What is real estate crowdfunding: how does it work, pros & cons

Property crowdfunding is becoming an increasingly popular way to invest in various property projects, even for those who don’t have millions to buy property.

What makes it such an attractive venture is the opportunity for individual investors to pool their funds to participate in lucrative projects with high ROI potential. The property crowdfunding approach has significantly democratised the investing landscape by leveraging the power of technology and inviting a larger investors’ audience to the niche.

But how does real estate crowdfunding work? Let’s explore in more detail the real estate crowdfunding definition and what it entails.

First, let’s understand what crowdfunding in real estate is

What is property crowdfunding? It’s a method to collectively pool funds from multiple individual investors to fund various projects. The process takes place through online crowd-investing platforms, allowing investors to contribute with relatively smaller amounts and then share the returns.

Previously, investing in property was accessible only to high-net-worth individuals and institutional investors, but the introduction of crowd-investing has disrupted the old way and made it available to almost anybody.

The introduction of crowdinvesting via crowdfunding platforms has become a beneficial break-through for both parties involved: property developers receive access to a far larger investors’ audience which raises chances of hitting the target funding goal and having the project implemented. On the other side, investors get to access the niche and diversify their portfolios.

Real estate crowdfunding: how does it work?

Now that you have a basic understanding of what property crowdfunding is let’s dive deeper to understand how this niche operates and how crowdfunding real estate works.

Essentially, a property crowdfunding platform serves as a mediator between sponsors (those who publish offerings) and investors by facilitating the exchange of funds and ownership between both parties. The platform is also responsible for verifying investors’ and sponsors’ personalities, previous credit history, and compliance with all regulatory standards.

Still, since crowd-investing is considered to be a high-risk venture, we recommend always conducting the due diligence process of the platform and projects yourself before making any investment decisions.

Once you’ve verified the provider’s reliability, here are the steps you’ll most likely need to take as an investor to fund a real estate project:

- first, you register an account on a reliable platform. Remember to check such details as requirements to investors and if you comply with them;

- make sure the minimum investment is acceptable, and the fees charged by the platform are reasonable to you;

- research the available offerings and pick those that look suitable for you;

- make the investment and start monitoring the project through the platform;

- when the project starts making a profit, start receiving your dividends based on the pre-agreed terms.

Types of real estate crowdfunding

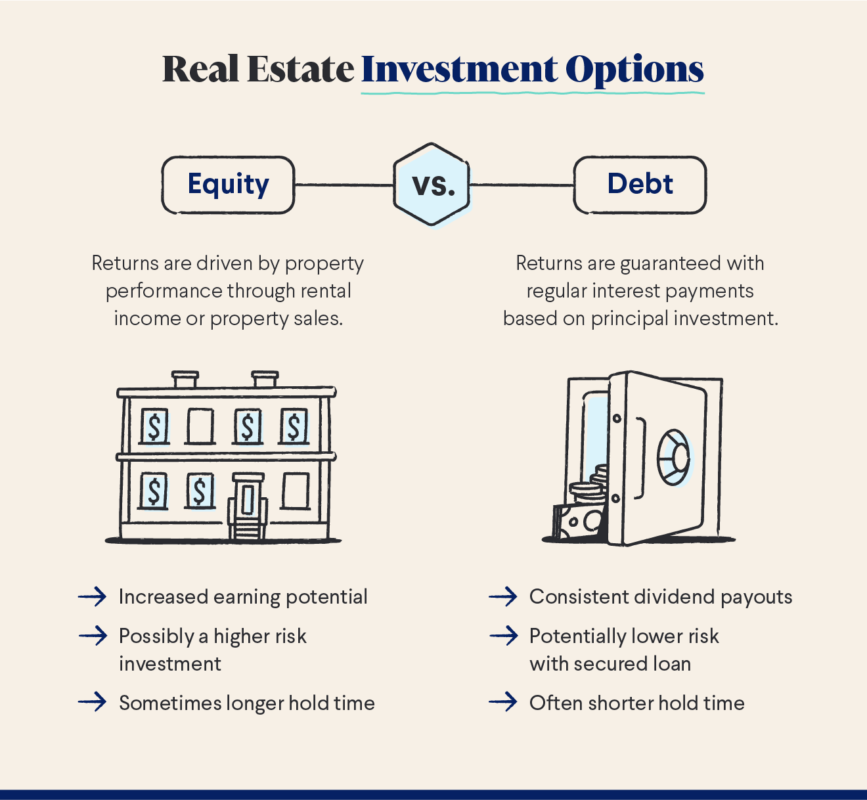

There are essentially two types: debt and equity. To understand better how crowdfunding real estate works, let’s review the two models to see what they entail.

