Crowdfunding regulations in the UK and Europe

New crowdfunding businesses face many challenges that can freeze the achievements of the whole team: inexperienced developers, incompetent managers or lawyers can easily fail a project.

But there is one aspect you can control and manage: learn about crowdfunding regulations in advance and never start developing the platform before you figured out the legal side.

The main goal of the regulatory bodies is to make sure your crowdfunding business complies with a set of base rules and won’t harm the financial state of investors and fundraisers that use your crowdfunding platform.

In this article, we will explore some of the requirements of the regulators in the UK and Europe.

Note: the information presented should not be treated as legal advice. Please seek the consultation of an experienced lawyer or compliance advisor.

Here’s what we will cover:

- Who are the regulators, and why do we need them?

- What is the Financial Conduct Authority?

- What crowdfunding platforms are regulated by the FCA?

- How is crowdfunding regulated in Europe?

Financial regulators and why we need them

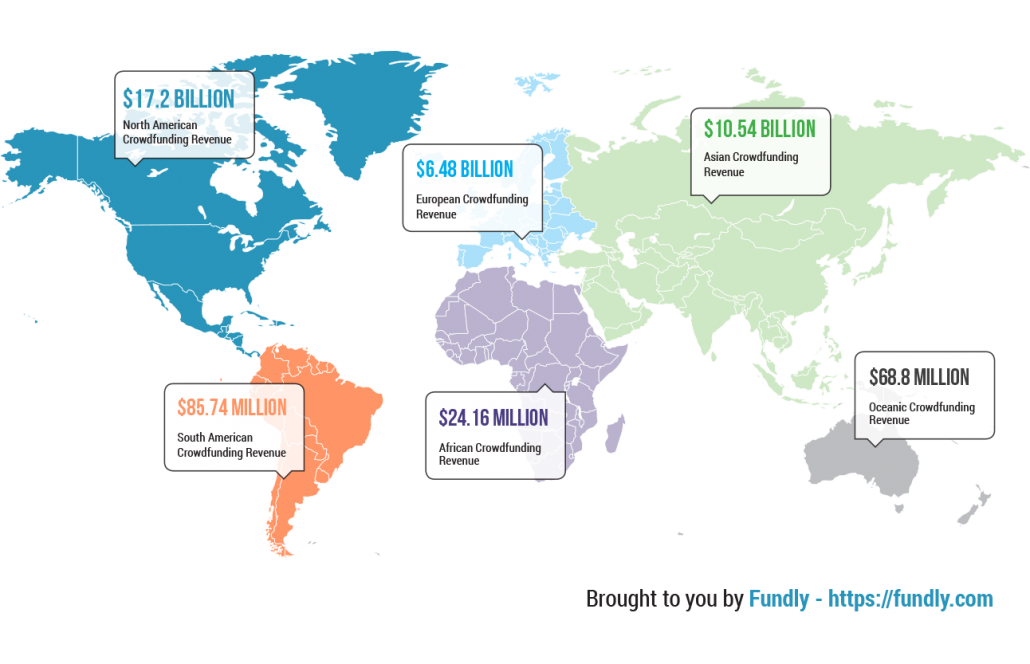

Financial markets are developing quickly. In 2006, the word “crowdfunding” was new, and now it is an everyday term that does not cause any confusion.

With the growth of the market arose new problems that prevent the crowdfunding sector from functioning properly.

Financial regulators were created to regulate these markets, protect consumers and promote healthy competition, bringing profit to their countries.

Thanks to financial regulators, it’s not only the countries’ economies that are developing. The global economic hub is developing too, which makes the entire financial system move.

