Risk assessment & management in P2P lending: interview with Pavel Klema, CEO at Bondster

Bondster is a P2P marketplace headquartered in the Czech Republic connecting investors with selected trustworthy lenders. It allows funding businesses, real estate developers, crypto assets holders, etc, while yielding up to 14% annual return. Thanks to the rich variety of deals available at Bondster, it offers exclusive diversification opportunities.

Since 2017 Bondster has accumulated over 127 million EUR in investments with over 5 million EUR of paid out interest.

One of Bondster’s core values is building trust in the financial sector. To deliver this mission, Bondster team has come up with their risk assessment method that helps them select secure loan originators and, at the same time, gives their investors maximum transparency to make well-informed financial decisions.

We’ve spoken to Pavel Klema, Bondster’s CEO, who has shared with us how they select reliable loans, which loan types are safest, and what the future holds for P2P lending platforms.

How would you describe Bondster in a few words?

Bondster is an investment platform, a P2P marketplace where you can invest in loans of various kinds to diversify your portfolio on a single platform and earn over 13% yield p.a.

What do you think makes Bondster stand out among other platforms?

From my point of view, the vast diversification options while maintaining a high yield with a managed risk make Bondster stand out. Moreover, except for unprecedented situations such as the global pandemic and the Russian war in Ukraine, there have been zero defaulted loan originators during Bondster’s entire five-year history. This shows how thorough and profound our due diligence process is.

It’s also worth mentioning that the loans backed by cryptocurrencies are unique solely to our platform. When the crypto market is down, our investors are actually earning even more on these loans. If your readers would like to know more, there is a dedicated article on our blog highlighting this topic.

Bondster has a variety of loan types introduced. Which one is the safest, in your opinion?

From my perspective, the safest loans are the ones backed by some collateral: real estate, cryptocurrency, etc. You may choose the strongest loan originators based on your personal analysis or rely on our internal scoring system, introduced at the beginning of this year. I am convinced that any collateral is the thing. Even if the loan originator fails, you have a pretty good loan value and are prepared for the collection phase if the loan defaults.

What’s your process for choosing a loan originator?

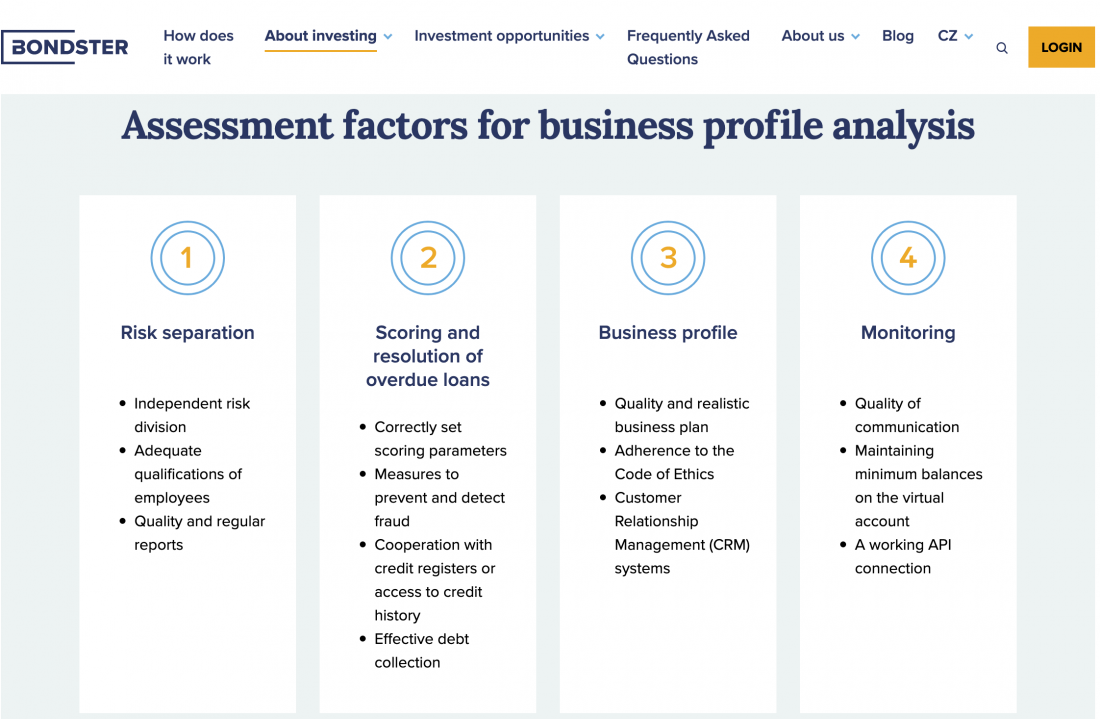

Before accepting a loan originator, it must undergo a due diligence process that consists of several steps.

Step 1: an initial inspection. We make sure the loan originator and people behind it, mainly the management and its ultimate beneficial owners, are not involved in any illegal activities such as fraud, money laundering, human or drug trafficking, terrorism, etc.

Step 2: risk assessment. It includes financial analysis, business profile and operating environment review.

As part of the financial analysis, we look at financial statements and some other data requested by the loan originator. We evaluate capital adequacy, profitability, liquidity, and asset quality. The focus is on assessing the loan portfolio of the loan originator because it accounts for most of its assets and is also the main source of income.

Once it’s done, it’s time to move on to the next risk assessment stage, the business profile. In this part, we examine how the company manages its risks and examine its scoring model, collection manual, and corporate governance.

