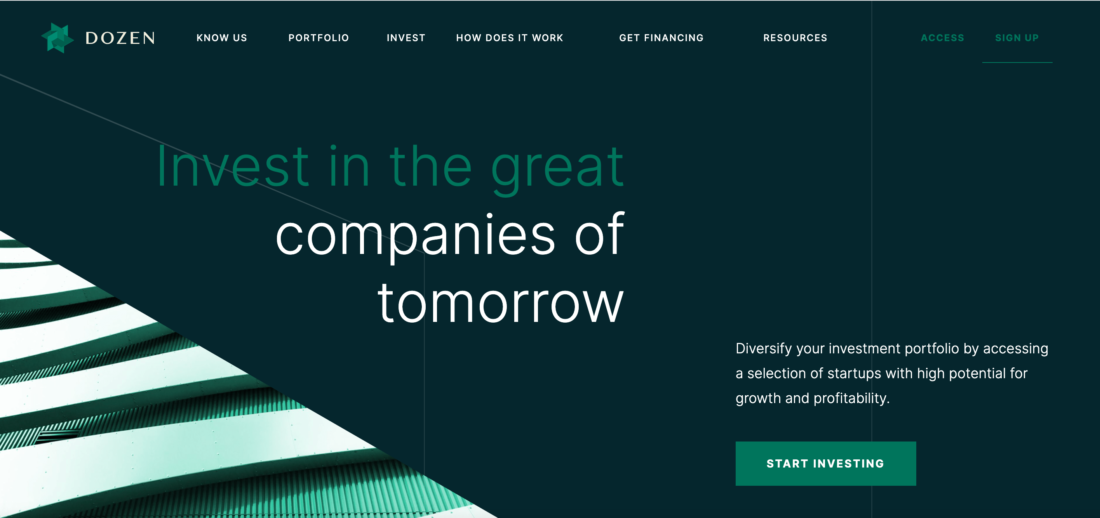

Dozen

Dozen is a venture capital and private equity firm based in Barcelona. Like any other Spain-based platform, Dozen is authorized and regulated by CNMV. The platform is free to register, however, it charges a fee of 6% on each investment + VAT. Once the investment starts delivering profit, Dozen charges its share of 15% + VAT.

The platform is open to investors from all EU countries, but they must present their NIE to access the Dozen offerings. Only accredited investors are permitted to invest more than 3,000 EUR in a single project.

The company has invested over 38 mln EUR in various startups in gaming, food tech, space tech, health, and other promising sectors.

Conclusion

With the ESCP regulations having entered into force, the Spanish crowdfunding market expects more opportunities and a new development leap. This transition is expected to eliminate the existing limitations of the Spanish platforms and push the market to a new growth wave. With the adoption of the new regulations well underway, it’s time to explore the diversity of Spanish crowdfunding platforms and see what they have to offer.