Impact investing through reconversion & insight into Italian crowdfunding: interview with Paolo Manetta, CEO at RE-Lender

Please meet RE-Lender, a Milan-based impact crowdfunding marketplace funding industrial, urban, real estate, ecological, and digital reconversion projects. In fact, they are the first crowdfunding platform dedicated to reconversion in these areas.

Their core mission is to promote sustainability in all the areas mentioned above: be it website transition or redevelopment of a building or brownfield. To achieve that, the platform works with a broad range of projects from mainly real estate and SME sectors.

We’ve spoken to RE-Lender’s CEO, Paolo Manetta, to find out their experience with impact investing, the state of the Italian crowdfunding market, and which reconversion projects are most popular these days.

How would you introduce RE-Lender to CrowdSpace readers?

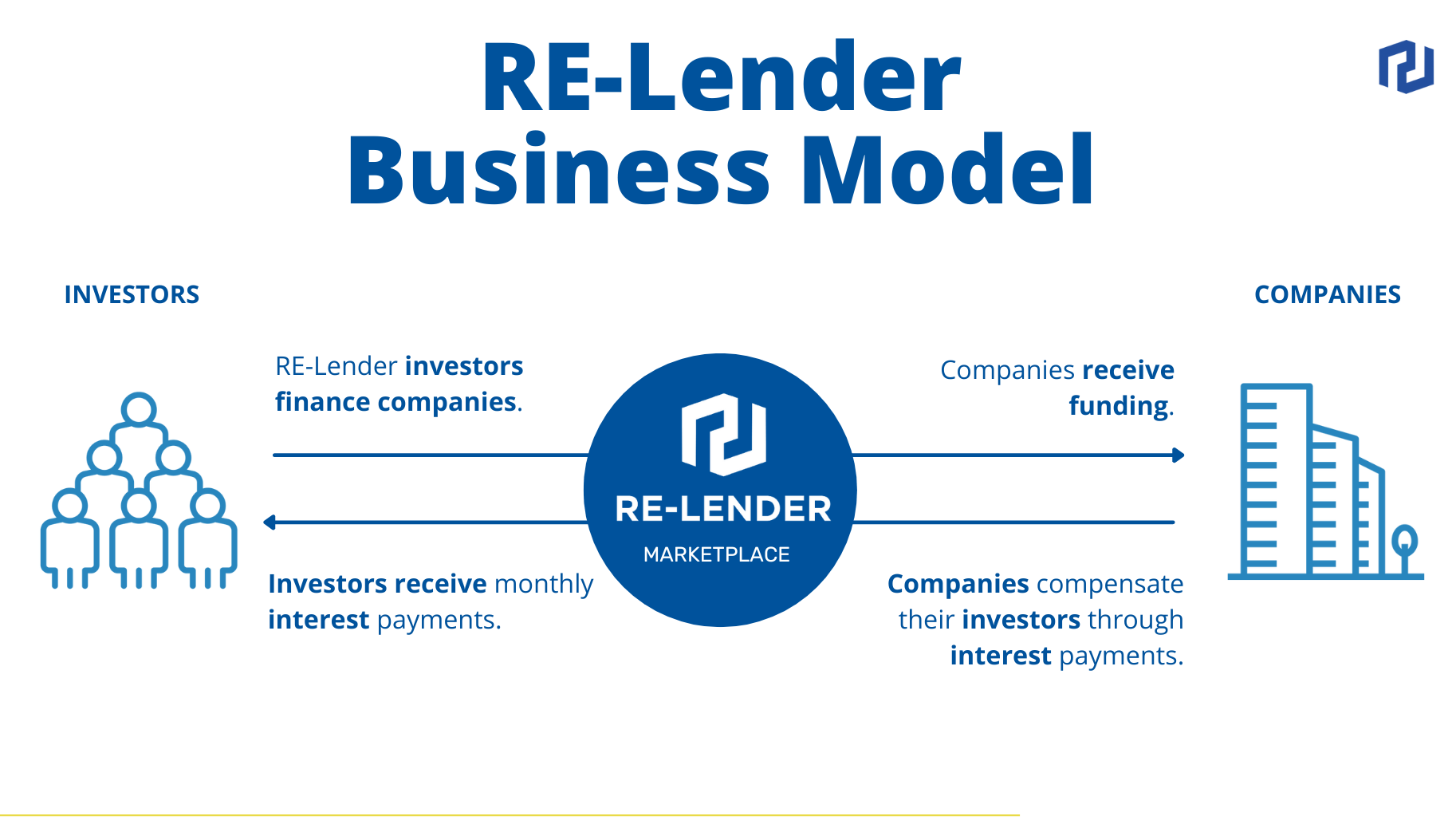

Re-Lender is a cutting-edge tech marketplace platform that works on the crowdlending crowdfunding model. We provide companies with fast funding to support their initiatives and investors the opportunity to invest and earn interest easily.

How has RE-Lender started?

We started as a completely new venture, yet we saw immediate success. We achieved in just 2 years what other platforms (with a 1.5-year advantage) have succeeded in five years.

