Equity crowdfunding in the UK: how it works & top equity platforms

Crowdfunding, as a form of business fundraising, is increasingly gaining popularity among many initiatives: creative and social projects, startups and early-stage businesses.

Given the volatile economic situation, entrepreneurs often resort to it as an efficient way to raise capital for a business launch or scaling.

Investors, in return, receive passive income in the form of regular instalments or get a business share, in other words, equity. In this piece, we will focus on the latter approach and discuss what equity crowdfunding is and how well it is developed in the UK.

What is equity crowdfunding?

Equity crowdfunding is a way to raise capital online from a large number of individuals for a business or project. In exchange, investors obtain a certain percentage of equity in a company they are funding. Previously, only business angels and venture capital funds could participate in such deals and were eligible for a share.

Equity crowdfunding has disrupted the old approach accessible only to high-net individuals by providing an opportunity to contribute capital to a larger pool of investors with smaller amounts.

In fact, you can invest with as little as £10, which was unprecedented before.

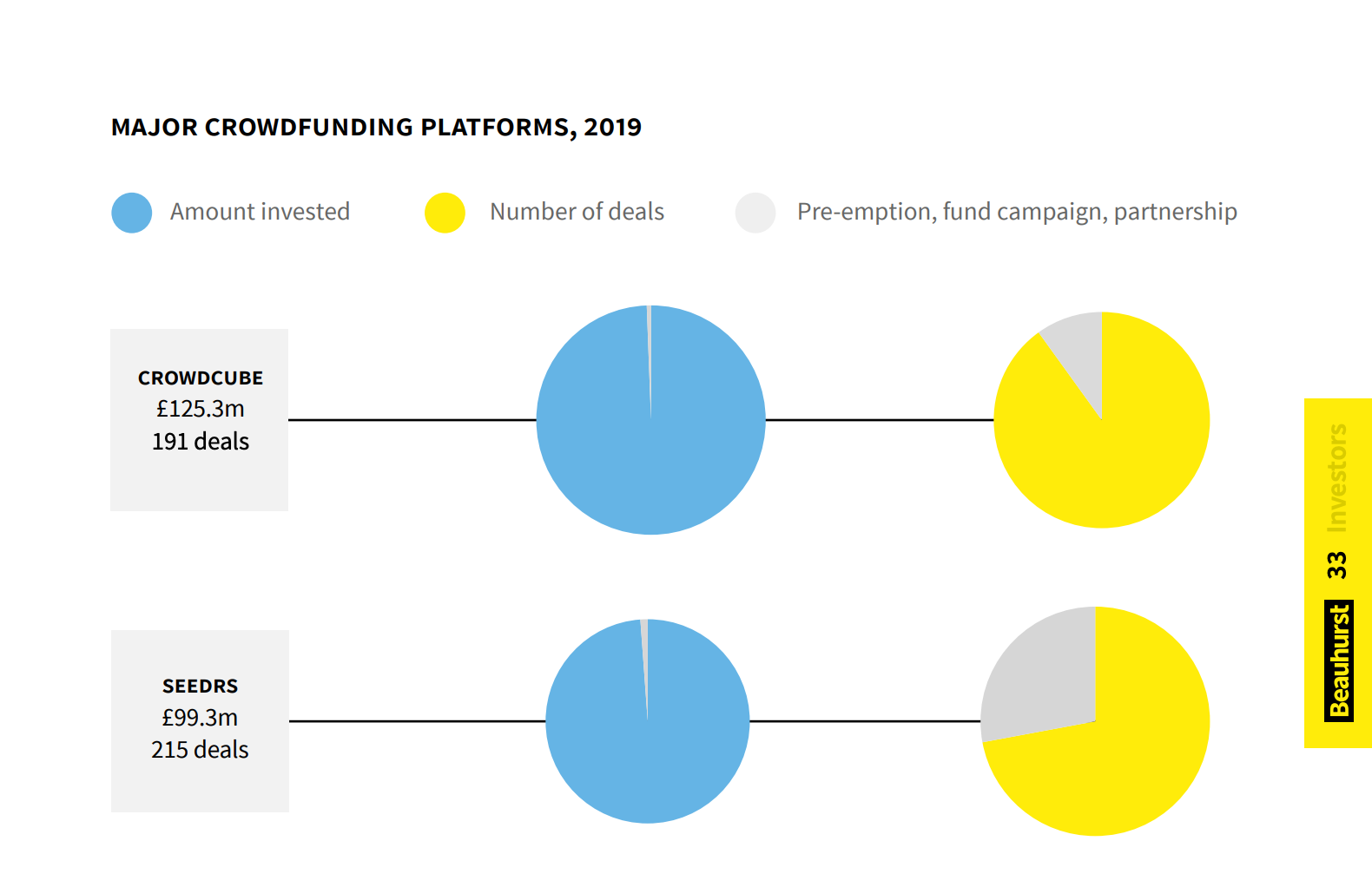

Since equity crowdfunding investment requires no middleman, it creates a more open and transparent way of financing. It’s safe to say that equity crowdfunding has taken root in the UK as a capital-raising method. Seedrs and Crowdcube are one of the largest equity crowdfunding platforms that are based in the United Kingdom. Before we jump on to the major UK equity crowdfunding providers, let’s take a look at the regulations first and the investment climate they create.

Crowdfunding in the UK

The term “crowdfunding” first made buzz back in 2011 in the UK. A few years later, the FCA, Financial Conduct Authority, was introduced by the Financial Services Act of 2012. The FCA is the regulatory body that oversees the entire financial service industry in the United Kingdom, including the crowdfunding sector. Its main goals are protecting consumers, managing and preserving market integrity, and boosting competition.

To maintain all this, the FCA has the power to investigate any misconduct, regulate the marketing side of financial firms, and establish minimum standards.

