Best real estate crowdfunding platforms in Europe 2020

Crowdfunding in real estate is a clear scheme for passive income. Investors invest in real estate, as this allows them to diversify risks and portfolio at the same time.

The only thing remaining is to choose a reliable platform that will take care of all the legal issues and offer a worthwhile project with a good annual rate. One question, how do you choose such a platform?

In this article, we’ll make a list of the best European real estate crowdfunding platforms 2020. Our specialists have compared several commercial, residential and buy-to-let real estate platforms and selected the top 7 for such parameters as:

- Founded year

- Platform type

- Minimum investment amount

- ROI

- Rating and Trustpilot reviews

TOP 7 best real estate crowdfunding platforms in Europe 2020

EstateGuru

Founded year: 2018

Platform type: P2P

Minimum investment amount: €50

ROI: 12%

Rating and Trustpilot reviews: 4.3

The first position in our list is occupied by the Estonian platform EstateGuru. Despite the Covid-19 pandemic, the platform continues to work successfully.

EstateGuru’s main focus is on development loans with a fixed interest rate of 10 to 12% per annum. The platform may offer less profitability than other competitors in the market, but EstateGuru is focused on getting a lot more loans, which provides a lot more choice for its clients.

Another convenient feature of EstateGuru is auto-investment function. You can specify the desired parameters and the platform will offer projects for investment.

To start investing with EstateGuru, you need to be over 18 years old, have a bank account in EEA countries or Switzerland, go through KYC verification and have just 50 euros.

What we love:

- Easy to diversify portfolio in several European countries;

- Automatic investment function;

- Secondary market.

Cons:

- Limited options for automatic investment with amounts of <250 euros;

- Secondary market commission will be 2%.

CrowdEstate

Founded year: 2014

Platform type: P2P

Minimum investment amount: €100

ROI: 17%

Rating and Trustpilot reviews: 2.8

CrowdEstate platform is placed second on our list. The platform founders focused on development loans as all projects are built for further sale. By investing in buildings under construction, you will not worry about its further maintenance and other everyday things. With CrowdEstate you get less risk and therefore smaller financial reward.

Unlike many platforms, CrowdEstate works with all European countries, but does not close deals with US customers.

Over 6 years of operation, CrowdEstate has attracted over 92 million euros in 270 projects.

What we love:

- Secondary market;

- Auto-investment function;

- Loans are secured by deposit.

Cons:

- Doesn’t work with US clients;

- No buyback guarantee;

- Despite all the advantages, the platform has a low rating on the Trustpilot website – 2.8.

Property Partner

Founded year: 2015

Platform type: equity

Minimum investment amount: €250

ROI: 7-11%

Rating and Trustpilot reviews: 2.4

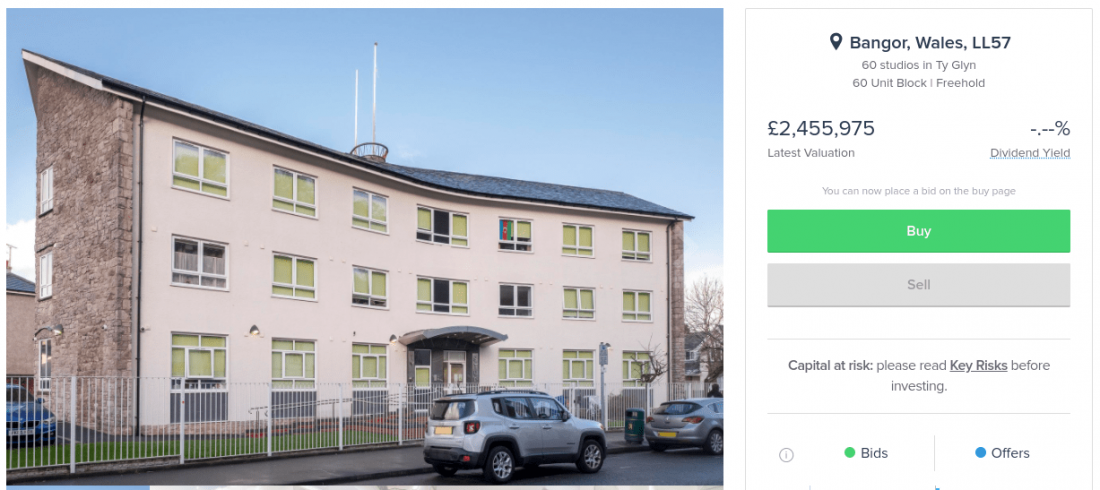

Property Partner is one of the largest platforms in the UK. The platform sale and rent out different properties, thereby increasing the flow of clients.

