Real estate crowdfunding: pros and cons to consider

Real estate crowdfunding is one of the easiest ways to tap into the real estate market. Until recently, real estate investments were available to accredited and institutional investors only because the entry barriers were very high. One of the alternatives was to join a syndicate where a group of investors pool their financial resources to access larger projects.

Another option was to purchase a share in a real estate investment trust (REIT) and receive steady returns from the rent that REIT receives from the tenants. REITs normally work with specific property types, for example, commercial or residential property.

Property crowdfunding has eliminated the high entry barriers typical for syndicates and the limitations characteristic of REIT. In this piece, we’ll review this phenomenon and dive into the pros and cons this investment alternatives entails.

What is property crowdfunding?

Real estate crowdfunding investment is a relatively new option for investing in real estate property. It implies collecting funds from multiple investors to develop or upgrade different property types.

Its main difference from syndicates is the amount invested. In syndicates, a few people invest equal amounts of money, while in crowdfunding, the number of investors and their investment amount can vary a lot. As to the property scale, syndicates focus on massive investments such as residential areas, commercial centres, and similar, while crowdfunding may target smaller projects.

Unlike REITs, this option allows investors to select which projects they want to invest in and they are free to pick various property types. Property crowdfunding also lowers entry barriers. Even though platforms normally set quite high minimum investment limits, they are still lower than those in traditional real estate investing forms.

Like any investment type, property crowdfunding has its benefits and drawbacks.

Real estate crowdfunding pros

Real estate crowdfunding offers unprecedented opportunities to investors. But they come with risks, too. So, consider both if you want to try investing in property via a crowdinvesting platform. Among all the benefits of real estate crowdfunding, the following are the most notable.

1. Portfolio diversification

Real estate crowdfunding allows investors to minimize risks by diversifying their investment portfolios. Instead of investing the entire sum of, say, $200,000 into a single project, an investor can spread it across, for example, 5 projects and invest $40,000 in each one. If one project fails, the investor loses $40,000 instead of the entire sum, which would be the case if the total $200,000 sum went into a single project.

2. Opportunity to generate passive income

Investing in real estate allows investors to generate a flow of passive income. In this case, you don’t need property construction or management expertise and actively participate in these processes.

You give a part of your funds to a developer or operator who does all the work. You are only responsible for collecting a share of the revenue generated by the property.

3. Lower entry barrier

Traditional forms of investing in real estate were mostly available for accredited and institutional investors, while the entry barrier was too high for retail investors.

Participating in real estate crowdfunding still requires money, but the entry barrier is much lower than in traditional investment forms.

4. Vetted investment options

Real estate crowdfunding platforms typically perform their due diligence before allowing investors to participate in an offering. While it is recommended that you do your due diligence before investing in property crowdfunding, projects available on a platform have already been checked by the platform’s team.

Real estate crowdfunding cons

Real estate crowdfunding has some cons you need to be aware of and consider if you want to try this investment option.

1. Poor liquidity

Real estate investments are typically illiquid, meaning they cannot be easily converted to cash. Selling a property can take time and may involve significant transaction costs.

2. Lack of control

When investing in real estate crowdfunding, investors typically have limited control over the management and decision-making processes associated with the underlying properties. The platform or sponsoring real estate companies handle the day-to-day operations, property management, and strategic decisions, leaving investors with little influence over the outcomes. If you want to manage the property independently, a traditional investment form is more suitable for you.

3. Platform risk

Real estate crowdfunding platforms vary in track record, reputation, and reliability. Investing through a less reputable or poorly managed platform may expose investors to risks such as platform insolvency, fraud, or operational issues. Investors must conduct thorough due diligence on the platform’s history, management team, and investment offerings before committing capital.

4. High fees

Crowdfunding platforms and sponsors typically charge various fees, including investment management, acquisition, and disposition fees, which can eat into your returns.

Best real estate crowdfunding websites

Crowdestate

Crowdestate is one of the leading European real estate crowdfunding platforms that connects investors with high-quality real estate investment opportunities across Europe. With a user-friendly interface, Crowdestate offers many investment options, including residential, commercial, and development projects.

Investors can start investing with as little as 100 euros.

Crowdestate rigorously selects and presents investment opportunities on its platform, providing detailed project descriptions, financial projections, and risk assessments to help investors make informed decisions. Additionally, it offers competitive returns on investments. With a focus on transparency and investor protection, Crowdestate ensures that investments are backed by tangible real estate assets.