FCA’s introduction influenced the rapid development of the crowdfunding niche since it gave the fundraisers and investors the sense that their rights were protected. In addition, by monitoring over 58,000 businesses, the regulatory body can spot any suspicious scam-looking activities and ban them from the market.

By 2020, the UK crowdfunding market volume had reached 12.6 billion US dollars becoming the second largest crowdfunding market in the world, after the USA.

Investment tax relief in the UK

The other factor that contributed to the rise of crowdfunding is undoubtedly the tax relief.

In 1994 the UK government established the Enterprise Investment Scheme, known as EIS, to help businesses raise capital by providing tax relief to investors. Under EIS, investors purchasing a business share receive an EIS certificate that allows them to claim the tax benefits during the next tax return.

To be eligible for tax relief, you must keep the shares for at least three years. Should you dispose of the shares sooner, the tax relief will be withdrawn and charged to capital gains. On the whole, the EIS scheme allows investors to claim up to 30% tax relief with a maximum investment of £1m claimed per year.

If you are willing to sell your equity after a three-year share of possession, any profit made on it is also tax-free.

The Seed Enterprise Investment Scheme, or SEIS, is a program introduced in 2012 to encourage private investors to invest in early-stage UK businesses.

The companies that qualify for the SEIS program must be trading no more than two years, have a staff that doesn’t exceed 20 employees, and possess a maximum of £200,000 in gross assets.

Investors who choose to fund such enterprises can count on 50% tax relief on a £100,000 investment. If you go for the SEIS program, the only way to do it is through a SEIS fund. This mechanism benefits the investor because the SEIS fund will spread the amount invested across a few ventures, which is a great diversification strategy.

These two tax initiatives offer significant relief for investors who are UK taxpayers and early-stage companies registered in the UK.

Equity crowdfunding risks

Startup investments are risky. The major risks you should consider are the following:

- It may take years before you see a return. It takes a lot of time for startups to increase in value.

- Equity investments have a high illiquidity risk since you can’t send your shares on a secondary market.

- The startup will likely raise more money, which means it will distribute more shares. It can reduce your percentage, so make sure the business plan says something about investor protection and guarantees.

- Lastly, the startup may simply fail.