Equity crowdfunding in real estate

In equity crowdfunding, investors get a share, a partial ownership of the property they invest in. A profit is generated when the property is rented or sold. In the first scenario, the returns come from rental income, and in the second one, from the price difference.

By choosing this investment type, investors can count on:

- unlimited earning potential if the property grows in value;

- usually no monthly management fees;

- tax benefits if the property depreciates.

However, this type of crowd-investing also has some drawbacks to keep in mind, such as:

- high risks connected to the probability that the property may depreciate;

- low liquidity, which means that you can withdraw your funds immediately. As a rule, the hold period varies from three to ten years.

Debt crowdfunding in real estate

In debt crowdfunding, investors get fixed interest monthly depending on the investment amount they’ve contributed and the agreed percentage returns. Debt investors are usually prioritized when paying out the benefits. This is why this investment type is generally associated with much lower risks than equity investment.

The main benefits of this investment type are:

- relatively short hold period that can last on average from 6 months to 2 years;

- fixed steady income;

- priority in payments over equity investors.

As you may guess, debt investment naturally comes with some drawbacks, the major of which are:

- the potential return is fixed and limited depending on the amount of invested funds;

- a platform may charge recurrent management fees.

To pick a suitable project, it all comes down to the funds you’re willing to invest and how long you’re ready to wait to make a profit. In other words, your overall investment strategy and goals.

Advantages and disadvantages of real estate crowdfunding investing

Alternative finance growth is transforming the property industry, creating more opportunities for all the parties involved: developers, fundraisers, and investors.

Yet, crowd-investing doesn’t eliminate all the risks involved, so it is important not only to understand how crowdfunding of real estate works but also to pick opportunities that can benefit your investment portfolio. And it means being well aware of all the benefits and drawbacks related to this investment type to make smart investment moves.

Real estate crowd-investing advantages

Investing in a property development or transformation project through a crowdfunding platform can deliver significant benefits, so let’s refresh and sum up what those benefits are:

- regular source of income: normally, property projects deliver regular income generated by rental payments, property sales, or interests;

- portfolio diversification: property is not correlated with other asset classes. It means that it offers decent portfolio diversification options that can strengthen your portfolio and help out if the market is down;

- income growth potential: the property tends to grow in value over time, especially when the property’s location area is rapidly developing. It can’t but benefit the income growth of investors, too;

- professionals’ expertise leverage: individual investors don’t have to do in-depth research, oversee the property construction, and manage it later. Instead, you can rely on the experts involved.

Real estate crowd-investing disadvantages

It’s crucial to be well aware of the risks involved and the possible worst-case scenarios since no platform can give you a 100% security guarantee that the project will be successful. Two major risks property crowdfunding involves are the following:

- high execution risks: a sponsor who takes care of the project needs to be very experienced in handling the property purchasing, construction or renovation, management, and rentals. If not, it may result in significant losses to those who decided to invest some money in a project;

- low liquidity level: investment in property is normally highly illiquid. If a platform doesn’t offer any additional exit opportunities, investors usually count on several years of hold period.

Is there a tax on investing in real estate crowdfunding?

Taxation of property crowdfunding varies a lot depending on a country since taxation policies are determined by EU member states individually. In most European countries, any rental income coming from real estate crowdfunding investments is subject to tax. Each return may be subject to different taxation regulations.

Some countries foresee tax reliefs. For instance, in the UK, you can look into IFISA, Innovative Finance Individual Savings Account, which allows investing mostly in debt loans up to £20,000 and receiving interest or dividends tax-free.

Laws and regulations can change over time, so it’s important to keep up with the latest developments in the area or, what’s better, consult a financial advisor for qualified financial advice.

Who are we?

CrowdSpace helps investors find the best platforms to invest in real estate and other lucrative opportunities in the market. Our aggregator allows you to filter platforms based on the investment type, country, licence availability, and industry.

On top of that, you’ll find more relevant data, such as country of operation, minimum investment amount, and business type, to help you make the best decision while saving time and effort.

Here, both beginners and experts can find some useful information with property crowdfunding explanation and crowd-investing in general, insights into the market, and exclusive interviews with the top platforms to navigate the investing world more consciously.

Conclusion

Unlike traditional methods of investing, property crowdfunding has developed rapidly and has become available to most users. Today, investors choose what to invest in, from hotels, shopping malls, and student hostels to luxury buildings on Baker Street. The three key takeaways that we would like to finish this article with:

- the biggest advantage of property crowdfunding is simplicity and easiness, without bureaucracy and banks;

- property crowdfunding can bring steady annual income;

- investing in such projects is a very risky business, and no one will give you any guarantees that your investment will pay off;

The last point is the most important. Before deciding to invest, you need to focus on all the pros and cons, read all the investment conditions and only then make a decision. Now that you know the principles of real estate crowdfunding work, you will be able to assign your investment capital correctly and get the profit you expect.