Best real estate crowdfunding platforms in Europe

Real estate crowdfunding in Europe is developing rapidly, and the implementation of the ECSP license will give another boost to the market. At the same time, it’s true that the market advancements alone do not help much if you aren’t aware of the existing real estate crowdfunding platforms in Europe, and what they can offer you for your investing or fundraising purposes.

Here, let’s have a look at some tips on how to choose the best real estate crowdfunding platforms in Europe and a list of the platforms with a proven track of successfully financed projects, the highest return on investment rates, and mostly positive investors’ review.

How to choose a real estate crowdfunding platform?

Real estate crowdfunding is a process where multiple investors fund a real estate project. A crowdfunding platform acts as an intermediary between investors and fundraisers. All the communication between the parties is performed through a platform. This is why picking the best European property crowdfunding platform is important for both project owners and investors to make things work.

We recommend assessing each new platform based on these criteria:

- types of investors that can participate: retail, institutional, accredited, etc;

- the minimum investment amount;

- platform’s licenses and permissions to operate in the field;

- projects and statistics on them: how many projects have been funded successfully, which ones failed, and if the platform had any issues with them;

- yield for investors advertised by the platforms;

- automatic investment availability;

- access to secondary markets for an early exit.

Additionally, personal experience with a platform’s website also plays a significant role. The top European real estate crowdfunding platforms usually have an easy-to-use interface that enables even beginners to participate in the promising offerings. Customer support is another essential factor that we recommend paying some special attention to. The quality and speed of their response speaks volumes of the company’s client policy.

So, don’t hesitate to get in touch with the customer support even with a simple question. It’s best done at an early stage of your platform-choosing process to get a comprehensive idea of the crowdfunding provider before trusting it with your funds.

We’d also stress checking the type of projects to see if they generally look appealing to you. Many investors prefer to invest in different types of projects on a few different platforms to ensure that they won’t lose all my funds in case something doesn’t go as expected. Think of spreading your investments across a few platforms, loan types and industries.

Best property crowdfunding platforms in Europe

Based on the essential investors’ requirements, we’ve picked the following platforms to get familiar with. Remember that, like in any business, you need to consider all the pros and cons of real estate crowdfunding and all the related risks. Even though the demand for real estate is constantly rising, it doesn’t guarantee that your investment will be profitable.

