Real estate syndication vs real estate crowdfunding: full comparison

As the investing world evolves, so do various investment types and forms. The property sector is no exception. What stays the same, though, is property investing’s reputation as one of the most reliable and attractive investment opportunities.

You may have noticed that one standard recommendation for a solid investment portfolio is to diversify it by including a property-backed loan. In this article, we will focus on the two property investing options often compared these days: real estate syndication and crowdfunding.

Real estate syndication and crowdfunding are relatively new models of investing in property deals. These models are closely related, this is why many people mistake one for another. And indeed, in some regards, they are very similar. However, these are not synonyms, there are significant differences between them.

What is a real estate syndication?

It is one of the models that allows investing in institutional property deals. It is a form of partnership between several investors and a property sponsor. By pooling their funds together, investors can afford to invest in bigger and more profitable deals such as:

- buying commercial property;

- purchasing blocks of apartments;

- renovating the property to lease or rent it.

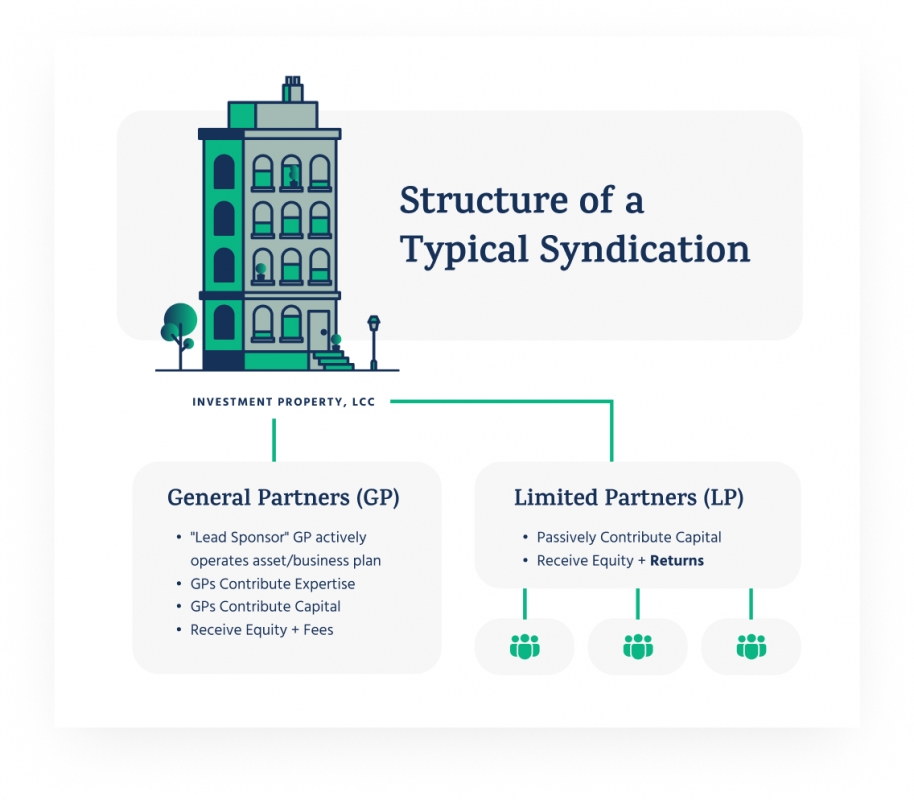

A syndicate has to be a registered legal entity, a Limited Liability Company (LLC) or a Limited Partnership (LP).

According to the SEC, property development companies that market their projects to the public are only permitted to deal with accredited investors. Most syndicates do so, so they belong to the category of companies that can work with accredited investors only. However, some syndicates offer deals only to a limited circle of trusted investors, not to the public. On the other hand, they are permitted to raise funding from accredited and non-accredited investors.

A sponsor manages all the syndicate’s operations by leveraging his experience, knowledge, negotiating talent, and other intellectual resources to find the best deals for passive investors who bulk the capital. This is another convenient moment in syndication.

Advantages and disadvantages of real estate syndication

Just like any other investment opportunity, it comes with its benefits and drawbacks. It is important to know them to pick the right investment model.

Advantages

- The availability of an experienced sponsor

At the head of each syndicate, there is an experienced and knowledgeable sponsor who chooses and negotiates the best deals and manages the daily operations of a syndicate.

- Equity is offered

By participating in the deals, investors get equity, meaning they become co-owners of the property in which they invest. So, they get ownership rights over the property.

- The syndication company takes care of everything

The syndication company is responsible for all the paperwork to comply with the valid legislation, due diligence procedures, collecting money, and distributing dividends.

Disadvantages

- Deals for accredited investors

Syndicates deal with accredited and institutional investors. Retail investors do not have access to a syndicate company.

- High entry limit

To participate in a syndicate, one would need to have at least $50,000.

What is real estate crowdfunding?

