4 ways to create a passive income with P2P lending

Passive income refers to the money made without working for it full-time on a daily basis. Dividends on an investment, portfolio income, and royalties are a few examples of passive income sources.

Recently, peer-to-peer lending passive income has become a new trend popular among newbies and experienced investors because it helps to diversify your investment portfolio and make it more risk-resistant. There are good reasons to consider P2P lending a decent source of passive income.

Here, we will explore more about how to turn P2P lending into a reliable source of income in the long term. So, let’s dive in!

What is P2P lending?

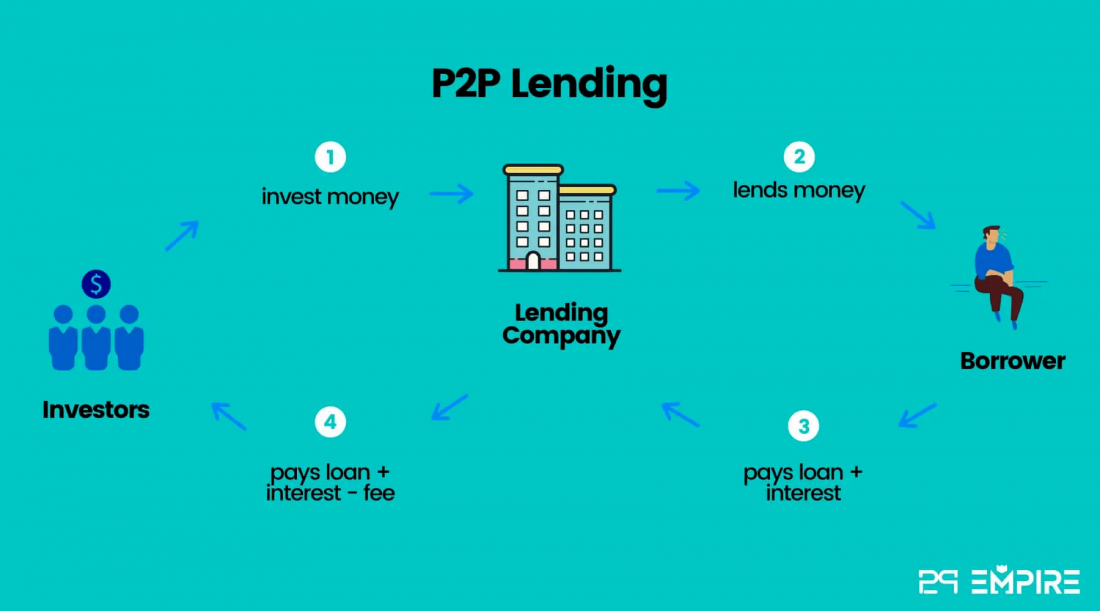

Peer-2-peer lending (P2P) is a way to earn money online by investing in loans borrowed by individuals or businesses.

In other words, you act like a bank that lends money and receives interest for it. The investment return from P2P lending is usually more attractive than the return of a savings account, for example.

However, in exchange you take the risk by giving your money out for loans to unknown people.

In the majority of cases your investment will be allocated for simple consumer loans.

Most common ones include buying a new car or a property, getting an education, covering medical expenses, etc. They may also be related to small business needs like purchasing some new equipment or covering repair costs.

Applying for a loan from a bank is a lengthy process and requires piles of documents. Businesses that need funding fast can’t spend that much time and are forced to look for alternatives to traditional bank loans.

Individuals in urgent need of money also often have to look for alternatives. Peer-to-peer lending offers a viable alternative to banks by offering loans to businesses and individuals without excessive hassle but at a higher interest rate than banks.

How can I make money with P2P lending?

How to make money with peer-to-peer lending? The principle is simple. All processes are performed and facilitated through a P2P lending platform. You, as a lender, create an account on a reliable P2P lending platform, choose businesses or persons whom you would like to lend to, and send the funds to a dedicated account.

You receive back the money you lend in equated monthly investments (EMIs), each EMI includes a principal and the interests earned. These funds are collected by the P2P platform from a borrower and sent to a special escrow account for you.

Further, you can withdraw the funds and spend them or continue earning P2P lending passive income by applying one of the following strategies.