Another advantage of the Property Partner is the construction of studio complexes since most of the tenants of these properties are students who receive funding from the UK government (through Student Finance).

Despite a rather controversial rating on the Trustpilot website, Property Partner has voted the best real estate investment platform for 2018 and 2019.

What we love:

- Liquid secondary market;

- Auto-reinvestment feature;

- Regulated by the FCA since 2015.

Cons:

- Doesn’t work with US clients;

- Dividends and capital gains are slightly lower than some competitors;

- The auto-reinvestment feature is available for transactions of £5,000 minimum.

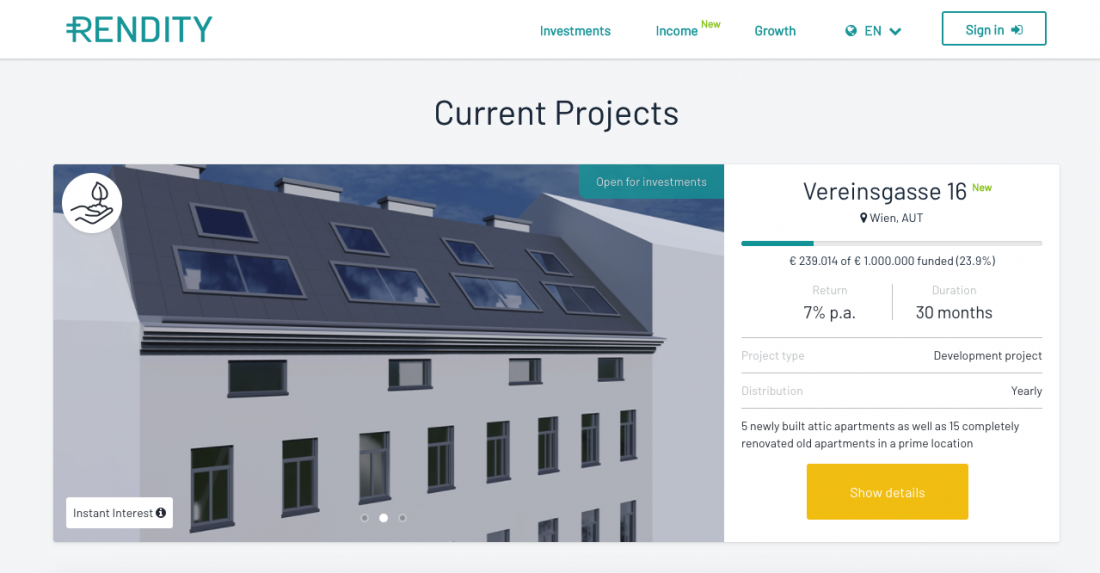

Rendity

Founded year: 2015

Platform type: P2P

Minimum investment amount: €500

ROI: 7%

Rating and Trustpilot reviews: 3.9

The Austrian platform Randity has been successfully operating on the German market since 2015 and has already attracted 3,447 investors, who noted that Randity’s lead risk is lower compared to other real estate markets in Europe.

Unlike the platforms listed above, Randity works with clients around the world and provides an opportunity to try your hands at the German market.

Despite the good reviews from Randity’s clients on Trustpilot, the platform has 2 main disadvantages: the lack of an auto-investment feature and a secondary market.

What we love:

- User-friendly interface;

- No fees;

- Quality Austrian projects.

Cons:

- No secondary market;

- No auto-investment function;

- Early exit is first available after 24 months.

