Real estate investing tips and emerging markets: interview with Tanel Orro, CEO at Reinvest24

Reinvest24 is a real estate crowdfunding platform from Estonia that launched in 2017 and has been offering attractive and reliable investment opportunities to date.

The team at Reinvest24 has decades of combined professional experience in finance, real estate and technology. Over the years, the company has managed over 10 million euros in investments.

Meet Tanel Orro, CEO at Reinvest24, who is on a mission to turn the company into the top real estate investment platform in Europe and who will explain why Moldova might be your next investment destination.

How would you describe Reinvest24 in a few words?

Reinvest24 is an Estonian real estate investment platform which focuses on pre-vetted residential and commercial properties across Baltic countries, Germany, Spain, Moldova, and Switzerland.

We are a boutique-style platform which focuses on quality rather than quantity and treats “excellent customer experience” as a mantra for our everyday operations.

During four years of work, we have achieved to become one of the most reputable and fastest-growing platforms in the European market.

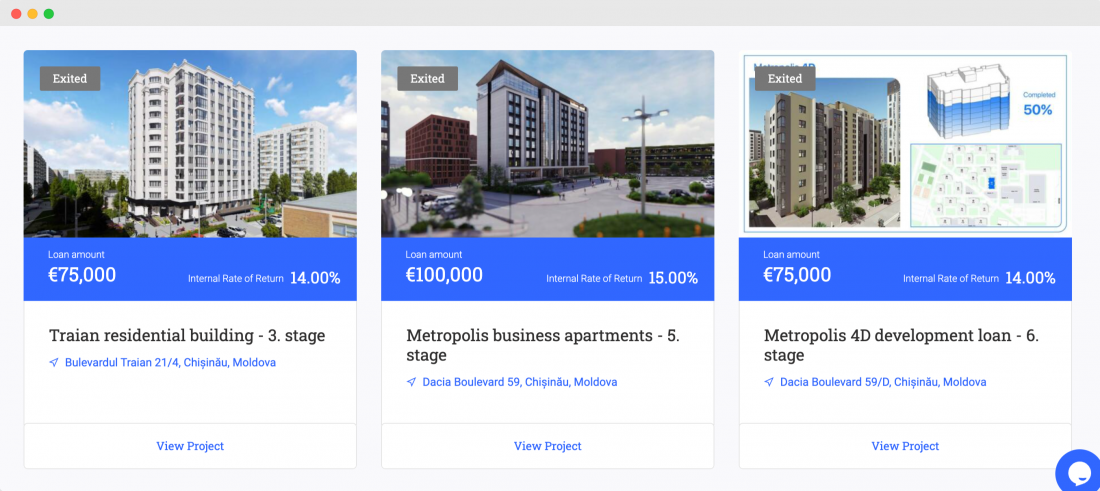

Moreover, we grew an extraordinary community of more than 17,000 investors and made a portfolio of over €25m while maintaining the average profitability of up to 15% p.a. and a 0% default rate.

What’s your process for selecting investment properties?

The real estate property comes to the Reinvest24 platform in different ways. Our team is constantly monitoring the market for projects with good potential, we are working with many real estate agencies as well as the borrower might come to us directly.

After that, Reinvest24 performs due diligence on the borrower or the project and signs preliminary agreements. In this blog article, we shed more light on how we choose the right investment objects.

How do you ensure Reinvest24 loans are safe for investors?

Before we put any project on our platform, it goes through a strict due-diligence process.

Apart from that, all of our projects are secured with a collateral guarantee. It means that if the property goes into default, the collateral will be sold and investments returned back to our investors.

Moreover, we use SPV (Special Purpose Vehicle) companies which manage the project. This way, we can assure that the risks are not transmitted to the other projects if any project faces troubles.

Who is the average investor at Reinvest24?

We cater to investors who prefer secured real estate investment for long-term passive income. Our investors come all over Europe. As the top 5 countries, we would name Germany, Netherlands, Estonia, Spain, and Bulgaria.