We reached Break Even Point (BEP) barely a year after launching our platform, with a fundraising speed of €500,000/h.

We wanted to allow individual investors to monetize their savings without requiring them to commit to large sums.

At the same time, we intended to provide small and medium-sized businesses with access to rapid financing to help them fund their activities seamlessly.

What’s RE-Lender’s business model?

We operate on both the B2B and B2C business models.

On the B2C side, we provide individual investors with the opportunity to earn high returns (interests) with a small initial investment of €50.

On the other side, we provide businesses with the option to get instant funding to support various projects through loans.

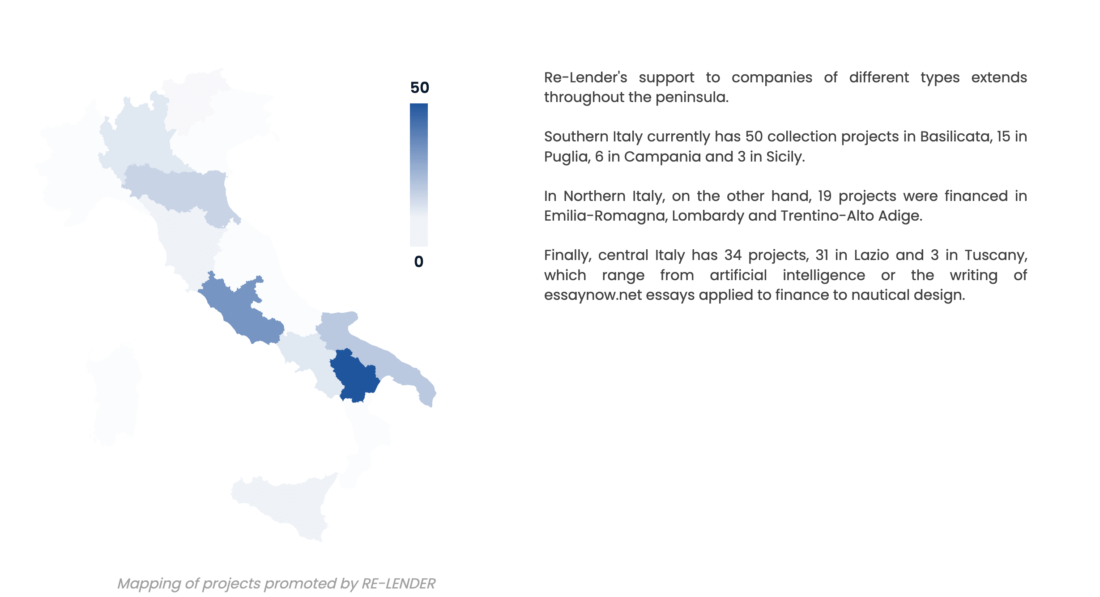

Are your projects solely Italy-based?

For the time being, all of our projects are based in Italy. Nonetheless, we plan to expand to other European countries, such as Spain and Portugal, where we have already had the opportunity to test and familiarize ourselves with the markets through our business partners.

Which project types are the most popular these days?

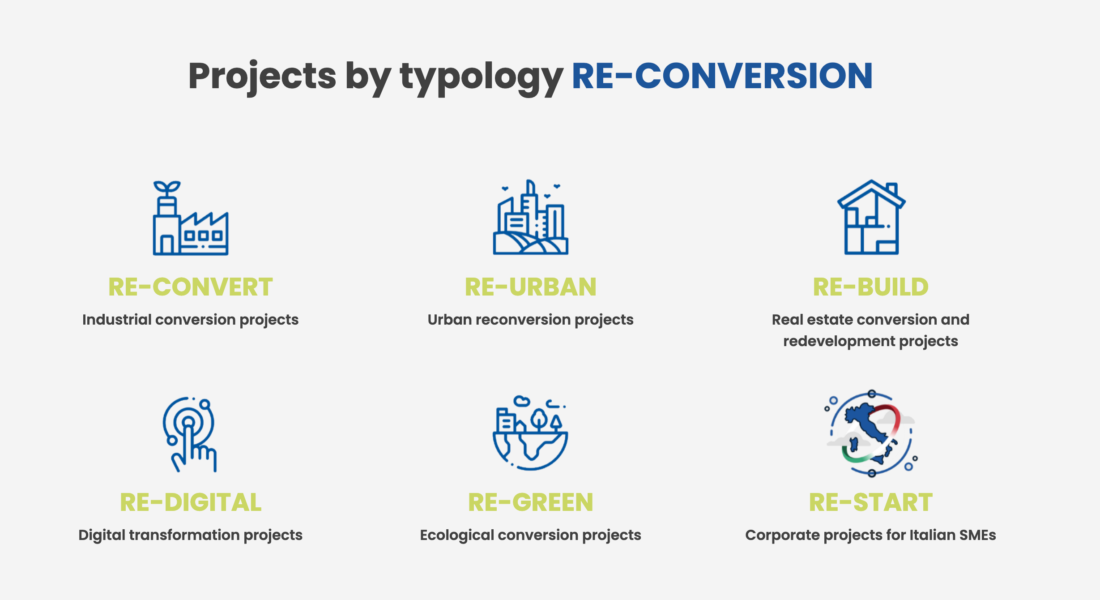

We have six project types introduced: re-convert, re-green, re-urban, re-build, re-digital, re-finance, re-think, re-start.

