P2P Lending: is it safe?

That’s a fair question every potential investor should ask before jumping into a new business.

Let’s face it: risk-free investment ventures simply don’t exist. Just like any other investment, P2P lending carries some risks.

By definition, any investment type always implies a possibility of losing the money invested. And it’s only up to the investor’s knowledge, experience, and diligence to avoid this well, unpleasant event.

In this article, we will highlight the major risk factors every investor needs to be aware of before going for P2P lending investment. Naturally, we’ll share the tips & tricks on how to evaluate the P2P investment risks and manage them when possible.

Hopefully, this will help make your investment journey a smooth one. Fasten your seatbelts, off we go!

Risk 1. The P2P platform turns out to be fraudulent

The truth is there are indeed high risks of running into an untrustworthy P2P platform. The P2P market has been growing rapidly, creating the conditions, demand, and competition for more P2P lending platforms to enter it.

It’s definitely a positive tendency giving the investors a decent choice and stimulating the platforms to provide better investment conditions. At the same time, not every country has introduced regulations for the so-called “loan-based crowdfunding”, which leaves both borrowers and investors in a vulnerable spot.

Scammers get a perfect chance to disguise themselves as legitimate P2P lending platforms and make some “profit”. Unfortunately, in most cases they manage to get away with it way before their fraudulent behaviour is discovered.

Of course, one can file a lawsuit to retrieve the money lost. Still, as bitter as it may sound, the chances of winning it back are very low.

The silver lining is that there is a way to minimise the risk of getting involved in a scam. By taking these precautions, you can identify suspicious P2P providers before trusting them with your investment.

- Delve into the platform’s terms and conditions before signing up.

Apart from the general provisions, find out about the platform’s scenario if it goes out of business or if the borrower goes bankrupt.

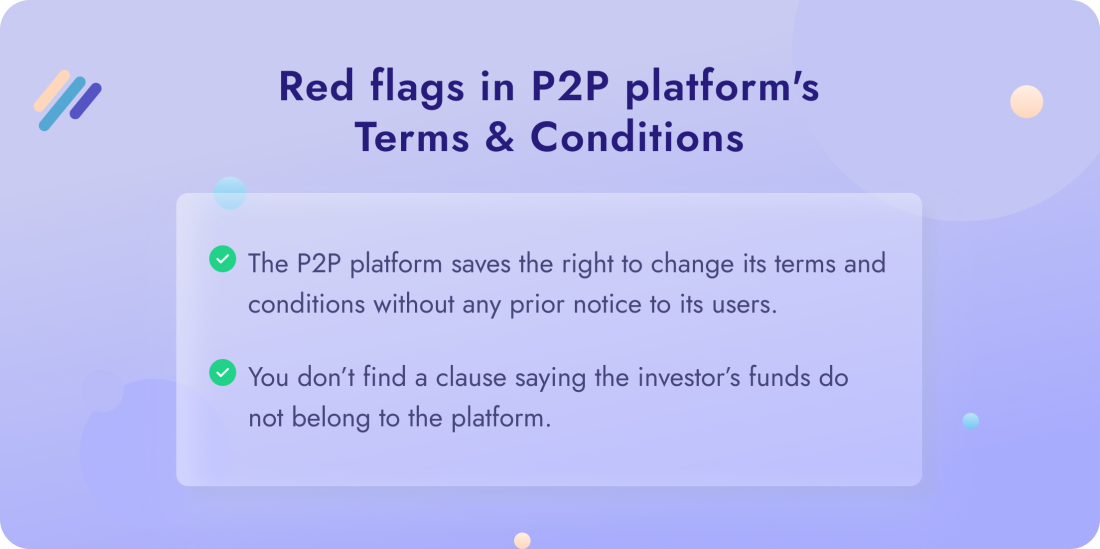

Also, pay attention if there are any of the red flags below:

These are dangerous clauses that allow the platform to alter the terms & conditions whenever they like with any innovation they see fit.

- See if the platform has a proper About Us page with the top management introduced and their contact information listed.

We recommend checking out their LinkedIn page or any other social media available to see how transparent they are about the platform’s business.

If any of the names come up in the news related to scams, money laundering or any other fraudulent schemes, that’s a burning red flag.

- Ask for a loan agreement template.

Get in touch with the company to look at the agreement and ask any questions, if needed, before you sign it.

Any vague answers, lack of efficient communication or any feet-dragging you notice, don’t build a trustworthy image.

- Check if the P2P lending investment comes with buyback guarantees.

Buyback guarantee is the platform’s or loan originator’s commitment to return the funds to the investor, in case the borrower goes bust.

Again this is something typically stated in the Terms & Conditions.

