Crowdfunding in Germany: market & top platforms overview

With the introduction of the European Crowdfunding Service Providers (ECSP) license, it’s logical to assume that the European countries represent a united crowdfunding market.

The newly adopted regulation is forming and supporting a more unified ecosystem for crowdfunding providers. Still, it’s useful and informative to look at every country separately to see how rapidly crowdfunding is developing, which crowdfunding types are dominating, and what factors contribute to it.

In this article, we’ll explore the state of crowdfunding in Germany and naturally, find out more about German crowdfunding platforms.

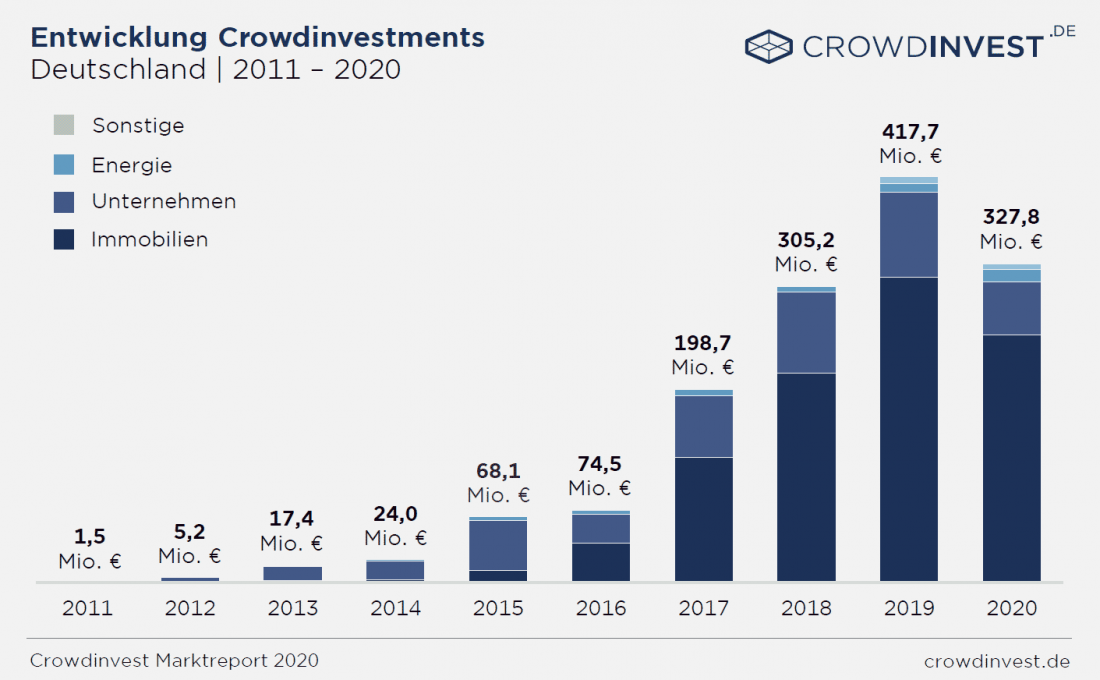

Crowdfunding market in Germany

The German market has seen some major growth over the past decade, per crowdinvest.de. From $272 million in 2015, it has grown to $1,482 million in 2020. Before 2020, the leading crowdfunding models prevailing on the German market were equity and debt ones. While during the pandemic, the share of donation-based platforms grew significantly.

Though Germany’s transition to ECSP regulations was not that seamless, ultimately, they’ve been applied, which means that it remains an attractive market for new crowdfunding providers to emerge.

While there has been a distinct market, the regulatory market was a weak spot for the industry. So, the implementation of the EU regulations stimulated the country to adopt some additional laws to incorporate into a new legislative framework.