Recently we have noticed a growing interest in our platform from many professional investors, as they value us as the easiest gateway to the Moldovan real estate market.

Currently, Moldova is a developing country that faces important changes, which could bring outstanding and high-yielding opportunities in terms of real estate investing.

On top of that, we also offer loans in reputable and stable markets, such as Germany and Switzerland.

Especially now, when other asset classes are facing big downsides, and overall inflation is eating up the savings, more and more investors started to look towards more stable cash flow investments, like real estate.

What moment has been the most critical for the platform, and how did you overcome it?

A would say that the start of the Covid-19 was quite challenging, as the crowdfunding industry back then was facing the wave of questionable platforms going out of business and investors having trust issues with the rest of the market participants.

Our team put quite an effort into proving our reliability, which helped us build a strong and loyal community around our platform. We were also having issues with a couple of our projects but were able to successfully overcome them, maintaining the default rate at 0%.

Per the statistics presented on your website, your largest project share comes from Moldova. Do you think it’s a profitable market?

Yes, we definitely do see a big potential in this market. To be honest, we treat Moldova as a true investment gem. It is 10-15 years behind the Baltic states in terms of development, so there is a big room for real estate market growth.

We have recently entered the green energy sector, financing the development of one of Moldova’s biggest solar panel parks.

Taking into account the rising demand for the energy supply, especially in such developing countries, we expect that green energy projects will be quite profitable.

What advice would you give to real estate investors in terms of building a solid portfolio?

- Don’t wait to invest in real estate. Invest and wait.

- Choose only reputable partners, don’t chase the ones who promise you a fortune overnight.

- Diversify well over the geographies and project types.

- Be patient and consistent, as even investing only €100 every month will make you a millionaire in 30 years.

- Make your investments as effective as possible by reinvesting even the smallest profits every month. A compound interest strategy really does magic over a longer period.

If you consider trying your chances with real estate investment, feel free to join Reinvest24 now and get a welcome bonus of up to €1,000!

How it works: register and invest in any project on the primary market on the Reinvest24 platform from July 1st to November 30th 2022 and get a bonus for investments made during the first 30 days after registration.

The following bonus rates apply:

- invest between €599 – €1,999 and get a €25 bonus;

- invest between €2,000 – €9,999 and get a €50;

- invest between €10,000 – €99,999 and get a €200 bonus;

- invest €100,000 and get a bonus of €1,000.

Learn more about the terms and conditions of this bonus.

Are there any news or plans you think Reinvest24 potential investors may be interested to find out?

I would suggest following Reinvest24 social media channels or joining our official Investor’s Telegram channel, soon we are going to introduce many exciting things and projects. So stay tuned!

What property regions do you expect to grow in price and become more attractive?

As mentioned before, Moldova is one of the most attractive destinations in terms of price growth. As per the rest of the geographies, our main strategy is to look for growing locations near the big cities.

So, when it comes to Reinvest24 projects, our Spanish and German properties will generate great capital growth, as they are located near Valencia and Berlin.

How do you see the future for real estate, and do you see any emerging trends?

Taking into account that the long-awaited regulation will come into force later this year, it will strengthen the P2P investment industry overall. By that, I mean that there will be fewer market participants, but those who will stay will become the masters of the products and services provided.

Also, retail investors will become more educated in terms of real estate crowdfunding, project types and will understand better the risk profiles that are coming in hand with different types of investments. Many factors should be taken into account when evaluating the high-interest rates.

In our case, we are currently able to offer returns up to 16% because we are working on developing markets with a big potential for capital growth.

We also develop the majority of projects by ourselves, thus lowering the expenses as much as possible. In the long run, we believe that interest rates will go down. As for now, this is more like an outstanding opportunity rather than a sustainable paradigm that is here to stay. And one should definitely consider using it.

We thank Mr. Orro for this engaging conversation and curious industry insights. Find more opportunities with Reinvest24 and explore more real estate crowdfunding platforms with CrowdSpace.