Despite the risks listed, equity crowdfunding’s largest benefit is the opportunity to yield high returns. If you make the right choice, the company you’ve invested in may double in value. As mentioned earlier, you can also account for SEIS/EIS tax benefits.

With equity crowdfunding, you can invest small sums in numerous businesses to increase your chances of building passive income and diversify your portfolio. You don’t need to have a high net worth to own shares.

Equity crowdfunding in the UK

Now that you have a basic understanding of how equity crowdfunding works, it’s time to meet the top three equity crowdfunding platforms in the UK.

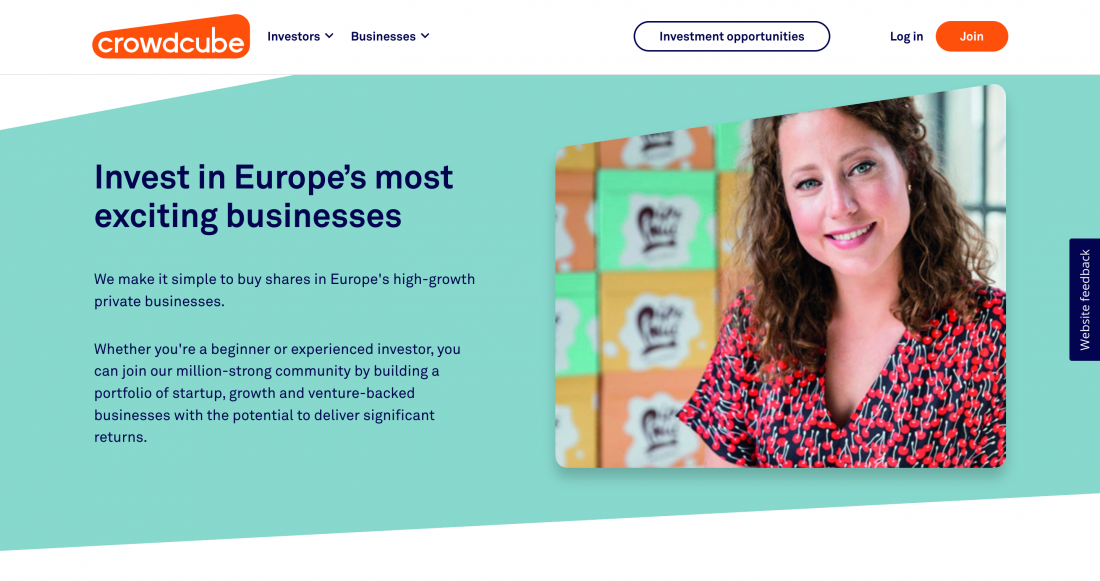

Crowdcube

Founded in 2010, Crowdcube is considered the UK’s largest and most well-known equity crowdfunding platform. It is FCA-approved and works with start-ups, early-stage businesses, and small companies looking to scale.

Crowdcube’s most notable successful campaigns were BrewDog, Monzo, and Revolut.

The platform is available for non-accredited investors offering EU- and UK-based loans.

