How to invest in startups through crowdfunding platforms

You’ve probably heard stories of successful startups that made their founders super-rich. Normally, such startups are either bought by tech giants (look at YouTube, Instagram, or WhatsApp) or the idea behind a startup delivers some unmatched value to the target audience (Airbnb).

One way or another, any startup needs funding – either internal (bootstrap), or external (capital from VCs, angels, or everyday investors).

Investing in a new company early on can bring good returns, but you never know if or when the startup is gonna actually fly.

The good news is that previously, the concept of “investing” was available only to the wealthy segment of the population, the so-called venture capitalists.

Things changes, and today, virtually any person can buy shares or lend money to startups online. In this article, we will figure out whether it makes sense to invest in a startup and how to do that with the help of crowdfunding or P2P lending platforms.

Top 3 reasons to invest in a startup

1. Receiving a profit

Investing in startups is one of the most profitable types of investment. It is also another way to diversify your investment portfolio.

2. Availability

According to the JOBS Act, everyone in the USA can invest in startups. Previously, this privilege was only available to business angels. The only thing you need is an understanding of how the business system works.

3. Investing networking

People, who invest in startups become not just a wallet, but in most cases the mentors of the project.

A successful startup can make you famous in the investment world. In addition, you will be able to communicate with other investors and track interesting projects.

If you want to start communicating with investors from all over the world or gain experience with business angels, we recommend registering on the AngelList platform and reading some news of the investment market.

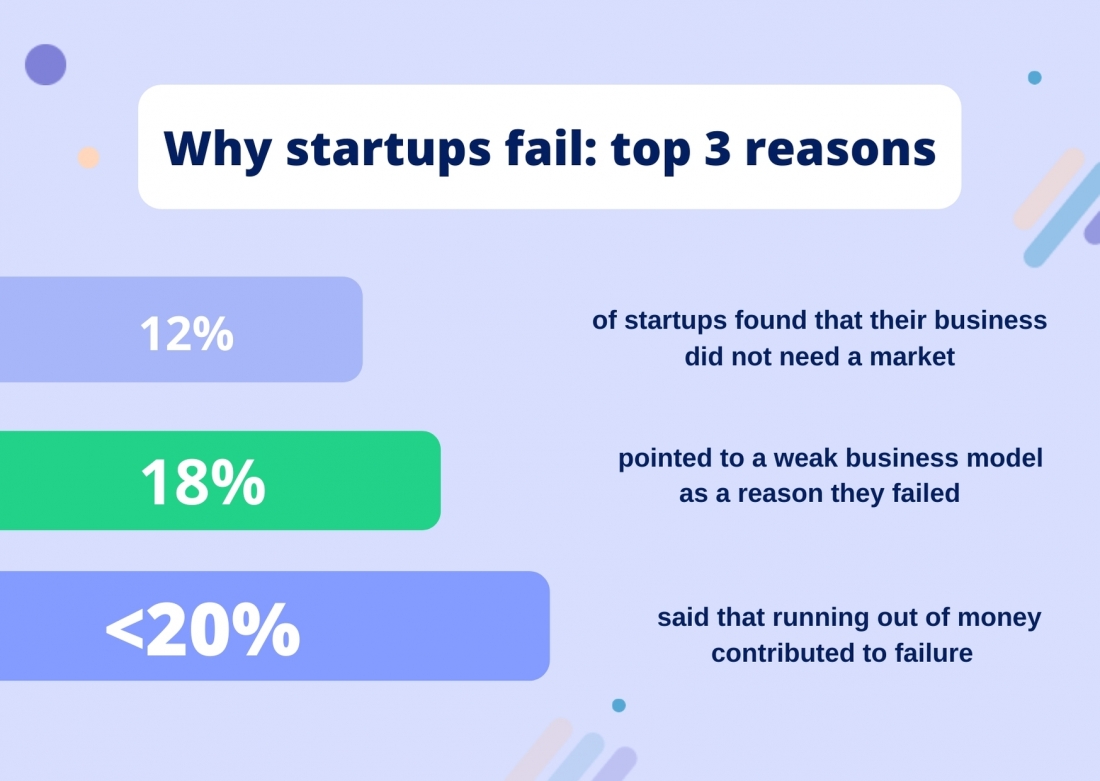

Why do startups fail?

Before you start investing in startups, you need to understand that not many startups are doomed to success. Just look at this figure … 90% of startups fail.

Let’s see why this happens.

There can be a variety of reasons, ranging from location to team inexperience. Most often, a symbiosis of problems that somehow relate to each other leads to failure.

For example, if your idea is not unique, you simply won’t be able to find funding, and without money you won’t succeed.

Another example is when you have good funding, but an experienced team that is just wasting money.

Many entrepreneurs think that their unique product is needed by everyone, regardless of the industry, and this is another reason for failure.

According to Rubygarage research, the largest percentage of failures belongs to information startups – 63%, where construction and manufacturing take the honorable second – 53% of failures and the third place – 51%.

Why invest in startups when the failure rate is so high?

Despite the rather high risks, investing in a startup can bring good returns. In the event that you pull the lucky ticket 10% out of 90%.