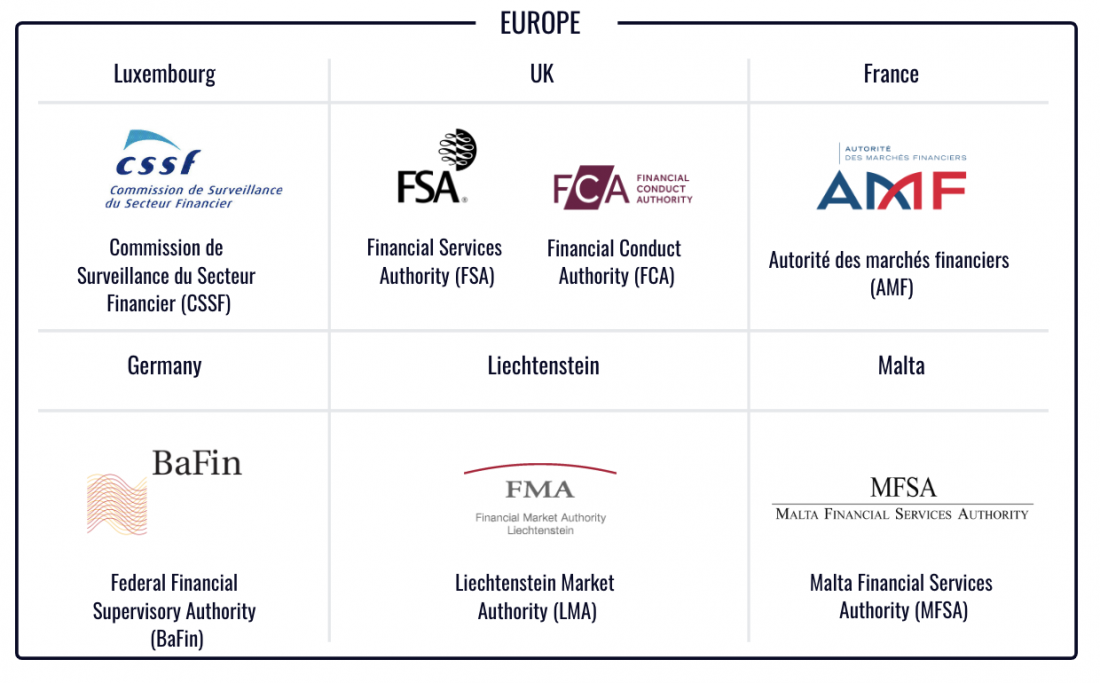

Some of the earliest financial sector regulators are FCA in the UK, BaFin in Germany and AMF in France.

What is FCA and what does it do exactly?

The Financial Conduct Authority (FCA) is the premier financial regulator in the United Kingdom which overlooks more than 59,000 firms.

Since 2013, the FCA has regulated 1,500 banks, building societies, credit unions, insurers and large investment companies. Crowdfunding platforms are also regulated by the FCA.

UK crowdfunding regulation started in 2014, following the release of new rules that aimed to protect consumers from fraud and improve the UK financial system.

Which crowdfunding platforms are regulated by the FCA?

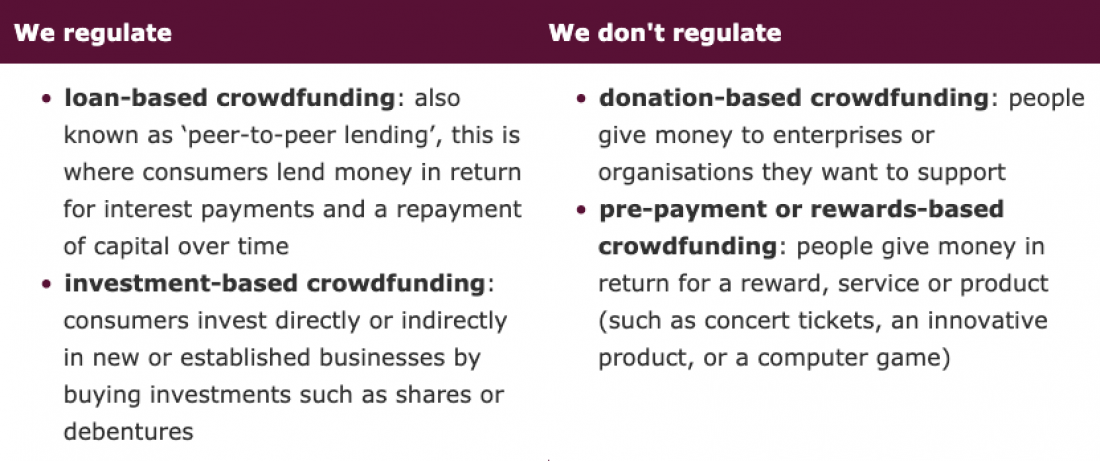

FCA regulates all types of crowdfunding platforms, except donation- and reward-based as they do not participate in the purchase and sale of shares and do not imply capital increase.

What about P2P lending platforms?

Peer-to-peer or P2P lending is an alternative financing method which is subject to FCA regulation, although up until 2014, P2P platforms were regulated by the Office of Fair Trade (OFT).

