Green investing: what’s there to know

Socially and environmentally responsible businesses have been a steady trend for some time now. Investing is no exception. More and more investors seek not only to make attractive returns but also to support companies that produce a social or environmental benefit.

Sustainable impact investing can imply a broad variety of causes: from waste recycling and green energy investing to helping communities in need of better medical or educational infrastructure. Quite often, these causes can be interconnected. For instance, you can invest in solar panels production and instalment resulting in more jobs and a growing economy.

This article will focus on some of the top green investing companies and crowdfunding platforms that pursue sustainability causes. But before we get straight to them, let’s first see sustainable and impact investing work and how to invest in green energy.

What’s environmental impact investing?

Climate change, pollution and natural resources exhaustion inevitably stimulate global shifts in how we work and make business. Green investing refers to an investment mindset that aims at two major goals: positive impact and returns.

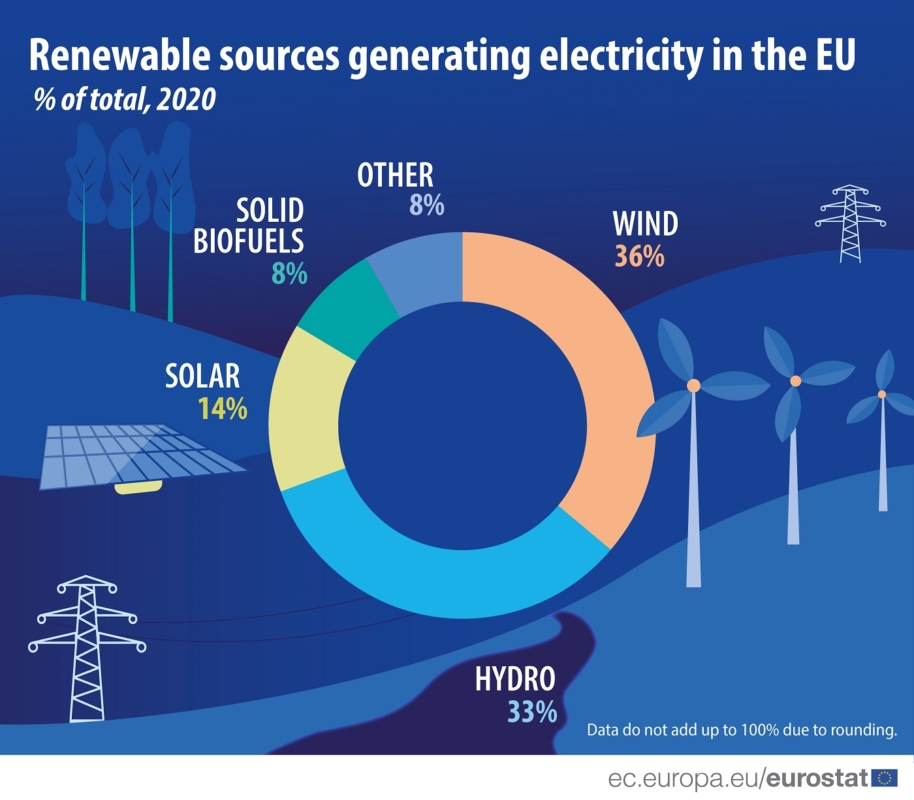

Green energy implies any alternative technology replacing the need to use fossil fuels. These are mainly renewable resources such as wind, hydroelectric, and solar power. It’s hard to tell which one is better since everything depends greatly on geography.

Still, statistics are proving that solar and wind power have resulted in some significant improvements in electrical output. Moreover, the solar power cost keeps falling every year and given the favourable weather conditions, it is cheaper than fossil fuels.

Some investors have concerns that these goals rarely combine, but that’s not the case. Sustainable green investing offers competitive return rates today.

Per recent data from Allied Market Research, in 2020, the global renewable energy market reached $881,7 billion, and it’s expected to hit $2 trillion by 2030. According to the same research source, the green energy market currently satisfies only 7% of the global demand.

The green energy industry has seen a significant rise since wind and solar power panels installations have been introduced. BloombergNEF reports that this sector will need at least $1.5 trillion annually between 2026 and 2030.

Thanks to this rising tendency, emerging markets have seen a record investment influx, and more are needed over the coming decades.

Top green energy crowdfunding platforms

GoParity

GoParity is an impact investing P2P lending platform that helps fund sustainable businesses. Headquartered in Portugal, Goparity operate in 11 countries and allow investments from as little as €5, with an average annual of around 5% interest.

The platform has its own loan evaluation and selection process that they don’t disclose. Still, GoParity have shared that since 2017, they’ve accepted 68% of the loan applications submitted.

GoParity fund projects that:

- spread access to green energy;

- help fight climate change;

- protect and preserve ecosystems;

- supply clean water and reduce poverty;

- establish safe communities.

Ecoligo

Ecoligo is a leading P2P marketplace focused on sustainable impact investing.

Based in Germany, they offer green energy loans in a broad range of countries: Chile, Kenya, Vietnam, Thailand, and the Philippines, to name a few. Investing in solar panel construction with at least €100 means fighting the climate crisis and contributing to the emerging market.

Ecoligo’s team is involved in every step of the project cycle: from negotiations and paperwork to solar panels construction and installation. Their mission is to lead the transition to clean energy globally by implementing solar-as-as-service projects.

In Oct 2022, the company raised €10 million to expand, grow, and drive forward with their mission.

Windcentrale

Windcentrale is a Dutch crowdfunding platform that aims to facilitate sustainable energy transition by offering an opportunity to co-own a windmill. It operates the equity crowdfunding model that allows splitting the windmill construction and maintenance costs into many parts.

So, you can consume your electricity and take care of your energy bills for at least the next ten years. A dedicated smartphone app even tracks the wind speed and electricity production level in real-time.

Up now, Windcentrale have raised over €14 million since 2010, making them the largest green energy crowdfunding platform.

Bottom line

Green energy has long been viewed as the technology of the future, but it’s safe to say that it’s already the present technology. Sustainable impact investing is on the rise since climate change is no longer a concern but an urgent issue that we can’t postpone dealing with.

Many governments worldwide are passing legislation to help with decarbonisation, so companies focusing on renewable energy and environmentally beneficial activities are likely to be in demand.

To become a part of the world’s global transition towards cleaner energy, find out what green investing options are available these days.