8 most successful equity crowdfunding campaigns in recent years

The crowdfunding market is evolving, and a lot of new promising changes are introduced under the evolving regulations. The U.S. regulators are very clear about the equity crowdfunding legal status, and Europe has finally implemented a single crowdfunding regulatory framework that is expected to boost the development of this sector. And with it, new successful projects are expected to emerge.

Equity crowdfunding has a special place in the crowdfunding market. Along with being the most regulated sector, it is also the most promising in matters of return. It allows accredited and retail investors to benefit from promising innovative projects by funding their development and getting a share of their profit in the future.

Investors see the immense potential of equity crowdfunding, and the most successful crowdfunding campaigns in recent years prove it.

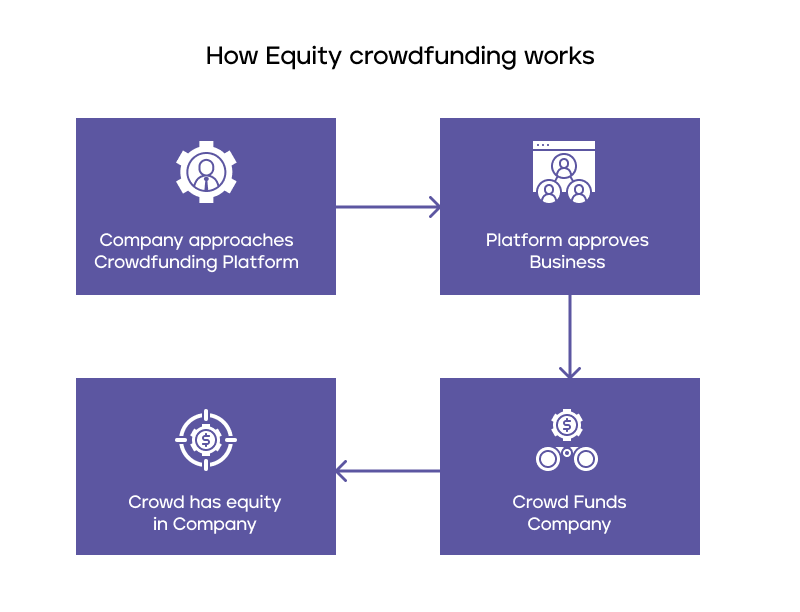

What is equity crowdfunding and how does It work?

Equity crowdfunding is a type of crowdfunding where businesses raise capital by selling an equity, or a share in the business. Unlike other common crowdfunding types based on donations, like those run on Kickstarter, equity crowdfunding is based on investment. It means that in return for the funding, investors expect to get a profit: either a share in the revenue made in the long term, dividends, or both.

The main difference between equity crowdfunding and traditional investment models is that in the first case, companies offer equity to a wide range of investors, and some of them may become the platform’s future customers in the future.

This is why investors become increasingly interested in innovative projects that are starting their way in the market. With the availability of a new consistent regulation, new promising campaigns will be run and new projects will enter the market with the help of equity crowdfunding platforms.

8 most successful equity crowdfunding projects

Here, we will have a look at the most successful crowdfunding campaigns that were run in the period from 2022 to 2023.

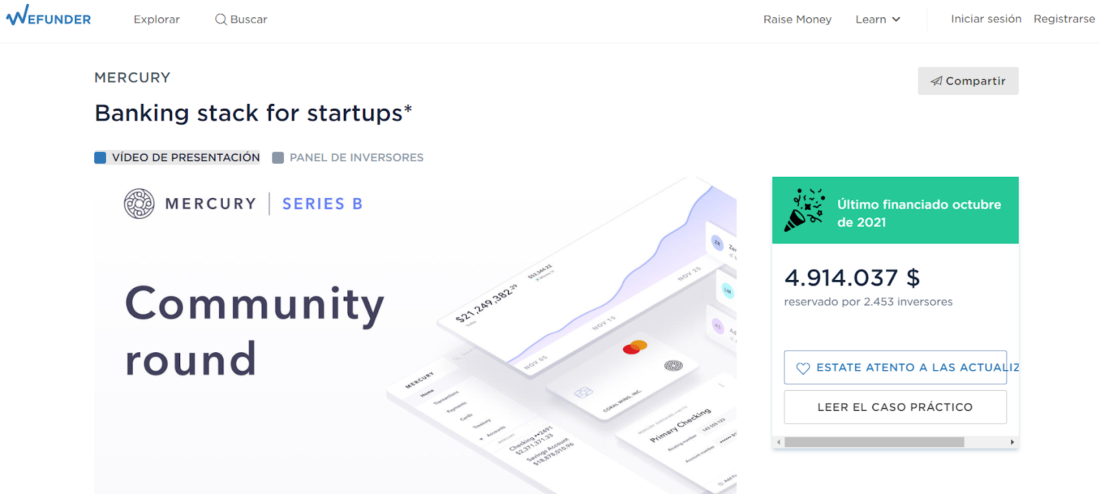

Mercury

San Francisco, United States

Mercury, an innovative financial services provider for startups, raised almost $5mln from investors on Wefunder in 2022. Earlier, the company ensured over $120 mln of funding in Series B with such top institutional investors as Coatue, Andreessen Horowitz, and others. The solid demand from highly reputable customers, high interest from venture capital investors, and significant progress made since the launch of the company make Mercury one of the most successful crowdfunding campaigns to raise capital for its development in equity crowdfunding.