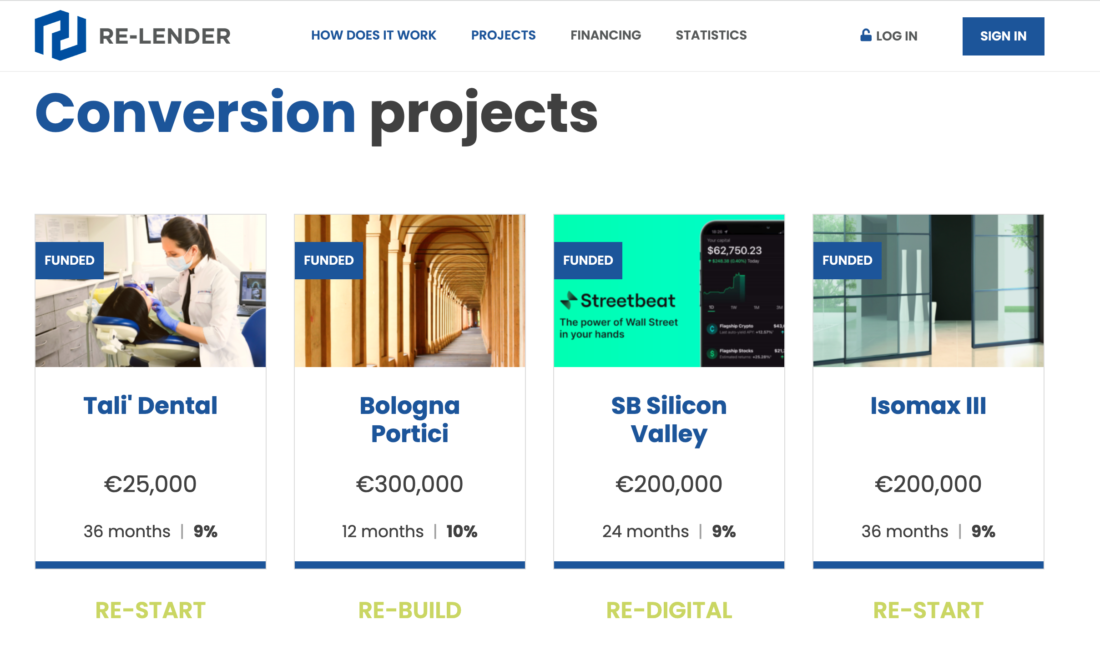

At the moment, the most popular categories on our site are RE-Start and RE-Build, which account for 45% and 28% of our total projects launched thus far, respectively.

I believe the RE-Start category is the most promising.

Among the six loan types, which are the safest, in your opinion?

Overall, we can not claim that one loan type is more secure than another.

What changes, though, is the investor’s perception of the various categories. Because real estate is one of the driving areas of the Italian economy, it is regarded as one of the most profitable and safest investments.

Given this, our RE-Build category may be regarded as the safest.

How do you ensure RE-Lender loans are safe for investors?

To ensure that our loans are “safe” for our investors, we carefully analyze every company that contacts us for a loan, as well as the possible risks of the project they seek to fund through our platform.

We accomplish this by attentively reviewing the company’s records and history and conducting site visits when needed.

How would you describe the crowd-investing market in Italy?

The Italian crowd-investing market is likely to be in its infancy. Nonetheless, we see a lot of interest from investors who are willing to give this new investment approach a go.

We currently operate under the Bank of Italy’s legal regulations for the collection of savings from non-banking institutions, which delegate third-party payment institutions (authorized to provide payment services) to manage money flows.

We will soon be subject to the European Crowdfunding Regulation, allowing us to operate cross-country in other European countries.

Existing industry players (such as our company) will be “Passported” into regulation more easily, but no new entrants will be allowed until the November 2023 regulation is formalized.

How is RE-Lender different from other platforms?

Compared to other platforms, Re-Lender allows all investors, including those with a limited investment budget, to see their savings grow.

On the B2B end, we provide a rapid and accurate review system that, once completed, allows companies to begin raising money from the community through our platform immediately.

What’s coming up next for RE-Lender?

We can’t reveal or go into too much detail right now, but as for our next steps, we’re planning to expand in other European countries and thus attract more international investors. We also plan to employ new technologies, such as blockchain and metaverse.

How do you see the industry’s future in general?

We anticipate a more educated market on crowdfunding. As far as we can tell, only younger generations appear to understand what crowdfunding is and how it works. Nonetheless, we expect that as time passes, this consciousness will spread across all generations.

We also await the adoption of legislation that will allow us to operate on a wider market scale while adhering to clearly defined standards.

In terms of industry growth, we anticipate crowdfunding to be one of the leading players in the alternative investment sector.

We thank Mr. Manetta and RE-Lender team for sharing their experience in real estate and SME sustainable funding, and invite you to explore more investment options.