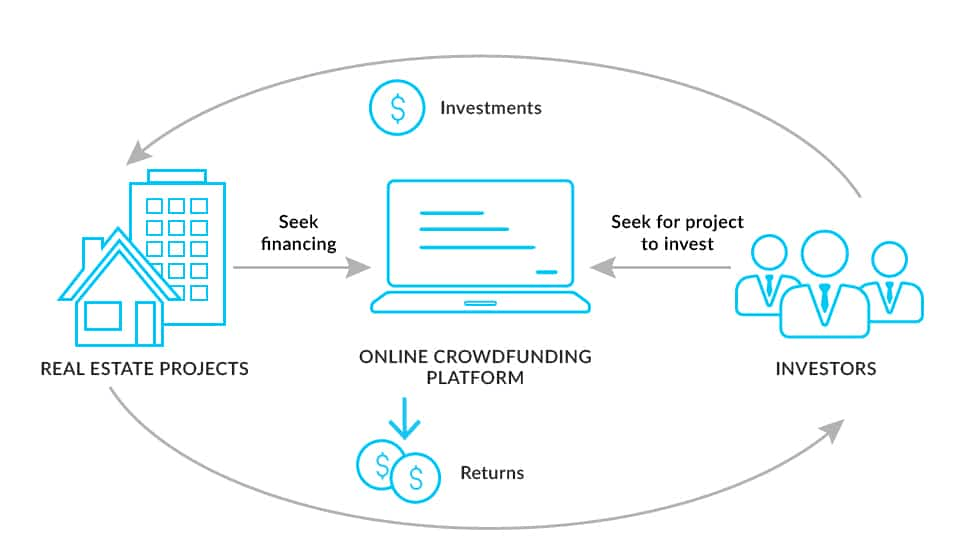

It is a form of raising funds from multiple investors to fund a specific property project. The main difference between real estate syndication vs crowdfunding is that the latter investment form is available to anybody.

While some real estate crowdfunding platforms limit their services to accredited investors only, some work with anybody who can meet the minimum investment amount.

Advantages and disadvantages of real estate crowdfunding

Like any investment form, property crowdfunding is not perfect and comes with its drawbacks and risks.

Benefits

- Investors don’t have any responsibility for the project’s success

Investors provide funding but aren’t responsible for the project management and development, so getting passive income if the project is profitable.

- All types of investors are accepted

Even though most platforms limit their operations to accredited investors only, some accept retail investors. This fact means that top-tier property investment opportunities are now open to more people.

- Lower minimum investment

Crowdfunding platforms normally work with lower minimum investment sums. It opens opportunities for more people to participate.

Drawbacks

Among the main drawbacks, the following are worth mentioning.

- High entry barrier

Even though crowdfunding platforms have more reasonable minimum investment limits than investment funds, these limits may not be accessible to the majority of people.

- High risks

Despite the fact that all property crowdfunding platforms perform due diligence, the risk to lose funds is still very high.

Key difference between real estate syndication and crowdfunding

When you compare syndication vs crowdfunding for real estate, you will see that indeed, there are many differences between these two forms of raising funds. The main difference between real estate syndication and crowdfunding is in the opportunities these two models provide.

1. Investment model

Syndications are usually equity-based: an investor receives equity in the property project, which allows them to take advantage of tax benefits. Crowdfunding can be equity-based or debt-based, and many platforms opt for a debt-based model because it is easier to manage. So, one must understand the difference between these models very clearly to make proper investment decisions.

2. Investment term

The next difference between real estate crowdfunding vs real estate syndication is the investment term. In syndication, the investment term varies from 5 to 10 years, while in crowdfunding, this term is much shorter (around 2 years).

3. Investment size

Investment size is another important detail to consider when we compare the real estate crowdfunding model vs syndication. While both investment forms are about pooling funds from multiple investors, syndicates focus on bigger properties, and thus, minimum investments in syndicates are higher while crowdfunding is usually more accessible.

4. Number of investors

The number of investors is another detail to remember when comparing property crowdfunding vs syndication. Anybody who complies with the platform’s requirements can participate in a crowdfunding project. Some investors may contribute a minimum sum while others can invest much more. Syndicates normally rely on a fixed number of investors, each contributing equally to the investment pool.

Syndication or crowdfunding: what model of real estate investment to choose?

So, should one choose real estate syndication or crowdfunding? It depends on which model is more suitable to you and what you expect.

If you choose a better deal flow, you may consider crowdfunding. An increasing number of people are looking for opportunities to diversify their portfolios with property-backed deals. So, if you own a crowdfunding platform, you will find a lot of investors for each promising deal you are hosting.

For those investors who prefer a stable structure and a share of the property asset, syndication is recommended more. While those investors who look for lower and more diversified investment options, crowdfunding is a better choice.

However, if you compare syndication vs crowdfunding in matters of profit, the first one wins. Syndicates carefully pick projects and invest in commercial property, retail centers, and apartment blocks which are high-yield projects and almost guaranteed to deliver high returns.

When comparing property syndication vs crowdfunding from the management perspective, the first requires less manpower, while running a crowdfunding platform requires hiring more people even if you automate all processes.

So, when choosing between real estate syndication and real estate crowdfunding, you need to consider quite a few details. If your aim is a fixed number of high-net investors, you are ready to handle all the paperwork to ensure your company operates in compliance with all the regulatory requirements, and you have the right expert to work as a project sponsor, syndication may be your choice.

If you aim to involve a wider range of people, and you are ready to handle all the challenges connected to raising funds from a crowd, a real estate crowdinvesting platform is your best option.

As for investors, it is better to pick a deal and a company to work with rather than a specific investment model since both models are relatively new.

Who we are

On CrowdSpace, you can find the best real estate crowdinvesting platforms. CrowdSpace is a crowdfunding platform aggregator that enables those who are interested in this sector to find providers based on their needs.

It is possible to filter the available platforms based on their location, business type, flow, and the presence of a license. You can choose among over 600 top platforms which means that here, you get greater choice and flexibility independently on whether you are looking for a platform where to invest or your aim is to pick a place to raise funds for your company.

Along with an extensive database, you can find here a lot of useful materials and guides on how to find the best platform, how to prepare and launch a successful crowdfunding campaign, and other tips on how to succeed.

Conclusion

Real estate crowdfunding and real estate syndication comparison shows that both are viable ways of raising funds from multiple investors to fund a real estate project. However, even though they are often mistaken one for another, they are quite different at their core. So, if you are planning to opt for one of them, real estate crowdfunding type vs syndication, make sure you read the article to understand the differences, pros, and cons.