All in all, any P2P lending platform is a business that keeps evolving: it may have its ups and downs, changes in management, or new policy implementations. So, it’s crucial to stay in the loop of the events and to inquire from time to time what experience other investors are having with the P2P provider.

We recommend following investors’ blogs that share their platforms’ impressions and reviews. Spotting a red flag early on may save you from larger investment losses in future.

Risk 2. The loan originator goes bankrupt

The loan originator acts as a middle man in a P2P lending ecosystem. Imagine you don’t feel like looking for loans yourself, so you just invest your money and trust all the rest to a loan originator.

In the meantime, borrowers apply for loans by submitting their credit and work history to a loan originator. Next, this entity, usually a company, finds the most suitable loan relying on the borrower’s profile. Finally, the loan originator company sells these loans to the P2P lending marketplaces.

Unlike traditional P2P lending platforms, on a P2P marketplace, you are not lending directly to borrowers but through a loan originator.

As a rule, loan companies are non-banking organisations that don’t require a banking licence in most European countries. And one should admit that the risk of a loan originator going bust or leaving the marketplace is high. Some of the largest P2P providers, like Mintos, experienced their loan companies ceasing business. It has been a significant reputation blow.

From the investor’s standpoint, you need to understand that there is no way to eliminate this risk completely. In most cases, loan companies are based in different countries operating under other laws and policy standards.

The best you can do is to look up the company’s owners and CEO, check the financial reports, if any are disclosed to the public, and research the parent company if any are involved.

Doing a thorough background check on the loan originator isn’t easy at all. So, it all goes back to paragraph one: choosing a reliable P2P lending provider, hoping they have done their due diligence.

Risk 3. The borrower goes bankrupt

In other words, the risk of your loan becoming default is due to a borrower who cannot pay back the debt.

The extent of this risk depends a lot on the quality of loans. Many loan originator companies and lending platforms develop their own criteria to determine if the borrower can apply for a loan or not.

They usually refer to the borrower’s job details and regular income. On top of that, borrowers may be asked to provide information about their monthly expenses, previous credit history, and any other debts.

For security guarantees, loan originators usually invest 5% – 15% of the loan themselves, which means that they are also interested to ensure the debt is repaid. It’s one of the common security guarantees these days.

As to the things you can do yourself to minimise the risk of losing funds due to a loan default, see below:

- invest in secured P2P lending platforms or marketplaces that have buyback guarantees;

- find out about the P2P platform’s default rates. 5% – 10% are normal indicators in the current market conditions;

- diversify your P2P lending investment by investing across different loan types;

- read the reviews and stay on top of the news.

Risk 4. The market suffers a crisis

It’s the risk that you can’t influence. This factor is hardly a subject for attention when the economy is growing.

But any global crisis, like the COVID-19 outbreak or the most recent Russian brutal war in Ukraine that is still ongoing, shakes the market and doesn’t go unnoticed by investors.

In the pandemic case, P2P platforms faced a good deal of borrowers unable to pay back their loans. With all the restrictions and medical issues, many people simply lost their jobs or business. In fact, P2P platforms themselves had to lay off a large number of employees to stay afloat.

As to the full-scale Russian invasion in Ukraine, the situation looks the following way:

- Sanctions have been imposed on the major Russian banks, leaving them disconnected from SWIFT. So, borrowers are having serious trouble paying back their loans.

- Ukrainian P2P business, on the other hand, looks paralyzed at the moment, even though other industries in the regions less affected by war are slowly renewing their operation.

- Investment risk has substantially increased in the countries sharing a border with Russia.

It’s fair to predict that investors are likely to expect payment delays, possible loan defaults, and losses due to currency fluctuations.

In both cases, P2P platforms have pulled their cash reserves to repay their lenders, while investors attempt to withdraw their funds, causing an increased demand for liquidity. It’s a serious test for a P2P provider that will either enhance the company’s reputation or damage it.

Still, these are the instances of the global events that are affecting not only the P2P market but the economy globally.

As mentioned before, it’s hard to predict what a future crisis may hold and how to prevent it.

Our only piece of advice here is to always diversify your investment across various loan types and countries. In this way, there are less chances to lose all of your investments, keeping a positive ratio between the yield and the profit.

Bottomline

All things considered, the largest risk with a P2P lending investment is to be scammed or run into an unreliable borrower.

Even though P2P is already an established phenomenon in the financial market, it still lacks transparency. The good thing is that the top platforms are doing their best to introduce tools and measures to improve this area.

As to the main question explored in this article, “P2P lending is it safe?” our answer is it’s as safe as any other investment type. If you are aware of the existing risks and do your due diligence to take the precautions, there are good chances to have a positive investment experience with P2P lending.