4 ways to make a passive income using P2P lending

According to the definition of passive income, it is made without spending too much time and applying a lot of effort, unlike traditional day-to-day jobs. Here are the top 4 ways to make money with peer-to-peer lending.

Reinvesting

While some lenders would prefer to withdraw the funds from their escrow accounts and spend them, it is not the best way to do so if you want to generate a source of passive income.

The most evident way is to reinvest the funds. In other words, you lend the money again to those willing to get a loan. Over time, interests accumulate, and the sum available for reinvesting increases.

Statistical data show that those lenders who reinvest earn 10% more than those who don’t.

By automating reinvestment, you can ensure that your earnings are reinvested into specific projects without your active involvement. It will save time and ensure your steady income.

Automated investment

Most P2P lending platforms provide lenders with an opportunity to automate their investment processes. This is one of the most efficient approaches to investing if your aim is to make earnings from P2P lending to passive income.

Select the parameters that match your financial goal and investment strategy, and activate the auto-invest functionality. A specially developed algorithm will pick projects and individuals that comply with the preset parameters and lend them money on your behalf automatically.

Joint efforts with other investors

Joining efforts and resources with other investors is another way to earn passive income with P2P lending. While it is relatively easy to handle smaller borrowers independently, lending to businesses, especially promising ones, may be challenging due to the minimum investment limitations.

So, if you are thinking about how to create P2P lending passive income and turning it into a source of living, you may consider joining a pool of investors.

Such pools use the latest technologies, such as Artificial Intelligence, to manage the investment pool as a single portfolio to deliver consistent results.

Rebalanced and diversified portfolio

When investors wonder how much can you make with peer to peer lending, they make the same mistake: put all their funds in a single asset. If the investment manages finely, earnings can be very high but if it fails, those who have invested in it lose all their money. This is why portfolio diversification is a must for successful investment practices.

Another important point is portfolio rebalancing. While with long-term investments, it is difficult, P2P lending allows one to do it efficiently. Constantly review your portfolio and check whether your past decisions have to be changed and how, if yes.

Is there a risk of losing my money?

Yes, always.

After researching how to create passive income with P2P lending, it’s natural to wonder if you can lose money.

P2P lending gives credit to somebody, a person or a business, who needs financial help. An individual can use the money to buy a car, house, pay for studies, cover medical expenses, etc.

A business can use the loan to buy equipment, hire talent, reorganize operations, etc.

It happens that people cannot return the payment on time or fail to return the entire amount at all. Businesses may go bankrupt, too, which means that the risk of losing the investment is always there.

Some platforms provide compensation in such cases, in other words, the buyback guarantees.

All reliable platforms perform their due diligence and give a borrower a risk rating depending on the borrower’s credit history, and if the borrower has a bad debt or not. Those who have a high-risk rating can take loans with higher interest rates. This is why a higher interest rate, even though it means a higher profit, also indicates a higher risk level of your potential investment.

It is essential to check the P2P platform’s conditions and guarantees before opening an account there and starting lending activities. Also, it is highly recommended to perform your own due diligence on each borrower to whom you would like to lend your funds.

How can CrowdSpace help you?

Finding a reliable P2P lending platform that will enable you to earn consistently is a challenging task. CrowdSpace, a crowdfunding platform aggregator, can help you make the right choice by providing unbiased, detailed information on the available platforms.

To facilitate the search process, you can filter the platforms based on their investment type, industry, country of operation, ears on the market, and licensing. Even though CrowdSpace cannot guarantee that you will not lose your funds by investing in one of the listed platforms, it will definitely help you to navigate the complex P2P lending world.

Conclusion

P2P lending is a phenomenon that has changed the financial market. It’s an alternative that eliminates time-consuming bureaucracy for both lenders and borrowers.

So, how to make money with peer to peer lending? We advise going for a research first. Given what’s been said in this article earlier, the recommendations summary would be the following:

- get familiar with the P2P website policy, the legislation of the country where it’s registered.

- check out the reviews of investors who have worked with the platform for some time.

- get in touch with the platform, in case you have any questions (or even if you don’t). See how efficient their communication is.

- start with small loans and diversify.

Pick the right P2P lending platform for you from those listed on CrowdSpace, and kick off your investment journey!