Investing in rental properties via crowdfunding

We observe how over time, real estate property goes up in value. This is the main reason why many investors get interested in investing in rental properties. However, while this option looks lucrative, one needs to be ready that it may not pay off immediately.

So, let’s explore how to invest in real estate rental properties and why investing via crowdfunding may be a decent choice.

How does real estate crowdfunding work?

The idea of real estate crowdfunding is that developers attract funds from multiple unaccredited, also known as retail, and accredited investors.

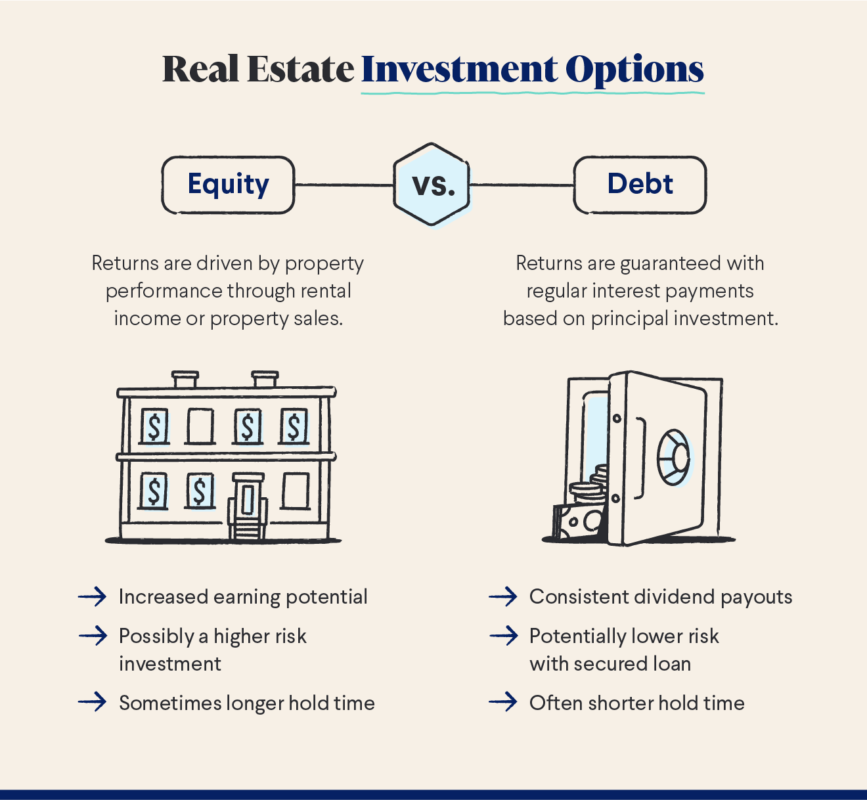

There are two main types of real estate crowdfunding:

- Debt – when investors give a loan to developers and expect to be repaid with interests.

- Equity – when investors get a share in residential or commercial real estate. This investment type is risky but it has the potential to deliver from 18 to 20% of income per annum, that’s why, it’s a valid and popular option among investors.

Alternatives to real estate crowdfunding

If you believe that real estate crowdfunding isn’t for you, you may consider alternative investment options such as real estate syndication and REITs.

Real estate syndication

A real estate syndicate is a pool of investors that contribute with their funds for investment purposes. A syndicate is managed by a deal sponsor – a person who is an expert in property development and handles the management of the project.

A real estate syndicate allows investing in projects that aren’t accessible for smaller investors: commercial property, residential blocks, complexes, etc.

While syndicates are considered safer, there is a risk that a sponsor can make a bad decision that will ultimately impact investment profitability. Also, syndicates usually have a minimum investment amount to be accepted which can be a substantial sum. That’s why this model is not accessible to anybody.

REITs

A Real Estate Investment Trust is a company that owns the property and rents it out. Investors can buy a share of a REIT and receive constant returns from the rent that tenants pay to the REIT.

Investing in a REIT is a way to build a constant source of passive income. However, dividends paid out by a REIT are taxed at a higher rate than other income flows. This investment type works in the long run, so if you want to get returns within a couple of years, it is not the best option.

Why invest in rental properties via crowdfunding?

While it looks like being an owner of rental property means a lot of profit, it is more complex than it seems.

To buy real estate, the future landlord has to make a 15-25% down payment for a mortgage. When the property is finally purchased, certain responsibilities include property management, renovation, maintenance, negotiations with tenants, etc. One can hire a property manager who typically charges 8-12% of the collected rent, but it adds to the expenses, which are not low anyway.

So, owning and managing a rental property requires time, dedication, and money. If you believe this way is not for you, investing in rental properties via crowdfunding may be your choice.

For beginners, starting investing in real estate with a relatively low entry point is a valid option. For professionals, rental property crowdfunding is an excellent option to diversify their portfolios and explore the niche.

Rental property investing via crowdfunding offers the following benefits:

- Investors get access to a long-term passive income source.

- It is easy to get started, especially if a crowdinvesting platform doesn’t limit its offerings to accredited investors only.

- Normally, it is possible to start investing with a small sum of money. However, some deals may have higher minimum investment requirements.

- In the end, it is also an excellent risk diversification opportunity.

Crowdinvesting in rental property also has its drawbacks, such as:

- Investors have no or little control over the processes even though, in some cases, they can have voting rights when it comes to some major changes, such as property sales.

- Investors cannot increase the leverage by purchasing more properties within the same deal.

- Even though more secure than those received by property owners, returns usually are lower than when one owns a property.

- If tenants are late with their rent, repayments may be delayed, too.

Crowdfunding websites to invest in buy-to-let properties

If you are looking for a reliable crowdfunding platform to invest in buy-to-let properties, consider having a look at the following ones.

Fundrise

Fundrise is a US-based SEC-registered real estate crowdinvesting platform. It was founded in 2010 to lower the entry point for those interested in real estate investing.

Everybody can participate in the offerings with as little as $10, even though some deals will require a higher minimum investment.

The funds of those who invest in Fundrise are allocated across various offerings known as eREITs (electronic real estate investment funds) and eFunds. Both of them are professionally managed portfolios of real estate assets located all across the United States.

eREIT is an investment type used exclusively by Fundrise. eREITs focus on commercial real estate such as apartments, shopping centers, hotels, and office buildings.

eFunds are focused on residential real estate such as single-family homes, condominiums, and townhomes.

CrowdStreet

CrowdStreet enables accredited investors to benefit from investing in private real estate projects with a minimum of USD 25,000 for individual deals, and $250,000 for a tailored investor portfolio. This crowdinvesting platform was launched in 2014 in the USA, and since then, it helped to invest over USD 1 bln across more than 400 projects.

Investors have three options to invest through CrowdStreet:

- Individual deals

- Tailored portfolios

- Real estate vehicles and funds.

The platform enables each investor to pick an account based on their risk tolerance, budget, and other parameters.

Bottom line

While there are several popular options to invest in rental property, doing it through crowdfunding has some benefits such as a lower entry point, a variety of offerings, and some platforms accept unaccredited investors along with accredited ones.

If you are thinking about what way is better for you, consider carefully your resources, to what extent you are willing to participate in property management and maintenance, and pick an option that is more suitable for you.