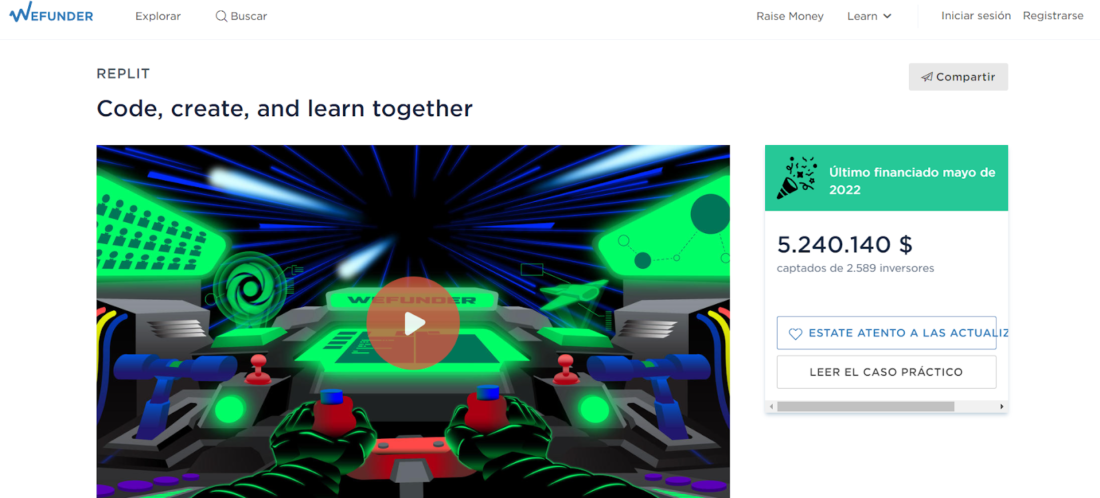

Replit

San Francisco, United States

In 2022, in the last funding round, Replit raised over $5 million from over 2,000 investors on Wefunder. Replit is a collaborative coding platform that targeted institutional investors initially. But only when the project started delivering mesmerizing returns (over $150K revenue rate), they got the attention of Y Combinator, a leading startup accelerator.

When Replit was launching its equity crowdfunding campaign on Wefunder, it had already gotten funding from such institutional investors as Coatue, Bloomberg Beta, and Andreessen Horowitz. The company continues growing and developing, with the latest milestone reached in the form of a partnership with Google and getting GitHub.

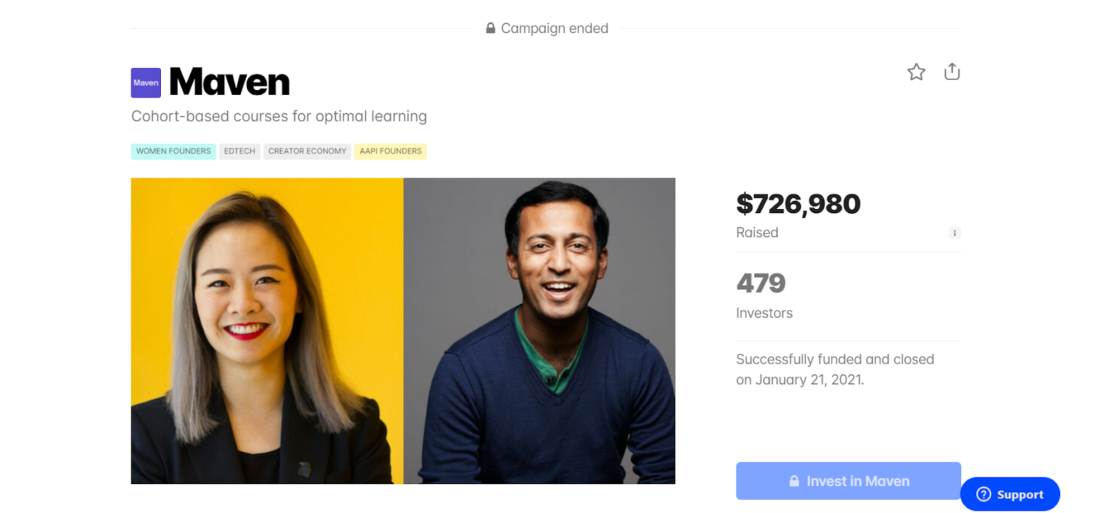

Maven

Colorado Springs, United States

Maven raised $726,980 in an equity crowdfunding campaign on Republic. It is an innovative ed-tech company that has developed over 400 courses with famous tech influencers and specialists. Founded by Gagan Biyani (a co-founder of Udemy) and Wes Kao (the creator of altMBA, an intensive leadership workshop, among other projects), the company successfully closed the Series A funding round with $20 million from Andreessen Horowitz in 2021.

