How to earn money with P2P lending

P2P lending made the life of many entrepreneurs out there way easier.

Before 2006, they needed to collect many documents, go to the bank, answer uncomfortable questions and wait for a fateful decision about their loan application.

So what happened in 2006?

That’s the year when Prosper and Lending Club — the first P2P lending companies — launched in the USA. These guys soared so high that by the end of 2012, they were the largest in the country, issuing loans of $1.5 billion.

The story is intriguing, but let’s first understand what P2P lending is and how it works.

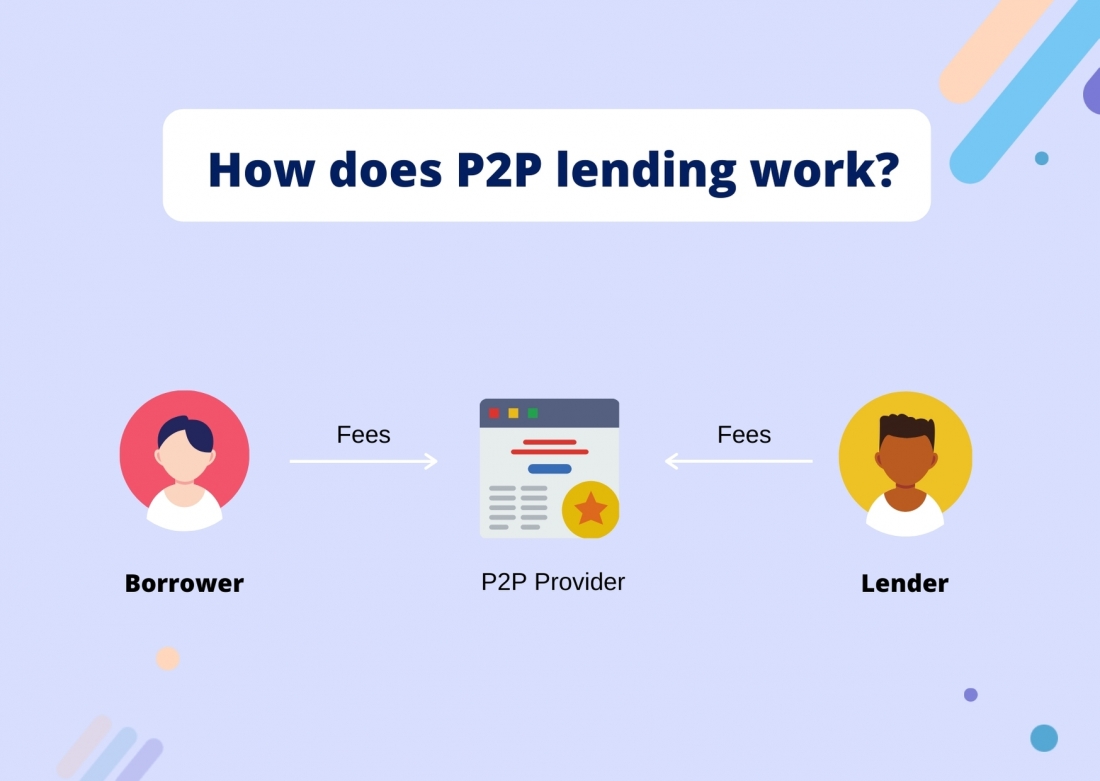

Peer-to-peer or P2P is a legitimate way to get a loan from a private person avoiding financial institutions such as banks. Roughly speaking, this is social lending, which has become an excellent alternative to traditional loans.

How did P2P lending come about?

The global financial crisis of 2008 led to a slowdown in the economies of many countries. Banks began to lose confidence with already dissatisfied customers, the interest rates to backers were almost 0%, and it was the finest hour for P2P lending to appear.

Entrepreneurs started to borrow money from each other at lower rates, and this process has become the basis for peer-to-peer lending.

