How does equity crowdfunding work

It’s truly fascinating to see how many forms crowdfunding, as a phenomenon, has taken to help people solve various purposes.

In this piece, we will focus on equity crowdfunding, a method to raise capital common for early-stage companies and startups. We think it may be useful for both entrepreneurs and investors willing to put their money to work in exchange for partial ownership of the company.

Whichever side you are on in this process, welcome!

What is equity crowdfunding?

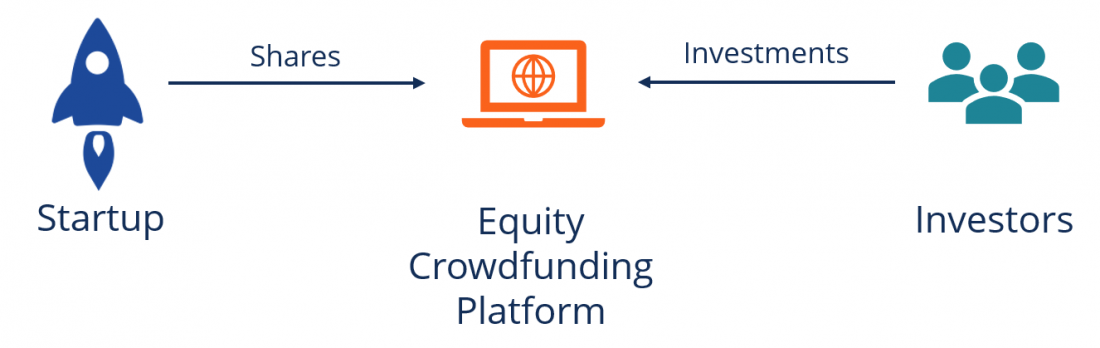

Unlike other crowdfunding types, equity crowdfunding excludes any debt component.

It implies the process of raising money from an individual investor or a group that takes place on equity crowdfunding platforms. Business owners use it to fund a business launch or expansion. In exchange, investors get equity ownership of the business.

On top of it, once the company makes profit, investors are also eligible for percentage returns. And similarly, investors may lose some or all of their assets if the company fails.

On the whole equity crowdfunding business model resembles the traditional way of attracting angel investors and venture capitalists to get the funding.

The core difference is that it aims to involve a more significant number of investors with smaller sums, increasing the company’s chances of receiving the necessary funding. In fact, potential investors may start from as little as £100.

So, essentially equity crowdfunding is an old approach that has been enhanced and democratised by the introduction of equity crowdfunding platforms. You still have to pitch your business plan, have a convincing presentation, and keep your financial records in order.

The recent equity crowdfunding statistics show that the sector has seen an incredible rise. In 2021 equity crowdfunding experienced a record-breaking number of campaigns. But the truth is that it wasn’t always this way.

For quite some time, equity crowdfunding was viewed as the last resort for entrepreneurs whose offerings were not interesting or promising enough for venture capitalists and angel investors.

It wasn’t until 2018 that equity crowdfunding experienced its first boom. According to the data collected by KingsCrowd, equity crowdfunding campaigns raised more than $74 million that year, which had been unprecedented before.

In early 2020 equity crowdfunding was already recognised as a viable fundraising method, which led to some major venture capitalists’ names appearing as lead investors on the equity crowdfunding platforms.

A logical question here is, “What has stimulated such a change of perspective”? Well, it’s fair to start with the general tendencies of many industries switching to online workflows. Then the technological advancements followed creating equity crowdfunding platforms. Finally, the COVID-19 outbreak accelerated both these tendencies.

But the most crucial role belongs to the tax regulations passed. All these factors combined have created a favourable climate for equity crowdfunding companies.

Investment tax reliefs for equity investors

As you may know, things vary a lot geographically from the legislative standpoint. In some countries, crowdfunding still remains a grey area, while others have enforced tax reliefs for investors and monitor crowdfunding platforms to detect any fraud activities.

The UK, for instance, offers Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS), which provide investors up to 30% and 50% income tax reliefs. These initiatives are probably the most generous in the world.

Up to date over 33,000 companies have received funding under EIS, totalling £24bn. In short, here is how it works.

Once investors buy shares, they get an EIS certificate which allows them to apply up to 30% tax benefit against their next tax return. The shares must be kept for at least three years to claim the tax benefits. To be eligible for EIS, you can invest up to £1m annually.

