- The pooled funds will be used for real estate development;

- The mortgaged assets are other, liquid assets with 100% completion;

- The owner of the project has many years of experience in the construction sector;

- The development consists of exclusive semi-detached houses with installed solar power plants.

About the project owner:

The manufacture and installation of prefabricated, modular houses or buildings and their structures is the company's core business, with an annual production of around 2 700 - 3 000 square metres of buildings for both individual and commercial customers. The project owner also has experience in real estate development, having completed a block of 12 individual panel houses in Kaimeles Street, Kaunas. Together with Profitus, the developer has financed and successfully implemented 3 projects. The projects were successfully completed and the investors were settled on time.

About the project:

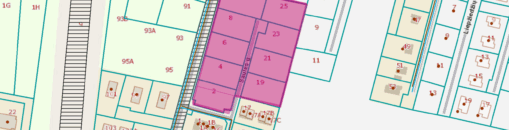

„Zatorskio vilos“ project consists of prefabricated modular houses that the company manufactures itself in its own factory. The manufactured structures-assemblies are delivered to the site and assembled. This type of construction is extremely fast, with the house being built within 4 months from the pouring of the foundations. The project consists of 6 duplexes of the same architecture and layout, class A++, with a total of 12 apartments. The apartments in the duplexes are sold fully finished. Currently there are two semi-detached houses left to be built at Zatorskio str. 16, Kaunas. One semi-detached house has an area of 221 square metres and a building permit has been obtained. This loan will be covered by the proceeds of the sale of the property. The estimated sale proceeds of the two semi-detached houses are EUR 454 000.

The maximum planned amount of financing for the Project: EUR 246 400 (EUR 138 000 already raised). The project is financed according to the current valuation of the mortgaged property until it reaches the set maximum LTV of 70%. Once the maximum LTV has been reached, a new valuation of the property will be carried out and further rounds of financing for the Project will only be advertised and collected if the maximum LTV is not exceeded. The loan-to-value (LTV) ratio with VAT at this stage is 55%.

Interest by investment amount:

– From EUR 100 to EUR 499 – 9.2%

– From EUR 500 to EUR 999 – 9.7%

– From EUR 1 000 to EUR 4 999 – 9.95%

– From EUR 5 000 to EUR 9 999 – 10.2%

– From EUR 10 000 – 10.7%

Important: investments made separately are not aggregated and cannot be pooled.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.