FCA monitors P2P platforms closely as some platforms may cheat on their customers and present their services as holding money in a deposit.

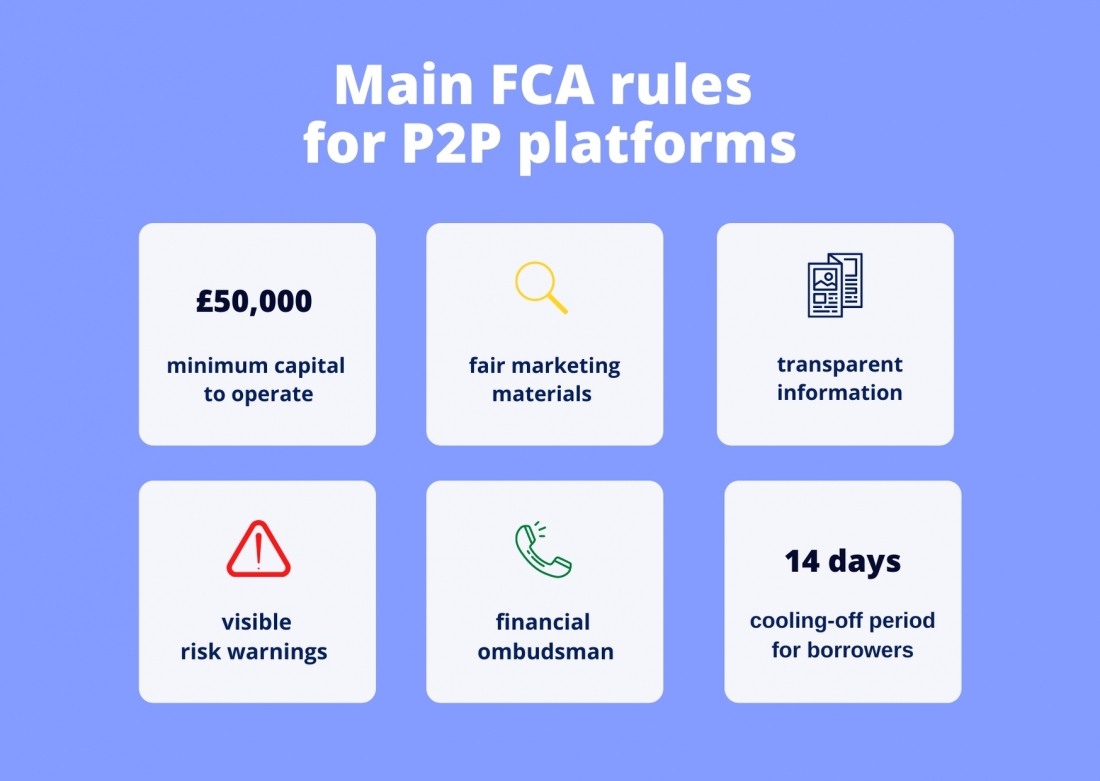

If you are planning to launch P2P lending platform, we recommend looking through the basic FCA terms for P2P platforms:

In addition to the ground conditions, FCA regularly makes new changes and issues warnings.

For example, in 2019, FCA updated the requirements for P2P lending and defined the investment limit for retail clients which should not exceed 10% of the invested assets.

How to apply for a crowdfunding platform authorisation?