Top 5 crowdfunding platforms in Germany

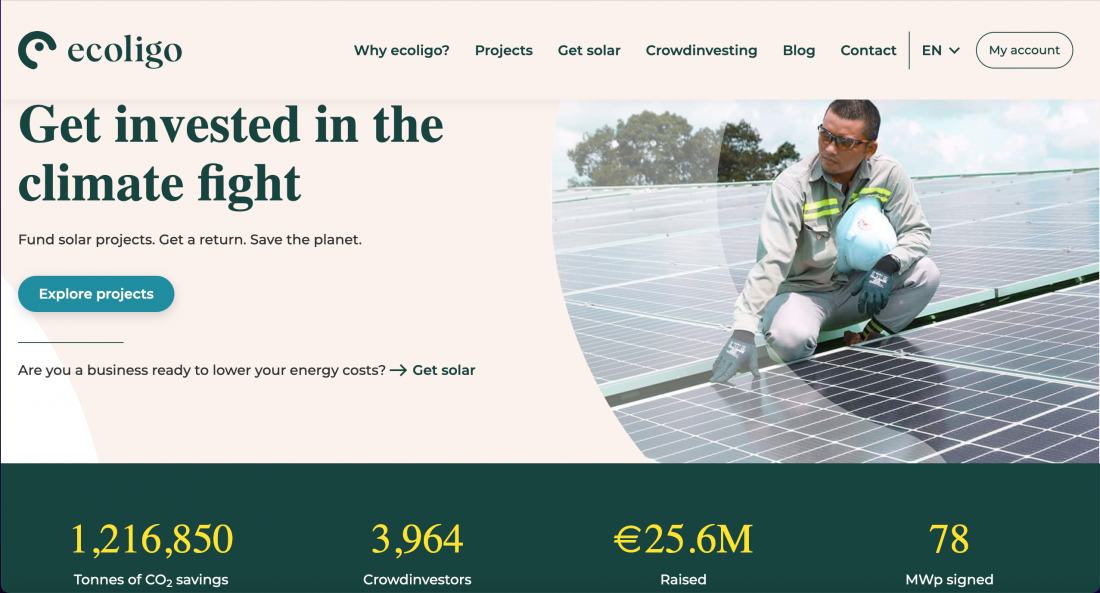

Ecoligo

Ecoligo is one of the leading green energy crowdfunding platforms with a custom transformative approach. It allows investing in sustainable businesses in emerging markets that construct solar panels. So, not only you help fight the climate crisis, but you also make a positive social impact. What is more attractive, you can make that impact with as little as €100.

Ecoligo’s team oversees the entire project cycle and has on-site representatives in every country of operation. The platform is responsible for financing and delivering the project.

Startnext

Startnext is one of the biggest German donation-based crowdfunding platforms for creative and sustainable projects, startups in German-speaking countries. Artists, creative and social entrepreneurs have an opportunity to access a large audience to get support for their creative initiatives.

Startnext founders strive to help creators to be seen, build a network, get the funding & the feedback, and test out the product.

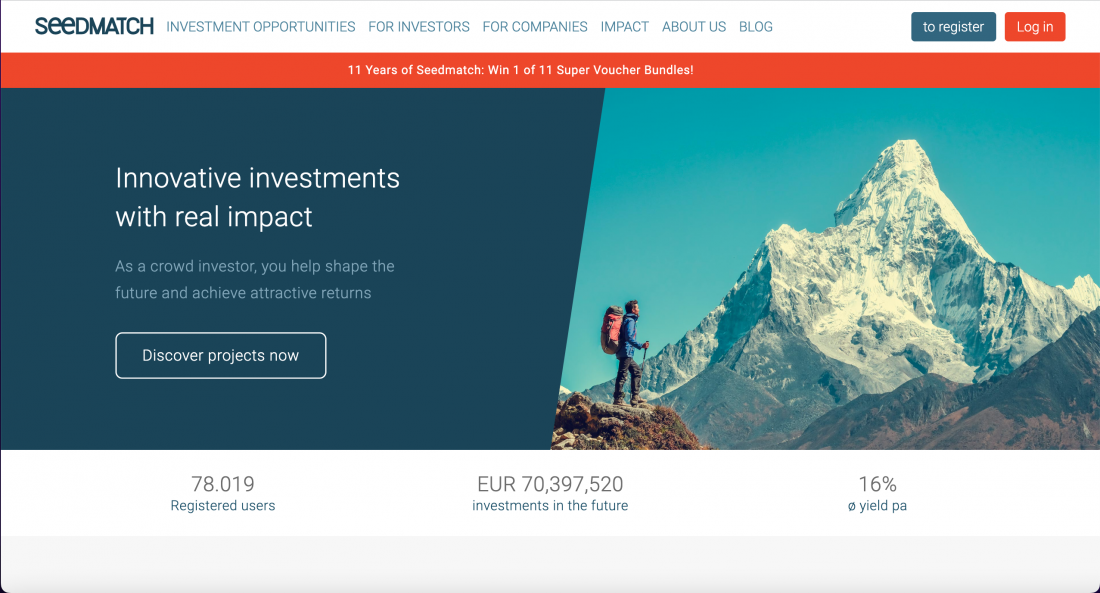

Seedmatch

Seedmatch is an equity crowdfunding platform that allows investing in startups and early-stage businesses with a min investment of €250. Since 2011 the company has accumulated almost 70 million in growth capital.

Seedmath’s mission is to boost innovation and support the economy by helping companies make it to the market and create more jobs.

ROCKETS

In September 2022, GREEN ROCKET, HOME ROCKET, AND LION ROCKET have merged into ROCKETS, a crowdivesting marketplace offering massive diversification opportunities in Germany, Austria, and Switzerland.

On one platform you can invest in:

- impactful startups;

- real estate;

- innovative green energy projects;

- businesses that tackle environmental and social challenges.

The group has been a pioneer among German-speaking countries and has contributed to Germany’s crowdfunding market establishment. ROCKET’s mission is to make real estate and green energy projects more accessible by attracting a larger pool of investors with a min investment of €250.

Companisto

Companisto is a Berlin-based equity crowdfunding platform offering shares in startups and growth companies. Founded in 2012, it has since been working with business angels, venture capital companies, and corporate finance specialists.

Its real estate crowdfunding deal for Weissenhaus, a five-star luxury resort, has collected €7,500,000, which has become one of Europe’s most successful crowdfunding investments.

The min investment starts with €250.

Final thoughts

The ECSPR is definitely a milestone for the overall crowdfunding industry that is reshaping national economies and transforming the crowdfunding services across the EU.

Despite the initial misalignment of Germany’s local legislation and the newly introduced ECSPR, the German crowdfunding market remains one of Europe’s most favourable markets.