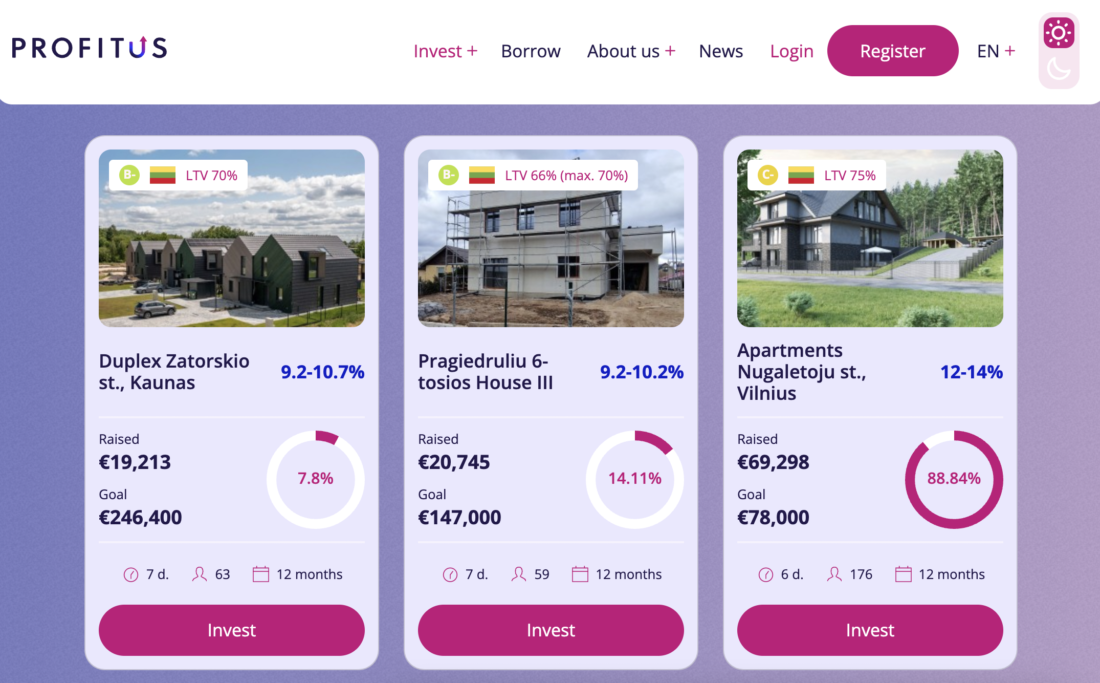

Profitus

Profitus is a crowdfunding and investment platform serving as an intermediary between investors seeking to deploy their available funds and individuals or businesses needing funding for various projects, including real estate ventures.

The platform aims to democratize investment by offering opportunities starting from as low as 100 euros, accessible 24/7. Investments are secured through real estate pledges and other collateral, ensuring investor protection. Each project on Profitus undergoes careful selection before being presented to investors, with terms and conditions clearly outlined.

Investors receive interest payments, backed by real estate assets, providing assurance of repayment. Profitus manages the entire investment process, ensuring timely settlements and representing investors’ interests while providing businesses with access to diverse funding sources and streamlined administrative support.

Its core focus is facilitating funding rounds for burgeoning companies, boasting a track record of over 900 projects completed and exceeding €500 million in secured funding.

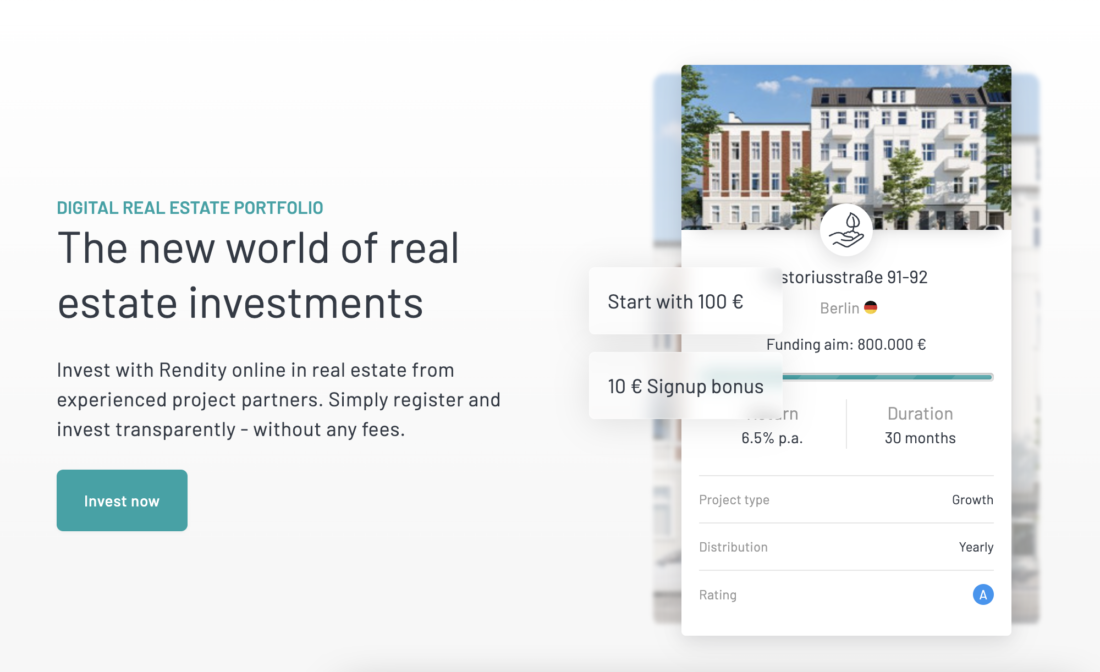

Rendity

Rendity is an online real estate investment platform based in Austria, allowing investors to invest in high-quality real estate projects across Europe. With a user-friendly interface, Rendity provides access to diverse investment opportunities, including residential and commercial properties.

Investors can start investing with as little as 500 euros, making real estate investment accessible to a wider audience. Rendity carefully selects and presents investment opportunities on its platform, providing detailed information and transparent terms for investors to make informed decisions.

Additionally, Rendity offers competitive returns on investments, with interest paid out regularly to investors. With a focus on security and investor protection, Rendity ensures that tangible real estate assets back investments.

Deposits in the platform’s trust accounts are insured for up to EUR 100,000, providing additional safety to the investors’ funds.

Bottom line

Is real estate crowdfunding a good investment? It depends on your aim and resources.

Real estate crowdfunding can be a great option to diversify your investment portfolio without spending much money. While the benefits of portfolio diversification, passive income generation, and lower entry barriers are attractive, investors must also consider the potential risks associated with illiquidity, limited control, platform reliability, and high fees.

Ultimately, real estate crowdfunding can be a valuable addition to an investment portfolio, but it’s essential for investors to carefully assess the pros and cons before making investment decisions. With proper research and risk management, real estate crowdfunding platforms can offer a viable avenue for investors seeking exposure to the real estate market while mitigating some of the traditional challenges associated with property ownership and management.