- The project owner has been awarded Profitus Trusted Developer status. To date, seven unique real estate projects have been financed, successfully completed and settled on time with investors;

- The surrounding area is full of single and semi-detached houses, and Lake Turgaiciu is only 2 km away;

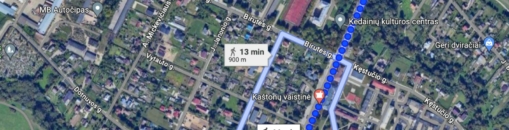

- The social and engineering infrastructure of the development is fully developed, with educational institutions and shops nearby;

- 85% of the houses in the first construction phase of "Biciuliu terasos" have already been delivered to their owners and 2-4 new preliminary purchase contracts are signed every month;

- More information about the project owner's "Lapino namai" project can be found here.

About the project owner:

The owner of the project has developed different real estate projects with a total area of approximately 4 300 sq. m. Also the developer also has the status of a trusted developer and together with PROFITUS has financed eight unique real estate projects: "Lapino namai", "Namas Dusmenu g.", "Lapino namai Biciuliu terasose", "Namas Dusmenu g. 63", "Biciuliu Ateities g. namai", "Biciuliu namai", "Namas D45". The projects have been successfully completed and investors have been settled on time.

About the project:

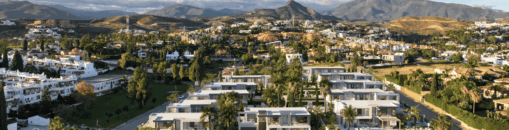

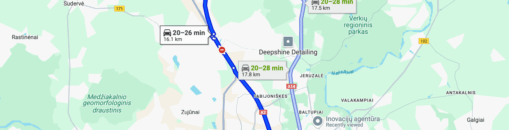

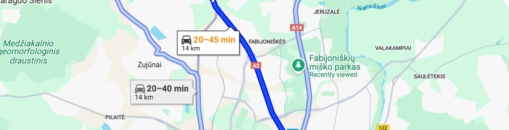

"Lapino namai" is a new-build block of detached houses being developed in the "Biciuliu terasos" housing estate. The project consists of A+ and A++ energy class one-storey detached and semi-detached houses with a unified architecture and spacious land plots of 4-9 hectares for each dwelling. In total, the development is planned to house as many as 46 families. The houses are fully finished and the size of each dwelling ranges from 62 to 179 sq. m. Nearby there are forests, the Trakai Lakes and the castle, which can be reached by bike. The neighbourhood is located right on the Vilnius city border and the city centre is reachable within 20 minutes by car. The houses will be sold and the estimated sales income for the whole project is EUR 10 445 600.

Project objective:

The project owner will use the pooled amount to refinance the existing loan, and the remaining amount to finance the development works of the project "Lapino namai", developed in "Biciuliu Terasos" This solution will give the project owner the time to sell the fully developed residential house on the best terms.

Maximum amount to be financed: EUR 250 000 (EUR 215 600 active portfolio). The project is financed on the basis of the current valuation of the collateral until it reaches the established maximum loan-to-value ratio of 70% LTV. Once the maximum LTV has been reached, a new valuation of the property will have to be carried out and further rounds of financing for the Project will only be advertised and collected if the set maximum LTV is not exceeded.

Interest by investment amount:

– From EUR 100 to EUR 199 – 10.00%

– From EUR 200 to EUR 499 – 10.40%

– From EUR 500 to EUR 1 499 – 10.80%

– From EUR 1 500 to EUR 3 999 – 11.20%

– From EUR 4 000 to EUR 9 999 – 11.60%

– From EUR 10 000 – 12.00%

Important: investments made separately are not aggregated and cannot be pooled.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.