Proceeding to the operating environment, our team evaluates the leading country of operations for the loan originator. In this regard, we monitor several macroeconomic indicators that, we believe, affect the loan originator’s operations. The country’s regulations, the ratio of non-performing loans, credit information sharing index, political stability, and restrictions concerning currency conversion as well as transferring funds out of the country – are the primary indicators.

Step 3: The final stage involves additional factors that we call stress and support aspects.

An example of a support factor can be a group guarantee or a strong partner of the loan originator. And an example of a stress factor can be short history, bad reputation, or currency risk.

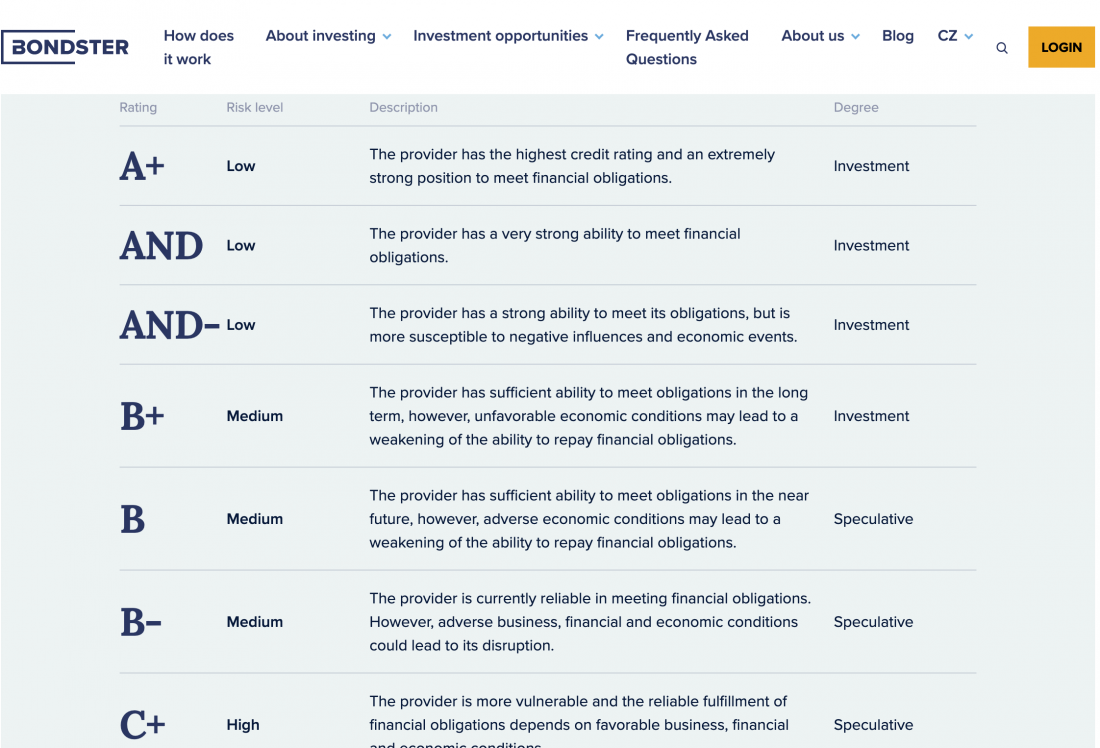

After evaluating all these steps, Bondster team assigns a rating and set the maximum exposure. The maximum exposure represents the maximum amount of loans the loan originator can upload to our platform.

The assigned rating is published on Bondster website so that you can use it as an indication of risk. You can see a scale from A+, for the best rating to C-, for the worst, and D for those loan originators who defaulted on a financial commitment.

Have you lately stopped working with any loan originators? If so, what was the reason behind it?

Of course, it happened. We finished cooperation with a few companies that were affected by legislation changes in their home countries’ jurisdictions during covid pandemics. And, sure thing, there were terminations of cooperation from the loan originator’s side based on regulations in their jurisdiction.

As of today, we are in breaking up mode with the Russian loan originators. Again, mainly because of legislation changes in their country.

Your risk manager assesses every lender applying on Bondster. How did you come up with your evaluation methodology for investors?

We focus on quality over quantity, so having a thorough due diligence process has been a must. The process indeed looked different when Bondster just started, and we’ve been constantly trying to improve it. In the process, the risk department studied different rating methodologies and came up with a method that proved most suitable for loan originators.

You’ve been on the market since 2017. What moment has been the most critical for Bondster, and how did you overcome it?

The COVID pandemic was critical, hitting mainly the Polish legislation where the rate cap and instalment holidays were applied for the debtors, so the loan originators were severely impacted on their cash flow. It resulted in their inability to repay buybacks.

Luckily, thanks to our specific approach for impacted loan originators, we managed to get 2/3 of the funds. Two loan originators have already covered 100% of their debt to investors, including interest.

How do you envision the future for your industry?

The point of risk gravity has shifted from the debtor to the loan originators. I think that in the future, it will shift further to the platforms. I believe we will witness more of this trend, since the platform is the one that can control the quality of loan originators. The other trend that is likely to persist is platform aggregators.

Are there any news or plans for Bondster you think investors may be interested in finding out?

This year has been pretty busy for Bondster. We have introduced three automated pre-defined investment strategies, created our scoring system that helps investors to navigate the “strength” of the loan originators on our platform and kicked off the crypto-backed loans.

Our team is currently working on new features for Bondster to make investing with us even more efficient but for now we’ll keep them in secret, so stay tuned!

We thank Mr.Klema for this insightful talk and are looking forward to Bondster’s new features. Discover more investment opportunities with Bondster and get familiar with P2P crowdfunding at CrowdSpace.