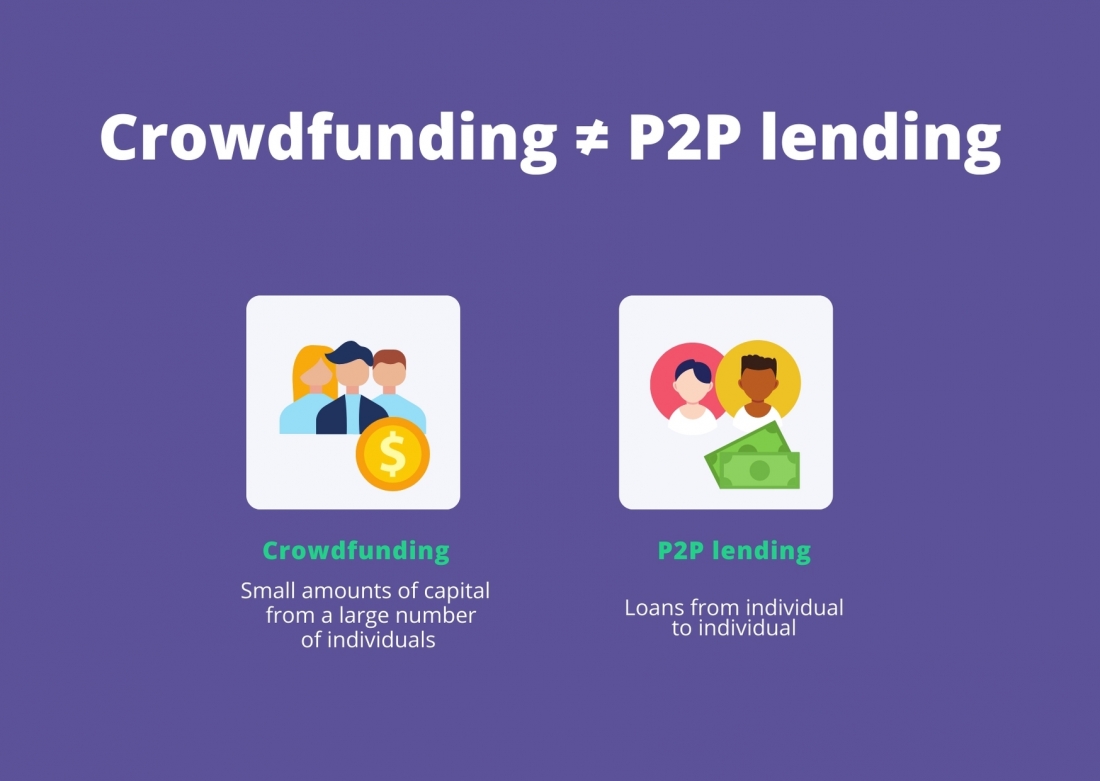

Crowdfunding vs. P2P lending

Both of these concepts are closely related but have a few differences. Yes, P2P lending is based on the idea of getting into debt, but it does not equal debt crowdfunding.

Crowdfunding is primarily designed to raise funds from the crowd, while in P2P, a person lends from a person with minimal risk.

The first thing you see on any crowdfunding platform is a risk warning. In the UK, the Financial Conduct Authority requires all crowdfunding and online investment platforms to make the risk warning prominent and always visible to a potential investor. Most P2P platforms, on the contrary, claim that they work only with solvent borrowers.

Unlike crowdfunding, P2P investors profit by paying interest and do not become shareholders.

Is P2P the same as P2B?

These are the peer brothers. P2B stands for peer to business and allows borrowing money for corporate projects. We will not focus on the P2B model now, but feel free to read more on P2B in this article.

Pros and cons of peer-to-peer lending

Alternative financing opens up new opportunities for entrepreneurs around the world, but, like any investment method, P2P has its pros and cons.

Benefits:

- Profitability of more than 10% per annum, while typical loan rates range from 6 to 36%.

- Affordable source of funding. Many entrepreneurs do not even consider traditional bank loans, but immediately turn to P2P platforms.

- Easy signup on P2P platforms without red tape.

- Peer-to-peer lending is classified as income but has excellent tax benefits.

- Peer-to-peer lending is controlled by the FCA in the UK and is accordingly regulated by the Securities and Exchange Commission (SEC) in the USA.

Disadvantages:

- Risks. Borrowers have low credit ratings, and since banks most often refuse to provide loans they turn to P2P platforms for help. Some platforms have a strict vetting process in place and thorough due diligence for borrowers.

- Lack of lender insurance.

- Some jurisdictions do not allow P2P lending.

How to earn money with P2P lending

The first thing to start with is choosing the right P2P platform. Today there are many platforms that differ in terms of lending. You must make sure that you are going to work with a solvent borrower, what are the repayment terms and how much does a P2P platform charge for its services.

On the CrowdSpace you can see the list of platforms that have been established on the market.

Believe us, beautiful design and marketing slogans don’t speak about reliability. Before investing, read customer reviews about the P2P platform, for example, on the Trustpilot.