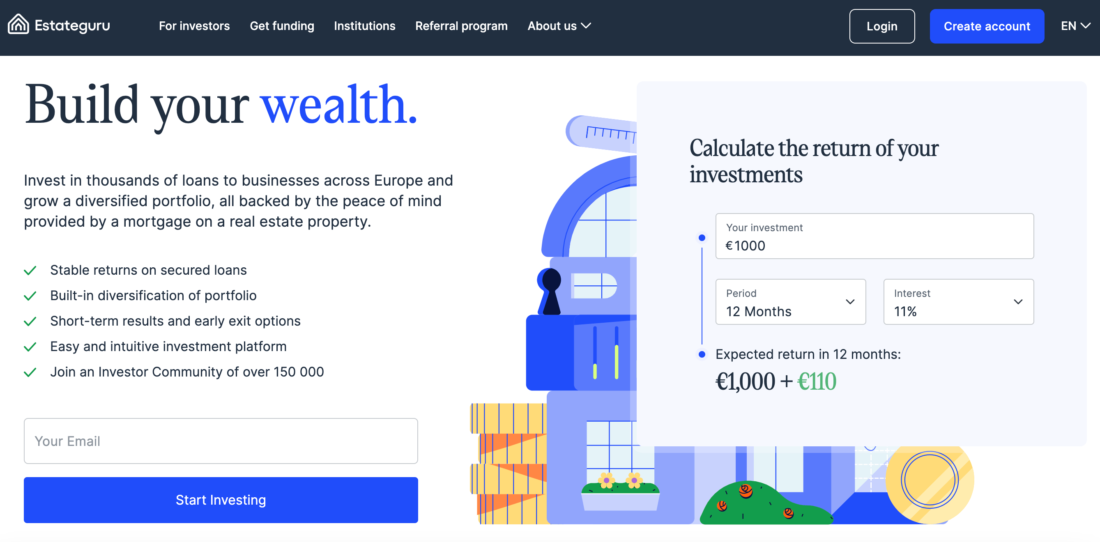

EstateGuru

EstateGuru is a popular crowdfunding provider that has been on the market for quite some time now. This Estonia-based platform was launched in 2014, and since then, it has offered investment options in real estate development loans with as little as 50 EUR.

The advertised yearly yield for investors is 10-12%, and the repayments are made at a fixed rate.

The platform operates across the EU, but its core countries of operation are Estonia, Lithuania, Germany, Latvia, Finland, Spain, Portugal, and Sweden. The majority of loans are secured with a mortgage with well-documented projects.

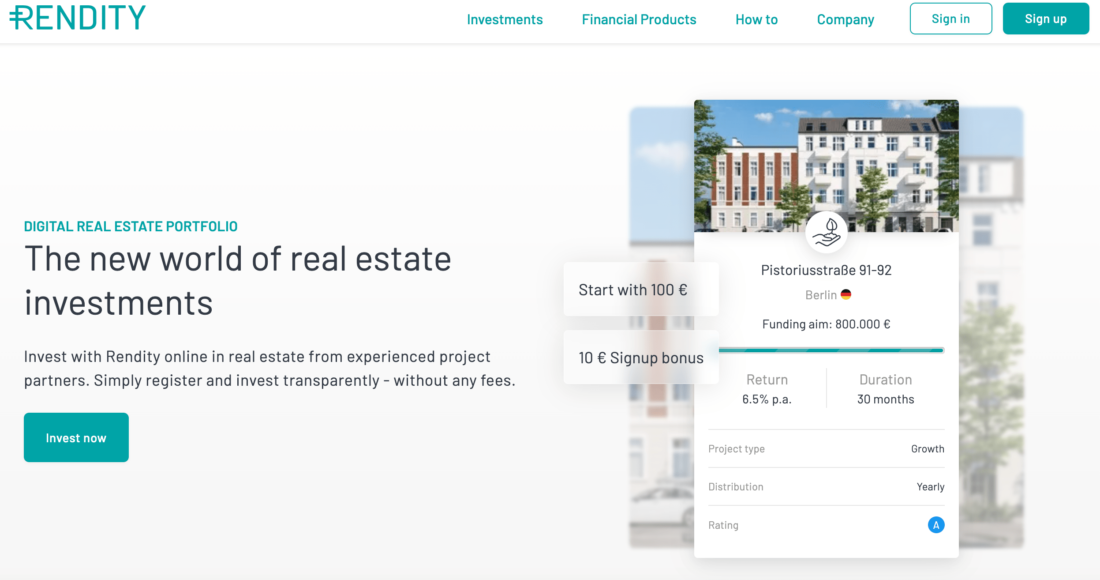

Rendity

Rendity is a crowdfunding platform focusing exclusively on the German and Austrian real estate markets.

The platform allows investors to fund rental real estate and get a fixed income from rent payments (equity-based) or to back development projects and get a fixed interest rate until the loan is repaid (debt-based).

The minimum investment is 100 EUR, and the expected yield you can account for is 6.43% per year.

Property Partner

Property Partner is a London-based regulated exchange for individual properties. The platform was founded in 2014, and soon, it became one of the best real estate crowdfunding sites in Europe. It’s true that it has lost its leading positions after Brexit, nonetheless, it is still a decent option for those who want to access investment opportunities in London real estate with as little as £1,000. The platform is a leader among other real estate crowdfunding platforms in the United Kingdom.

In most cases, the property available for investment is residential with the average yearly return of 10%. The platform also offers to invest in development loans, but this option is available for accredited investors only.

