Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.

Both natural and legal persons can invest on Profitus. You can start investing even in small amounts. As a licensed platform under the supervision of the Bank of Lithuania, we need to verify your investment knowledge and properly identify you after the registration. If you invest more, we may ask you to justify your source of income.

There are no platform usage or account administration fees for the investor, but there is a transfer of claim fee if you want to sell your investment on the secondary market.

Profitus does not provide information and/or advice on tax matters and we recommend that you contact the State Tax Inspectorate (STI) directly for any questions relating to tax liability.

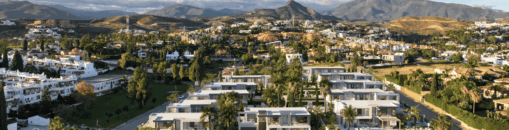

Profitus offers to invest in various crowdfunding opportunities from the Real estate sector.

At Profitus, you can start investing with €100.

The investment models Profitus operates is Debt, P2P lending.