The aim of the project:

The project owner will use the raised amount to refinance an existing loan. This loan will be repaid from the proceeds of the sale of the real estate. The apartment is already reserved, so this decision will give the project owner time to arrange the documentation for handing over the apartment and prepare for a notarial transaction.

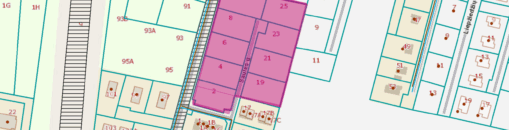

Apartment building where is mortgaged apartment:

Panauja is a newly built apartment building in a strategically convenient location, just a few minutes from Vilnius Old Town. The project is being developed taking into account the needs of potential residents, all apartments are equipped with autonomous underfloor heating, excellent sound insulation and recuperation system. The apartment building is equipped with 24-hour video surveillance cameras. There are a total of 24 apartments and 24 parking spaces.

To secure the interests of investors, real estate is pledged with a primary mortgage:

To secure the interests of investors, a two room apartment of 48.03 square meters, on the fourth floor of four is pledged at Panevezio st., 23-20, Vilnius. According to an independent real estate appraiser, the value of the mortgaged property is EUR 107 700.

Interest by investment amount:

- From EUR 100 to EUR 499 – 8,5%

- From EUR 500 to EUR 2 999 – 9%

- From EUR 3 000 – 9,5%

Important: investments made separately are not aggregated.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.