The Seed Enterprise Investment Scheme was introduced to help specifically small early stage companies that need to be a part of the SEIS fund. With SEIS, you can receive tax reliefs covering up to 78% of the investment. But keep in mind that the maximum tax benefits you can apply can’t exceed £100,000 per year.

These were just a few examples to give you a general idea of how taxation works for equity crowdfunding in some cases. Overall, it is safe to say that all the parties involved in crowdfunding need to pay income taxes. Regardless of the country, we recommend seeing a tax professional.

Pros and cons of equity crowdfunding

Equity crowdfunding can be indeed an option for many businesses. Still, it doesn’t mean it’s a golden standard for every business case. Like any other crowdfunding type, it has its strengths and weak spots.

Equity crowdfunding pros:

- Easier access to a larger investors’ pool.

As mentioned earlier, equity crowdfunding, as we know it today, emerged because of the central concept shift: businesses collecting smaller amounts from a larger number of investors.

The more people can participate, the more chances there are to receive the necessary funding. The accessibility of this niche is something previously uncommon to conventional methods of capital raising.

- An opportunity to spread the word about your business.

Another nice side effect is the opportunity to showcase your project to many potential investors. It’s a chance to build a professional network and even find potential customers.

- Lucrative passive income.

It’s no secret that the majority of startups eventually fail. Still, the statistics don’t eliminate the prospect of becoming a part of a company that makes it to a unicorn.

Equity crowdfunding cons

- Poor returns.

For most startups, it may take years to make enough profit to pay back the dividends to their investors.

Should you want to sell your shares, it may also take a long time for them to increase in value. Again, from the very beginning it’s important to realise that these events may not occur at all.

- Poor liquidity.

Obviously, there is no option to withdraw the funds invested. There is no secondary market where you can sell your shares whenever you want to.

Top equity crowdfunding platforms

Now that we’ve covered the basics, it’s time to look at some top players in the game.

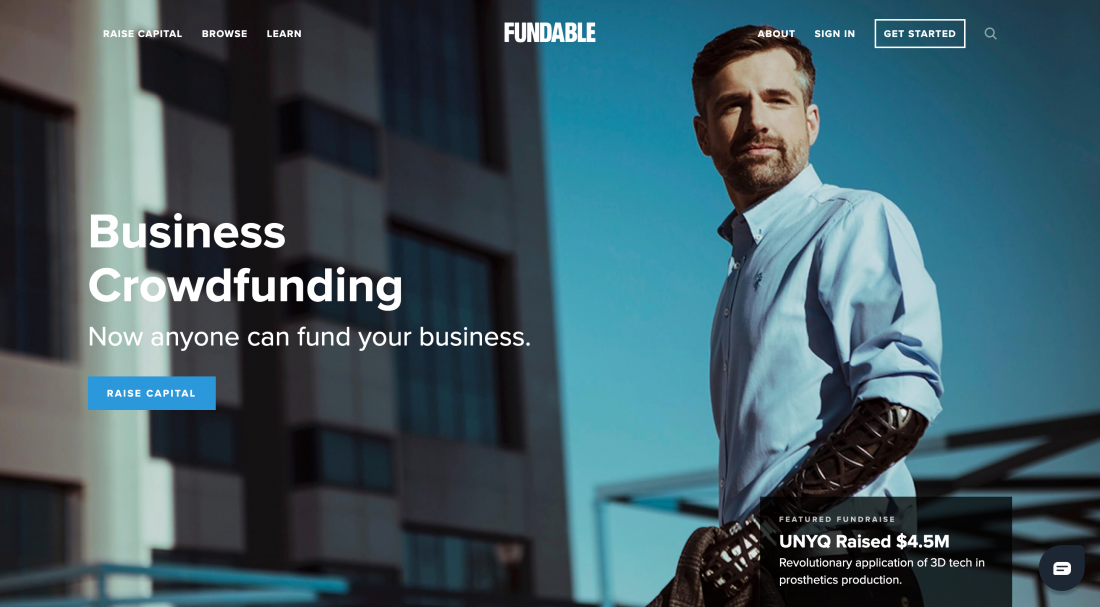

1. Fundable

Fundable is a UK-based crowdfunding company that works with accredited investors only.