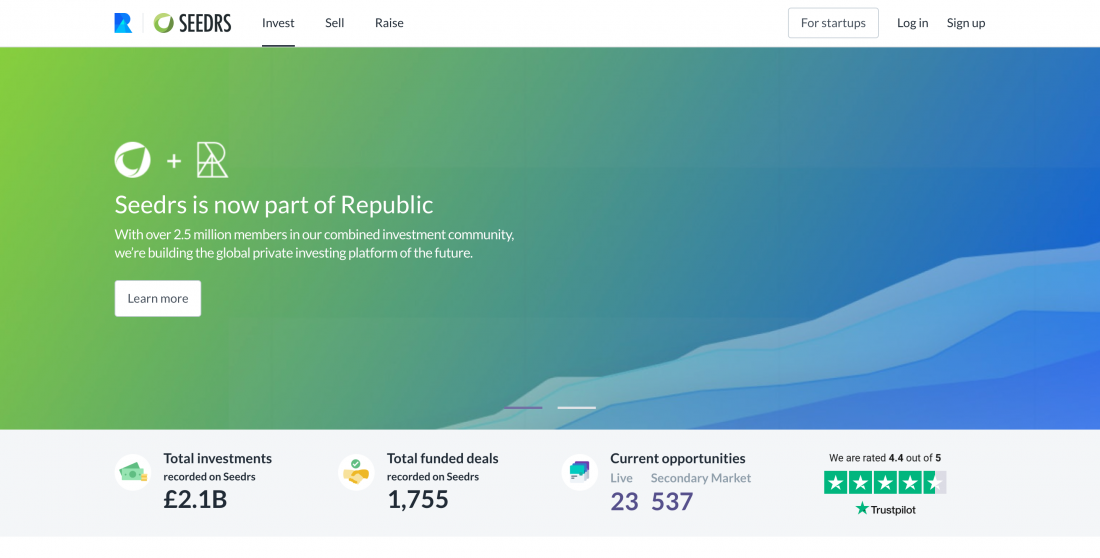

Seedrs

Seedrs is another big player in the UK equity crowdfunding market that has also gained FCA approval.

The platform is known for its secondary market, where investors can buy and sell their shares. Seedrs also provide support to startups through all the funding stages: documentation, pitch, tips on how to deal with investors, etc.

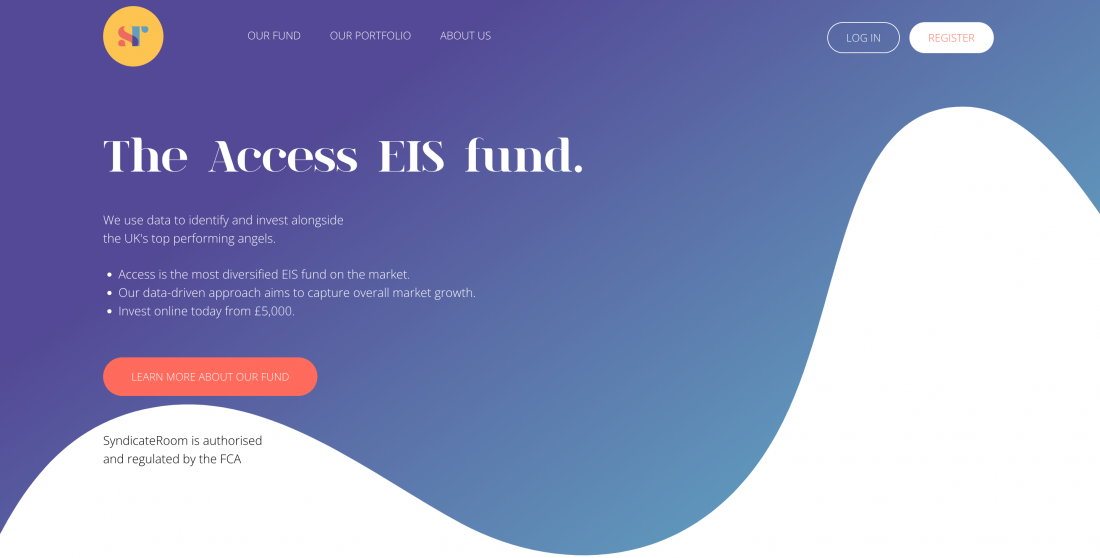

Syndicate Room

Though Syndicate Room is listed among equity crowdfunding platforms, it operates a bit differently. The thing is that Syndicate Room acts as a UK venture capital fund itself. Once it backs the company in applying for funding, it then attracts angel investors.

To apply for funding through Syndicate Room, businesses must be EIS eligible.

Final word

Combined with existing tax reliefs and regulations, equity crowdfunding in the UK looks like a promising industry for both parties involved. It allows funding for the projects that you see important for society and offers decent diversification opportunities and attractive returns. To enjoy all of this, you need to make the right investment choices.

Be sure to do the research, evaluate the risks, and consult an investment expert, in case of any doubts. This security kit will allow you to explore equity crowdfunding platforms with pleasure and make sound decisions for your portfolio!