Even though the company is relatively young, its successes make it one of the highest-funded equity crowdfunding projects up to now.

Beta Bionics

Irvine, United States

Beta Bionics raised $1 mln from 718 investors on Wefunder in an equity crowdfunding round completed in 2016 which makes it one of the most successful equity crowdfunding campaigns. The company developed the first in the world bionic pancreas, and by the time the crowdfunding campaign was launched, Beta Bionics had completed human clinical trials and provided some data to make the campaign work.

The main reason why people invested was the social nature of the project: the company was developing a tool to help those with type 1 diabetes. Additionally, the main reason behind the project was the fact that the Beta Bionics founder’s son developed type 1 diabetes at the age of 11 months, so people could feel for the family.

This was just the start of the company’s success. In 2022, its progress attracted the attention of such institutional investors as Soleus Capital and Perceptive Advisors, and in the Series C round, Beta Bionics managed to get a $20 mln funding for further development.

Levels

New York, United States

Levels, a health platform that produces biowearables to provide real-time feedback about users’ health based on their diet and lifestyle preferences, raised $4,999,989 from over 1,440 investors on Wefunder in 2022. Being one of the most profitable crowdfunding campaigns, the company already had over 15,000 beta users and more than 155,000 people on its whitelist.

After raising almost $5 mln on Wefunder, Levels secured $38 million in funding from Andreessen Horowitz and Shrug Capital.

Substack

San Francisco, United States

Substack is a platform that offers publishing space for writers and creators that raised $7,809,219 on Wefunder in April 2023. With it, it has become one of the top equity crowdfunding projects on our list of successful equity crowdfunding campaigns.

Substack positions itself as a new economic engine for culture. It is a subscription-based network for all types of content creators. It has already over 35 mln active subscriptions, with 2 mln of them being paid subscriptions.

Even though the sector in which the company operates is rather very industry-specific and thus, Substack may not grow to the level of unicorn businesses, it still has some potential. The crowdfunding campaign on Wefunder has already demonstrated it.

Doorvest

San Francisco, United States

Doorvest is the homeownership investment platform that ran one of the most successful equity crowdfunding campaigns on Wefunder in 2023. With over $5 mln raised from 574 investors, the platform has demonstrated that the interest of people in purchasing a share in real estate is growing.

Doorvest is not just another homeownership investment platform. It integrates the home acquisition process, renovation, home sale, and property management through technology by making top investment opportunities available to a wide range of investors.

With 10x year-by-year growth and by attracting over $22 mln in equity, and $75 mln in credit facilities, Doorvest has ensured its success among other homeownership platforms along with the possibilities of expansion to new markets.

Roam Research

San Francisco, United States

Roam Research is another project that ran one of the major and successful equity crowdfunding campaigns. This is one of the most profitable crowdfunding equity projects that launched its campaign on Wefunder and raised almost $1 mln from 756 investors.

Roam Research offers a powerful note-taking tool for networking to help people write and organize their ideas more efficiently. It is easy to use, powerful, and really helpful.

Before becoming one of the best crowdfunding companies that have achieved the most success, Roam Research had raised $9 mln in a seed round from top venture capital firms such as True Ventures and Lux Capital. The team works diligently to make the platform the best in the industry, and this is one more reason to believe that Roam Research will achieve significant success over the next few years.

Who we are

CrowdSpace is a leading crowdfunding platform aggregator that provides users with the most up-to-date information about the available crowdfunding platforms.

For businesses, we offer a list of platforms with their descriptions, along with useful tips on how to pick the right platform and run a successful crowdfunding campaign.

Crowdfunding platform owners can improve the results of their marketing efforts by using CrowdSpace to increase their visibility in the highly competitive market and find new investors and customers.

Fundraisers can search for platforms based on their location and fundraising type. They can also find valuable information on how to launch and run a successful campaign to become the most major and successful crowdfunding project ever.

Finally, investors can find on CrowdSpace an extensive list of reputable platforms where the best projects are listed. It is possible to filter the available platforms based on their location, the business sector they operate in, and the investment type. Also, one can check whether the platform is licensed to operate in a specific location or not. While it doesn’t guarantee someone’s success on a platform as a fundraiser or investor, it simplifies the selection process.

Final thoughts

Equity crowdfunding allows many promising companies to raise funding rapidly. We can already see projects raising millions, and this is just the start. CrowdSpace will be assisting all market participants in their search for the best opportunities by providing updated and reliable information on the major players in the equity crowdfunding space.