It also has pretty restrictive guidelines regarding who can use the platform for investors and fundraisers. Fundable charges monthly fees that are higher compared to other equity crowdfunding providers. Along with that, the company offers a variety of tools and resources to help fundraisers and is claimed to have excellent customer service.

Fundable’s recent offerings include mainly medical and fintech software.

Overall, it’s hardly the first go-to for newbie entrepreneurs, but it’s a decent choice for experienced business owners aiming for significant capital.

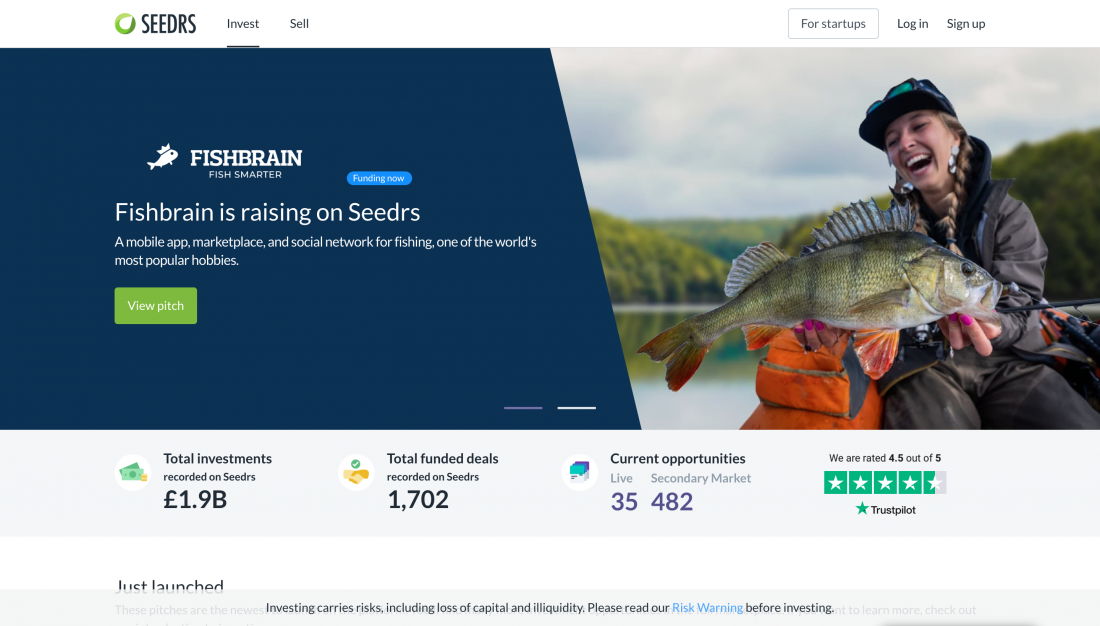

2. Seedrs

Headquartered in London, Seedrs is one of the leading equity crowdfunding platforms in Europe that has been recognized as the most active investor in businesses in the UK.

The platform works with startups and early-stage companies accepting non-accredited investors to participate in campaigns. Yet, this is valid for the UK and Europe-based investors. Residents outside this area need to get accredited to access the platforms.

Curious fact: back in 2012, Seedrs became the first equity crowdfunding provider regulated by Financial Conduct Authority, FCA.

3. Syndicate Room

Syndicate Room is an equity crowdfunding platform using an innovative data-driven approach to build investors’ portfolios. It uses data analytics to figure out the most promising startups relying on its research.

Syndicate Room is a venture capital fund that uses data science and diversification to maximise returns and to minimise the risks.

The fundraising companies and investors applying through Syndicate Room must qualify through EIS.

Final word

Based on the birds-eye view of the equity crowdfunding area, it’s clear that this crowdfunding branch has seen some massive progress and such tendencies are likely to persist.

It’s true that investing through equity potentially offers many rewards: decent passive income, an opportunity to become an accredited investor, a chance to participate in meaningful businesses that speak up to your values, and all in all, the prospect of boosting the economy through new business and jobs creation.

However inspiring as it may sound, the major risks associated with equity crowdfunding haven’t gone anywhere. You may end up with poor or no returns at all, run into a scam, or make bad investment decisions.

If you decide against equity crowdfunding, it’s vital to do the research and to choose a reliable equity crowdfunding platform. Taking the necessary precautions gives good chances to have a positive experience with equity investment and fundraising.