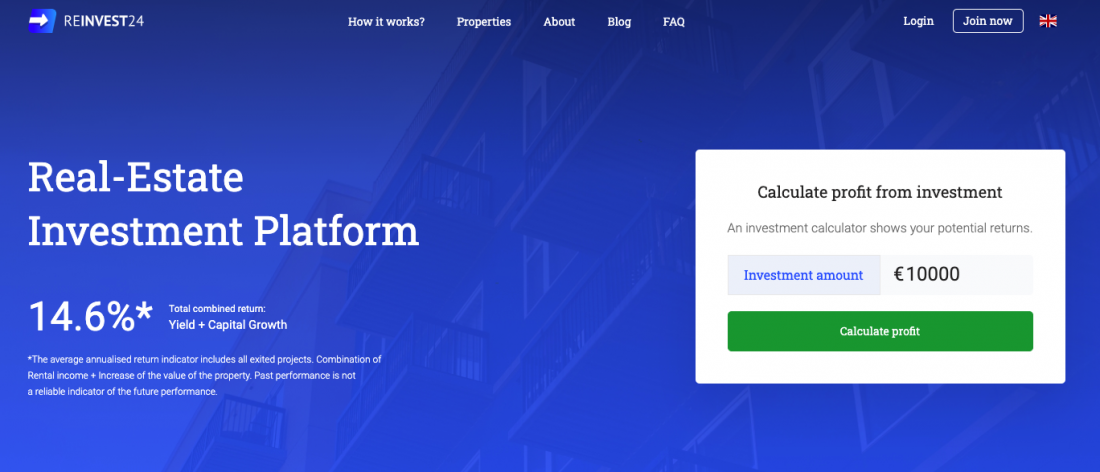

Reinvest24

Founded year: 2017

Platform type: equity

Minimum investment amount: €100

ROI: 8-14.6%

Rating and Trustpilot reviews: 4.4

The crowdfunding platform Reinvest24 has been operating on the Estonian market since 2017 and has already gained the attention of many investors.

Usually, the platform offers its clients to invest in real estate in Tallinn with a rather attractive yield of 7%, while after the completion of the project, the yield can grow up to 14%.

With Reinvest24, you can quickly diversify your portfolio as the platform offers different types of investments, from large commercial properties to small shops or coffee-rooms.

What we love:

- High capital return;

- Experienced team;

- Easy-to-use platform.

Cons:

- No secondary market;

- No auto-investment function;

- Some projects may take longer than expected.

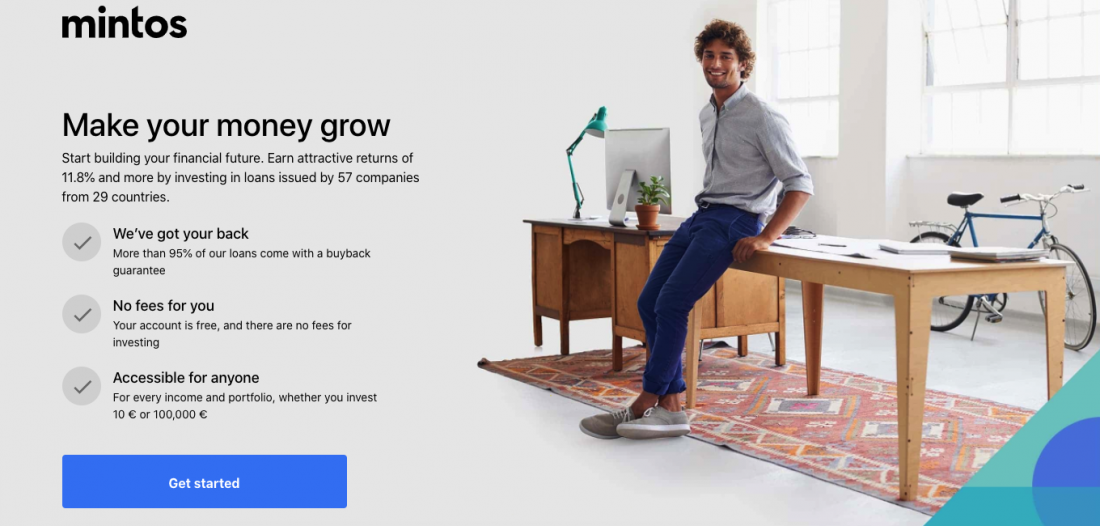

Mintos

Founded year: 2015

Platform type: P2P

Minimum investment amount: €10

ROI: 11.8%

Rating and Trustpilot reviews: 4.0

Mintos is a major player in the Latvian real estate market. The total amount of money invested exceeds 2.2 billion euros, which is a very good indicator for such a young team.

