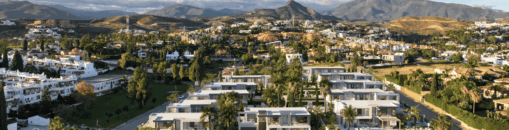

- Investment plan: The pooled funds will be used for the construction of A+ energy class 4 blocks of flats and the refinancing of an existing loan from another credit institution, thus reducing the cost of the existing loan.

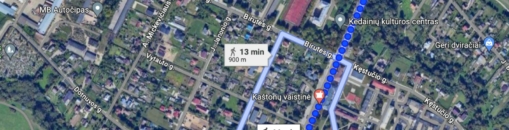

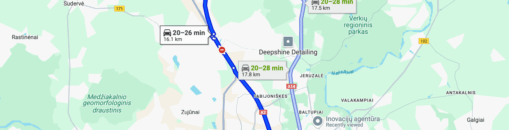

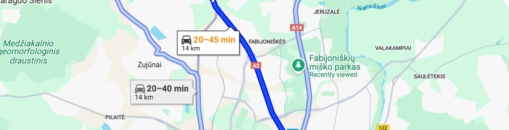

- Prestigious location: Project to be Implemented in a Convenient Location in Vilnius - Dvarcionys, 8.7 km. from the City Center and Just 1 km. from Dvarcionys Lake.

- Construction is in full swing: The foundation for the apartment building has already been poured and the walls of the first floor are being erected.

- Construction work plan: Project development is expected to be completed in February 2025. The projected sales revenue for the four multi-unit residential buildings at 100% completion is EUR 6 142 940 (Including VAT).

- More than 6 000 m2 of real estate projects (about 20 residential) developed: This demonstrates the developer's ability to successfully execute diverse real estate projects over the company's 4 years of existence. The number provides a tangible measure and allows for an assessment of the developer's capabilities in the real estate sector.

Project Rating (Project Loss Risk): BBB-. This rating is consistent with the previous project rating of D.

About the project owner:

The company was founded in 2020, the main activity of the company is real estate development, development, construction, sales. The company has developed about 12 units of single-family and semi-detached house projects in Pagiriai and Traku Voke, a block of semi-detached houses in Melekonys, a commercial building in Kalno Street, and apartment buildings in Valakampiai and Pavilnys.

About the project:

On the land plot owned by the company (from 2023), it is planned to construct 4 multi-family (3-storey) buildings with a total area of 2 829 m2 and 28 apartments. The area of the apartments for sale is 1 492.84 m2. The average size of an apartment is 51.72 m2. There are 34 parking spaces (underground), as well as 17 storage spaces. The owner of the project intends to furnish the apartments with full finishing and sell them. The project plan is to sell all 28 apartments to one buyer as a rental project. At the moment there are already 2 potential buyers to buy the whole project for rent, but the preliminary contract has not been signed yet. The delivery of all four apartments is scheduled for 10/02/2025. This loan will be covered by the sales proceeds and the interest will be paid to the investors from the project owner's operating income.

The maximum amount to be financed: EUR 3 200 000 (EUR 220 000 already raised). The project is financed on the basis of the current valuation of the collateral until it reaches the established maximum loan-to-value ratio of 79% LTV. Once the maximum LTV has been reached, a new valuation of the property will have to be carried out and further rounds of financing for the Project will only be advertised and collected if the set maximum LTV is not exceeded

Interest by investment amount:

– From EUR 100 to EUR 499 – 13.00%

– From EUR 500 to EUR 1 499 – 13.50%

– From EUR 1 500 to EUR 4 999 – 14.00%

– From EUR 5 000 – 14.50%

Important: investments made separately are not aggregated and cannot be pooled.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.