InRento

InRento is among the best property crowdfunding platforms in Europe that focuses on equity crowdfunding. It means that investors get their dividends from rental income on a monthly basis.

The company was launched in 2020 in Vilnius, Lithuania, and since then, it has offered to invest in low-risk projects with a minimum of 500 EUR.

The platform currently promises an average annual return per year of 13,34%. All investments are protected by a mortgage, and investors are eligible for capital gains if a project is realised. Trading in the secondary market is also available.

Raizers

Raizers is a French platform with offices in Switzerland, Luxembourg, and Belgium. Raizers allow investors to fund development and renovation projects and earn an average of 10% yield per year.

The platform has been on the market since 2014. The minimum investment on the platform is 1,000 EUR.

Most projects are France-based with decent diversification options. However, Raizers don’t offer an option to sell investments on secondary markets which can be a drawback for some investors. Still, it has earned a reputation of one of the best European property crowdfunding platforms for those who look to diversify their portfolios.

Bulkestate

Bulkestate is a Latvian company focusing on the Latvian real estate market. Bulkestate is a leader among EU crowdfunding platforms in real estate sector, and proof of it is its membership in the German-Baltic Chamber of Commerce.

With Bulkestate, you can choose to invest in property development loans or buy an apartment block jointly with other investors. The platform advertises an average return per year of 14%, which is pretty high compared to similar services.

CapitalRise

CapitalRise is an award-winning UK-based property crowdfunding platform giving access to prime real estate in the UK. Property developers can receive funding directly from investors who can participate in projects with a minimum contribution of £1,000.

Founded in 2015, it has since earned a reputation of a well-established and reliable provider. It was also one of the first platforms to offer IFISA, innovative finance individual savings account, that allows investing up to £20,000 yearly tax-free.

MaxCrowdfund

MaxCrowdfund is a real-estate-focused crowdfunding platform that enables participating in loans with a minimum investment of 100 EUR and with an average return of 10%. The platform is headquartered in the Netherlands but also operates in Belgium, Germany, and the United Kingdom.

MaxCrowdfund was launched in 2019, and in 2020, it received approval from the Dutch Financial Authorities (AMF) and was added to the registry of crowdfunding platforms in the country.

The platform has implemented a risk rating model that allows investors to learn the correlation between the possible profitability of an investment and the risks associated with the project. MaxCrowdfund accept both accredited and retail investors.

Search for the best crowdfunding websites in Europe with CrowdSpace

If you are looking for the best property crowdfunding companies in Europe, drop by our crowdfunding platform aggregator specifically designed to provide you with an up-to-date market selection. Here, you can filter over 600 platforms and apps based on the investment type, industry, and country of operation, offering you a decent selection when deciding on the best option for real estate crowdfunding in EU.

On top of providing you with an extensive database of the best property crowdfunding companies in Europe, CrowdSpace offers an extensive range of resources to facilitate the decision-making process. So, each platform is accompanied by a short review where you can find the major information on the resource, such as:

- country and industry;

- platform type;

- minimum investment amount;

- eligibility criteria for investors;

- average income for investors, and other details that allow you to compare platforms and benefit from the best real estate crowdfunding in Europe.

Bottom line

The introduction of property crowdfunding has undeniably democratised access to real estate investments, expanding the pool of potential investors who can participate.

- The adoption of pan-European regulation will boost this growth, meaning that more investors will be able to receive a profit from the most lucrative deal offerings. The technological side also keeps advancing, providing investors and fundraisers with handy apps for a better platform experience.

- Still, before committing your capital, it’s vital to perform the due diligence process yourself and assess the risks involved. While the crowdfunding industry progresses from the tech and legislative standpoints, it’s still a high-risk area. So, you need to keep in mind that there is always a chance of losing your investment.

- It’s essential to be well aware of the platforms that can offer you the best options for investing and where your capital can build a good sustainable income flow for you. This is where CrowdSpace can come in handy as your reliable resource for finding the best options for crowdfunding of real estate in Europe.