Meet the largest consumer loans platform in Lithuania: interview with Indre Krasovske, Head of P2P department at NEO Finance

NEO Finance is one of the most regulated P2P lending platforms in Europe, claimed to be one of the most transparent and user-friendly providers. Based in Lithuania, they have been on the market since 2015 and since then, have obtained compliance with local and European crowdfunding authorities.

In this concise and informative interview, the Head of P2P department at NEO Finance, Indre Krasovske, has elaborated on their AI-powered credit scoring methodologies, what it takes to takes to maintain high-transparency, and what challenges they’ve faced at the very beginning of operation and what they deal with now.

We thank NEO Finance team for sharing their professional experience with our readers, and eagerly invite you to dive into our discussion below.

Welcome on the CrowdSpace blog! What’s NEO Finance in a nutshell?

NEO Finance is a Lithuanian P2P lending platform offering personal loans to Lithuanian citizens available for European retail investors.

How did your business begin?

NEO Finance was started as a completely new venture in 2015. In 8 years of operation, we have managed to become the P2P market leader in Lithuania.

Our loan portfolio amounts to more than €55 million, and we can take pride in our loan issuance continuing to grow yearly.

How do you choose a loan borrower?

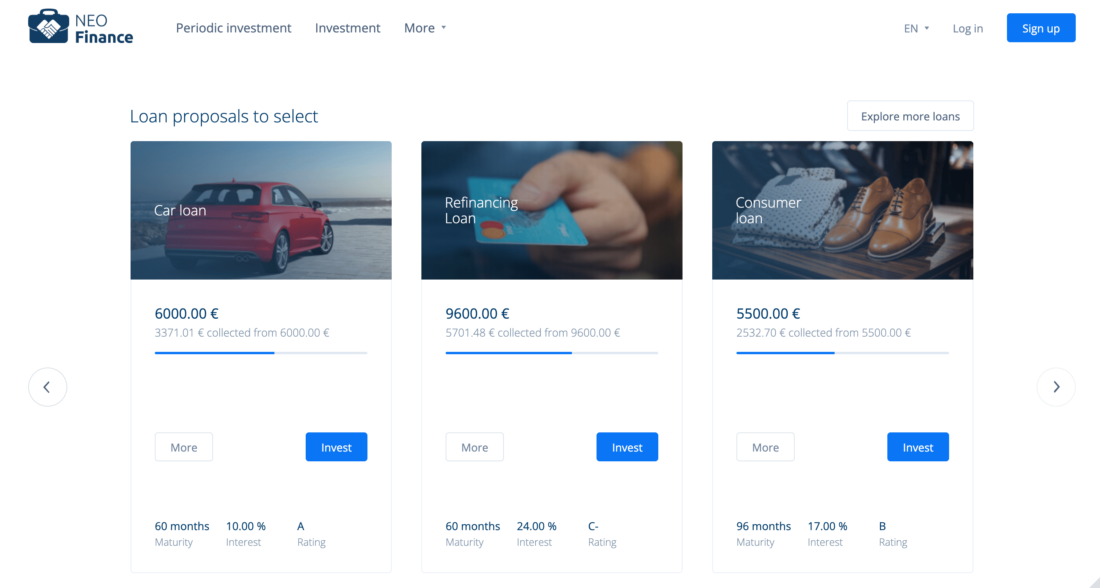

The borrower’s solvency is verified in accordance with the solvency assessment rules agreed with the Bank of Lithuania. Each borrower, who successfully passes the solvency check, is given a credit rating based on NEO Finance’s unique calculation methodology using artificial intelligence.

The AI innovation is one of the most advanced credit scoring methodologies in the world, based on artificial intelligence and machine learning technology. Our managers cannot have a direct influence on the credit rating that is given to a borrower.

Our risk assessment system has been developed based on years of loan issuance data and track records. The system analyzes more than 30 criteria and the compounds of a borrower, like his or her age, monthly income, liabilities, marital status and others, to assess the risk of default.

What loan types do you offer?

NEO Finance issues consumer loans to Lithuanian citizens, but legal persons from all over the EU can invest in NEO Finance, too.

Who’s an average investor at NEO Finance?

Our average investor has a portfolio of 3,900 EUR with an average of 240 investments on the portfolio. The age range is 35-40 y.o. Currently, more than two-thirds of our active retail investor base are Lithuanians, but we also have a lot of active investors from the Netherlands, Belgium, Germany, and Spain.

What’s your impression of the crowd-investing market climate in Lithuania?

The crowd-investing market in Lithuania has been experiencing growth and development in recent years. Now this form of investing is becoming even more popular, so more people are discovering crowd-investing.

Lithuania has implemented regulations to facilitate crowdfunding activities, implementing licensing requirements to ensure investor protection and promote transparency. It has significantly boosted the market stimulating more platforms to enter the market and giving investors a plenty of alternatives to choose from.

Are you planning to expand your geography?

Our borrowers are only Lithuanian but investors can be from the European area. And yes, we have plans to expand into Eastern Europe in the future.

What moments has been the most challenging for NEO Finance?

The hardest part was at the beginning of our operations when we had to convince the first 1000 investors that it was worth investing in our platform.

Speaking of more recent developments, the Bank of Lithuania is applying increasingly stricter requirements, which are challenging to implement and very costly: compliance, IT security, consumer credit law, EMI requirements, AML, and many other legal requirements.

How’s your experience with ECSP licensing?

One of our companies, Finomark, is currently in the licensing process. The process is long but dynamic, so we plan to successfully complete all licensing issues in the fall and start working globally.

What makes NEO Finance stand out among other P2P platforms?

We were the first P2P platform in Lithuania to have obtained an unlimited EMI license.

One of the reasons why investors choose us is the extraordinary safety that we can produce. NEO Finance is publicly listed on the NASDAQ First North stock exchange. Due to this fact, we follow strict NASDAQ requirements of providing public financial quarterly and annual reports.

Secondly, we have an electronic money institution license and are highly supervised by the Central Bank of Lithuania (CBL). CBL performs regular inspections of the operations and procedures of NEO Finance.

We also provide investors with investment buyback service, a liquid secondary market, an exceptional loan recovery track record, on top of a lot of useful data and reporting that allows them to make impactful investment decisions.

How has NEO Finance been recently? Any news to share?

There is indeed some news: since March of this year, the minimum interest rates have risen by 2-4%, so now investors may earn even more solid investment returns.

Also, we have relaunched the Referral program. Once you sign up on NEO Finance and share the registration link with your friends, they’ll get 1% each for three months in a row from the amount invested by friends.

What are your predictions for the future of the P2P sector?

The future of P2P lending in Lithuania appears promising, as the market has shown growth and potential in recent years.

The demand for alternative lending options has been growing, driven by borrowers seeking faster and more accessible financing solutions and investors looking for higher returns than traditional saving or investment products.

Moreover, P2P lending platforms allow investors to diversify their investment portfolios by allocating funds across multiple loans, borrowers and risk profiles. This diversification potential can attract more investors and contribute to the market’s growth.

However, it is important to note that the future of P2P lending in Lithuania, as well as any financial market, is subject to various factors, including economic conditions, regulations, adherence to best practices, and proactive adaptation to market dynamics. It will be crucial for the sustainable development of P2P lending in Lithuania.

We thank NEO Finance team for taking their time to speak to us and to share their background processes along with the industry views. Looking forward to more innovations and developments in the crowdfunding sector.