In addition to interesting properties and high interest rates, the platform is distinguished by the Mintos investor club. This is a kind of hub for the most valuable VIP investors (if you invest in Mintos more than 50,000 euros).

Mintos is also the two-time recipient of the 2019 AltFi Awards.

What we love:

- Mobile app available;

- Auto-investment function;

- Secondary market.

Cons:

- Currency conversion fee;

- Secondary market commission for sellers is 0.85%.

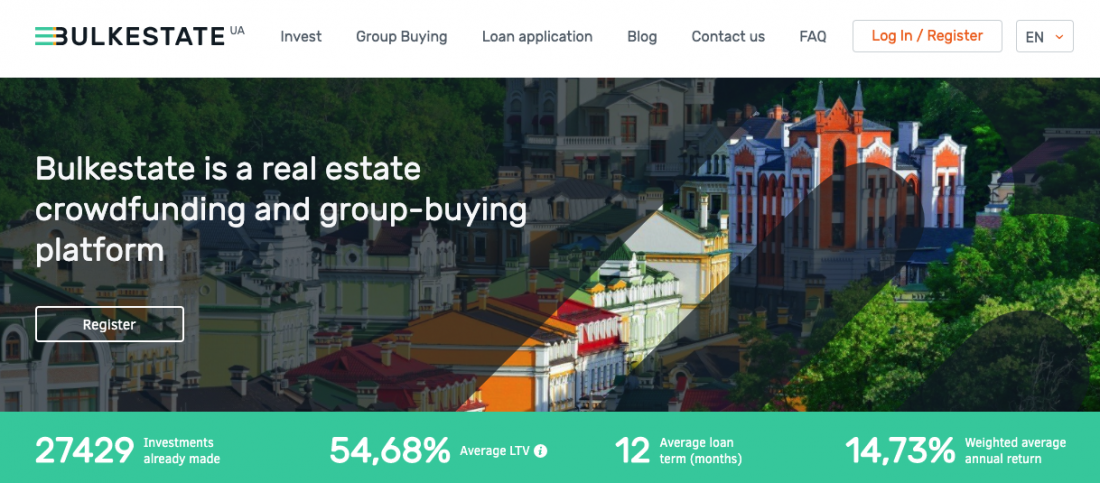

Bulkestate

Founded year: 2016

Platform type: P2P

Minimum investment amount: €50

ROI: 14.8%

Rating and Trustpilot reviews: 3.2

Latvian platform Bulkestate focuses on real estate crowdfunding and wholesale of apartments at below-market prices.

Since the Latvian market in 2020 is the most underdeveloped in the Baltic countries, this gives a great advantage and practically a monopoly for Bulkestate. To this end, Bulkestate only focuses on real estate financing with a high interest rate of 14% to 17%.

What we love:

- No investment fees;

- All loans are collateralized;

- Auto-investment function.

Cons:

- A low number of projects;

- Secondary market is not available.

On a final note

If previously the early investments were available only to business angels, then today you can invest with just 50 euros on your account. The real estate market is so diverse that you can develop passive income from renting/selling residential or commercial property.

Moreover, if you do not want to contact buyers or tenants directly, intermediaries or the platform will do it for you.

Investing in real estate is always a big risk, both from the developer’s side and from the platform’s side. Before you start investing, read reviews about the platform, check the licence and find out information about the developer. Compare all the advantages and disadvantages, discuss your choice with more experienced investors, and only then register and invest your money.

Remember that the choice is always yours!

If you still have questions or thinking about creating your own investment platform, feel free to discuss your idea with our team.