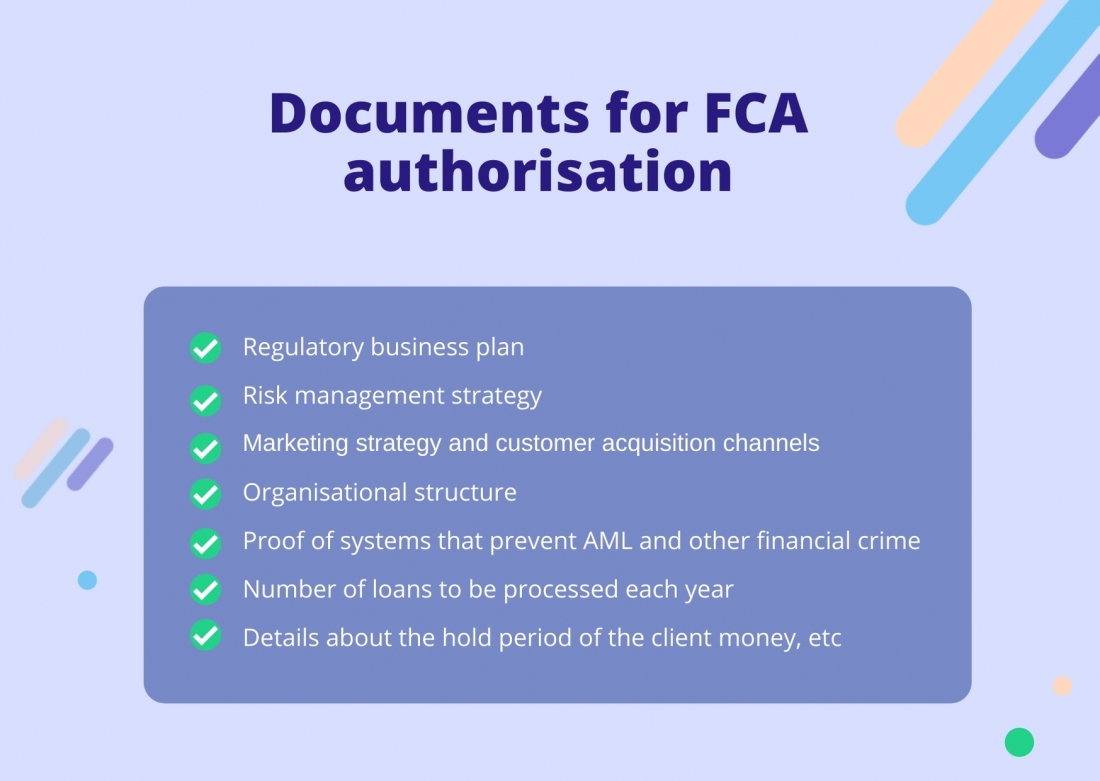

Submitting an application on your own should not be difficult, but collecting the necessary documents, fulfilling all FCA requirements on the site and going through authorisation single-handedly is unlikely to work. Most businesses hire a contractor firm that knows all the FCA “tricks”.

If you want to authorize the company yourself, here is the basic list of documents you need to collect:

Be ready that the authorization process will be long and make take from 6 to 12 months. You will have to personally communicate with an authorised FCA person, answer the same questions several times and pay the established registration fee.

To get a better idea of the authorisation process and purpose, read the FCA manual.

After successful authorisation, you will be assigned an FCA registration number, which you must indicate on your crowdfunding or P2P lending platform.

Crowdfunding regulations in Europe

Today, it’s still quite challenging for the crowdfunding platforms to expand across EU countries, as there are no general rules. Only in December 2019 the European Parliament and the Council reached an interim political agreement on the new regulation.

This document will allow the crowdfunding platforms to apply for EU labelling, which will give the platforms an opportunity to offer their services throughout the EU.

At the end of July 2020, the European Council adopted new rules for crowdfunding platforms which cover campaigns for up to EUR 5 million. Reward- and donation-based crowdfunding are outside the regulatory scope.

The regulation will enter into force after it has been adopted by the European Parliament.

Despite the positive developments, most investors do not consider European crowdfunding to be a successful market, as regulation is still largely based on national legislation.

At the beginning of the article, we have already cited financial authorities in various European countries and mentioned that crowdfunding in France has been regulated by Autorité des marchés financiers (AMF) since 2014.

In France, all crowdfunding platforms (except for the donation-based) must be registered in the ORIAS single registry as a crowdfunding consultant.

Unlike the French law, crowdfunding in Germany is regulated by the German Financial Supervisory Authority (BaFin), which is optimistic about expanding the crowdfunding power in the country and beyond.

The German Crowdfunding Association has recently adopted improvements to the legal framework for crowdfunding. According to the amendments, the individual investment limit was increased from 10,000 euros to 25,000 euros per investor per year.

If you are considering launching a crowdfunding platform in European countries, we recommend taking the crowdfunding regulation rules in a particular country as a note.

Let’s sum up

Alternative financial regulators seek to improve the environment for entrepreneurs and protect investors from fraud, thereby regulating healthy competition in the market.

Of course, regulation in the UK and the USA is much better developed than in European countries, but this does not mean that you do not have the opportunity to create a successful investment business in Latvia, Germany or Malta.

You just need more effort and time in order to understand the legal framework of a particular country and, most likely, enlist the help of contractors.