You’ve probably noticed that reviews on the platform are always positive, investors praise the site and recommend it to others. Things may turn out differently on third-party websites, you can find out information from real customers and even ask them questions in the comments.

Moreover, we recommend checking the platform licence on a financial regulator website.

If you have chosen a UK-based platform, its licence can be easily checked on the FCA website. Usually, the authorization number is indicated in the footer on the main page of the site.

If the verification was successful, and the reviews are positive, only then you can proceed to the next stage – choosing a project.

Basically, platforms carefully check all clients and projects, but no one is immune from scammers. You should understand that any investment, including P2P, is, first of all, a big risk, and only then profit.

If you have finally decided on the platform and project, create an account, invest and make a profit. Remember the most important thing — invest as much as you are not afraid to lose.

Top 5 P2P platforms

To start lending money, you need to understand the rules of a particular platform, because P2P lending is available in various industries ranging from real estate, loans for small and medium-sized businesses (SMEs) to lending to solar panel startups.

Based on the data from P2Pempire, we have compiled our list of P2P platforms that are worth checking.

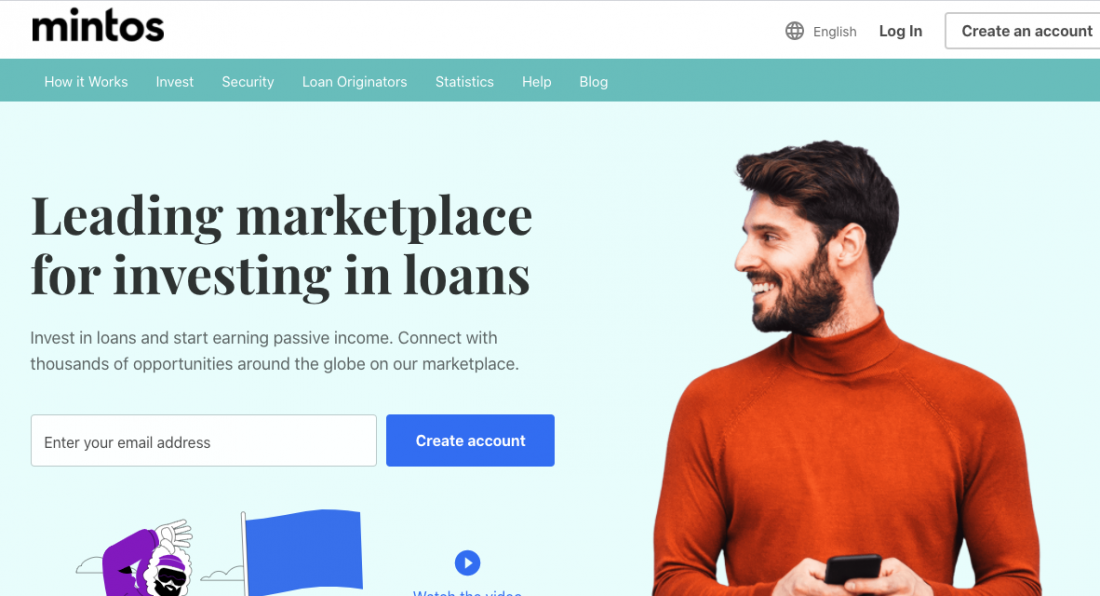

Mintos

Country: Latvia

Years on the market: 5

Minimum investment amount: €10

Average yearly return: 11.78%

Highlights: the biggest marketplace for P2P investing

Crowdproperty

Country: UK

Years on the market: 6

Minimum investment amount: £500

Average yearly return: 7-8%

Highlights: provides security for all loans

Twino

Country: Latvia

Years on the market: 11

Minimum investment amount: €1,000

Average yearly return: 14%

Highlights: 60-day buyback guarantee

Debitum Network

Country: Lithuania

Years on the market: 3

Minimum investment amount: €10

Average yearly return: 8.44%

Highlights: provides P2B loans

NEO Finance

Country: Lithuania

Years on the market: 6

Minimum investment amount: €10

Average yearly return: 17.28%

Highlights: had a successful IPO auction

Let’s summarize

P2P lending has become a great alternative to traditional financing. Borrowers are actively resorting to P2P lending services, as this is a quick way to launch a startup.

P2P lending also has opened up new opportunities in the financial market but still is not a universal term.

Key takeaways:

- P2P lending is a quick way of investing that does not require bureaucratic operations;

- To start making a profit on the P2P platforms, you need to understand all the investing processes, starting from choosing a platform.

- P2P investing is primarily a big risk, and then big money.