Unlike investing in real estate or P2P lending, where you can choose debt payments or shares, investing in a startup is of 3 types: reward, equity or donations.

Reward based investment works according to the rule:

“I give you money, and you give me a product / service”.

This method is not at all interesting for capital accumulation.

Donations are only interesting from the entrepreneur side, as they simply collect money for a startup without giving anything in return.

The only way that can bring a good return is equity. Simply put, when you invest in a startup, you buy stocks. The more successful and in demand the company becomes, the higher your shares grow.

A simple example.

If you bought 10,000 Apple shares in 1997, then at the beginning of 2017 your income would have amounted to $1,320,000, which is 22,300% of net profit.

Another example is Tesla shares, which broke all records on the stock exchanges. At the time of this writing this article, 1 Tesla share is worth $ 1134. Today Tesla is the richest company in the world.

How to invest in a startup?

If you are reading this article, most probably you are new to the world of investing. Regardless of the method of investment, there is only one thing to remember:

Your capital is at risk.

Crowdfunding and crowdlending platforms are a good option to consider for your first investment. There are hundreds of them and they focus on startups in different niches: technology, green energy, music, cars, appliances etc.

To start investing in a startup, decide whether you want to support a startup from a particular domain or country. Then search for a crowdfunding platform that offers to invest in startups and carefully study the conditions: fees, investor reviews, platform reputation, how long it’s been operating.

In addition, some platforms offer built-in auto-mailing functionality. For example, SeedInvest helps its clients allocate money to different projects based on the client’s preferences.

How to choose a startup investment

Okay, let’s imagine that you’ve already figured out the advantages and disadvantages of startups and decided to invest in one. How do you know which startup will make a hit and which one will not achieve the financial goal?

Don’t be afraid to engage with startups

Before clicking the “invest” button, start interacting with startups. Don’t be afraid to attend conferences and various hackathons where startup founders present their projects.

At such events, you can communicate personally and ask all your questions. In addition, you can meet more experienced investors which where the wind blows.

Invest in what you familiar with

The second method is to invest in what you understand. For example, а realtor can easily invest in real estate, as they know the market and can calculate the estimated time frame and return on investment (ROI).

An alternative example would be investing in additional applications or services for your own business. If you have your own business, you probably know the main “pain”, so why not invest money in what’s solving it.

Focus on your strengths. Start out in an industry you’re familiar with, especially if you’re new to investing.

Joe Gardner, CEO at VentureDevs.

Determine the investment horizon

Simply put, assess at what stage a startup is. Your expectations may not correspond to real terms at all.

Usually, a startup in an early stage “burns” investment money for its development, which is reflected in the timing of payment.

Remember that investing is always a long game and you can expect profit from 5 to 10 years. Typically, startups show development timelines to their investors so that they can compare their expectations with the real plan. If you are promised high interest within a year, this is the reason to think about whether you are dealing with scammers?

Determine the rate of return

The profitability directly depends on the type of investment.

For example, equity investment can generate more profit than debt one, but your shares can depreciate in one day. Debt investments, in turn, are less risky and provide a stable recurring income.

It is not correct to say that some type of investment is better or worse, you need to proceed from personal requirements, opportunities and expectations. In any case, you risk, but at the same time, the choice is always yours.

Moreover, all additional costs must be taken into account. Taxes, management fees and interest for using the crowdfunding platform itself can be quite a lot. The formula is simple — the higher the costs, the lower the profitability.

Risks, risks and more risks

Investing in a startup is a very risky business. Even if you personally talked with a startup, calculated its investment horizon and rate of return, you should minimize the risks and diversify your portfolio.

Yes, keeping the balance is not easy. If you have chosen this way, then it is better to distribute the invested amount to different startups than to invest all the funds in one.

The more startups you invest in, the better the chances of achieving your financial goal. The main thing is to have a winning startup on your investment list!

Top 5 equity crowdfunding platforms for investing in startups

Crowdcrux recommends considering the following platforms that you may be interested in.

Сrowdfunder

Country: USA

Founded date: 2012

Total funding amount: $5M

Features: for all types of investors.

Crowdcube

Country: UK

Founded date: 2010

Total funding amount: £552m

Features: launched the own Crowdcube iOS App.

Fundable

Country: USA

Founded date: 2012

Total funding amount: $830K

Features: hands-on service from profile creation to marketing.

Сircleup

Country: USA

Founded date: 2012

Total funding amount: $253M

Features: revenue of $1-$15M, raising $1-$10M in growth equity.

Wefunder

Country: USA

Founded date: 2012

Total funding amount: $15.9M

Features: like Kickstarter for investing))

The bottom line

In this article, we wanted to show the different sides of the same startup. The main thing to remember is that any investment is, first of all, taking risks, and then making a profit.

You need to invest in a startup competently, taking into account the mass of indicators that we wrote about above. No one can guarantee that this or that startup will take off.

90% of startups do not survive, but getting into the successful 10% will give you guaranteed financial benefits.

If you have close looked everything, read the book “Investing for Dummies” and have chosen a reliable platform, go for it and be lucky.