How much can you earn with crowdfunding

All the investors and investors-to-be ask this question at some point in their journey.

The truth is that there is no definite answer, which means that the possibilities out there are endless.

Yet, it’s essential to realize from the very beginning that any investment comes with a risk of losing it, let alone earning from it. The more lucrative the investment opportunity looks, the bigger the risk is. And it’s only up to the investor’s experience and knowledge to manage it.

Luckily, acquiring the latter has become a bit easier these days.

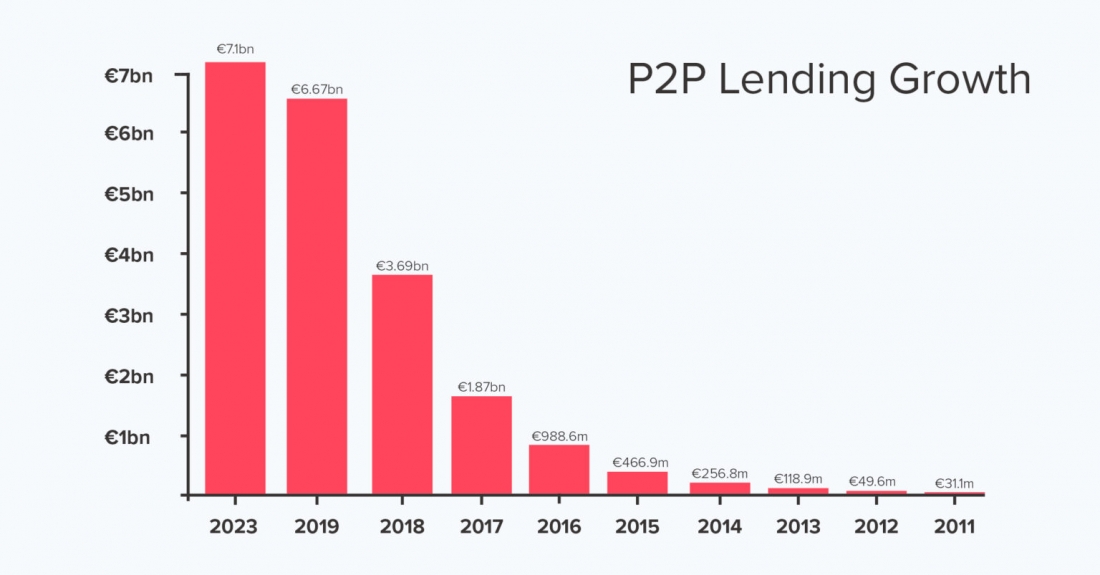

Firstly, crowdfunding, P2P lending in particular, has grown into an established industry that has proven to be viable with more than a decade on the market. For instance, in 2021, it was worth $83.79 billion, per Precedence Research figures.

Secondly, there are enough resources available today to get educated about investment strategies. For example, investors with hands-on experience share cases and tips other people can learn from.

Not to mention professional economic and financial online editions keeping up their readers with the most recent statistics and forecasts.

With that being said, one can find tools to project the potential investment outcomes. At least to some extent.

So, here is what we have to say regarding the main question this article explores “how much can you earn with crowdfunding” — it’s a complex equation. There won’t be a definite answer, but we’ll give you all the equation conditions to solve it independently.

How can I earn through P2P?

- First research, then invest.

Building a steady passive income has become a primary goal for many investors today. The abundant P2P lending market combined with a demand for a passive source of income contribute to an influx of new platforms.

On the one hand, it boosts the competition among P2P lending sites to provide a better investment experience for their users.

On the other, there are more chances of running into an untrustworthy company.

Some of them promise you almost no risks and high rewards right from the start. In most cases it turns out to be precisely the opposite. So, having thorough research is a must:

- How are investors and borrowers evaluated?

- What’s the platforms’ liquidity? How quick can I withdraw my funds?

- What’s the P2P lending platform’s flow for defaulted loans?

- What are the average returns?

- What are the reviews? How were negative experiences handled?

- Are there buy-back guarantees? In other words, if the borrower goes bankrupt, will the P2P provider pay back my investment?

These are just a few cornerstone questions to get started.

On top of trying to protect yourself, the answers will give you an understanding of the P2P platform’s business models and policies.

We recommend also looking up investors’ blogs who test out various P2P lending sites, describe their mistakes and smart moves, as well as share the overall impressions. P2P Empire is one of such convenient resources to get started with P2P investment.

For experienced investors, it might be interesting to explore P2P lending platforms comparison that P2P Empire often publishes.

- Start small.

After all the research digging, it feels right to go full steam with investing. Yet, we recommend starting slow.

Remember, “In theory, theory and practice are the same. In practice, they are not”.

Investing a small amount will give you the necessary space to go through the investment journey stress-free, get familiar with the platform, and ultimately, avoid costly mistakes.

By gradually increasing the investment amount, you’ll be able to figure out the risk level you are comfortable with.

- Always diversify.

Diversification is the solution to many investors’ pains. In a nutshell, it’s the only working mechanism that helps minimize the risk, build a solid investment portfolio, and yield more.

So be sure to spread your funds in multiple loans, which is very easy to do with £25-50 loan balances. In this case, there are good chances that the profits will always be higher than the defaults.

- Inquire about taxes.

P2P lending returns are considered as income, which means they are taxed.

So another box to check on the list is to find out about the taxation policy applicable in your country. If you are a UK citizen, there is some good news.

Thanks to the introduction of IFISA, Innovative Finance Individual Savings Account, interest earned through P2P lending is not subject to taxation. With IFISA, you can invest up to £20,000.00 per year and receive tax-free income. Still, keep in mind that anything exceeding the £20,000.00 allowance is taxable.

Best passive income platforms in 2022

The recommendations above are just a few basic precautions anyone can take to secure oneself and raise chances for successful investment efforts.

As you may see, choosing a reliable P2P provider plays a decisive role. Below are P2P lending platforms examples that may be suitable for passive income investors.

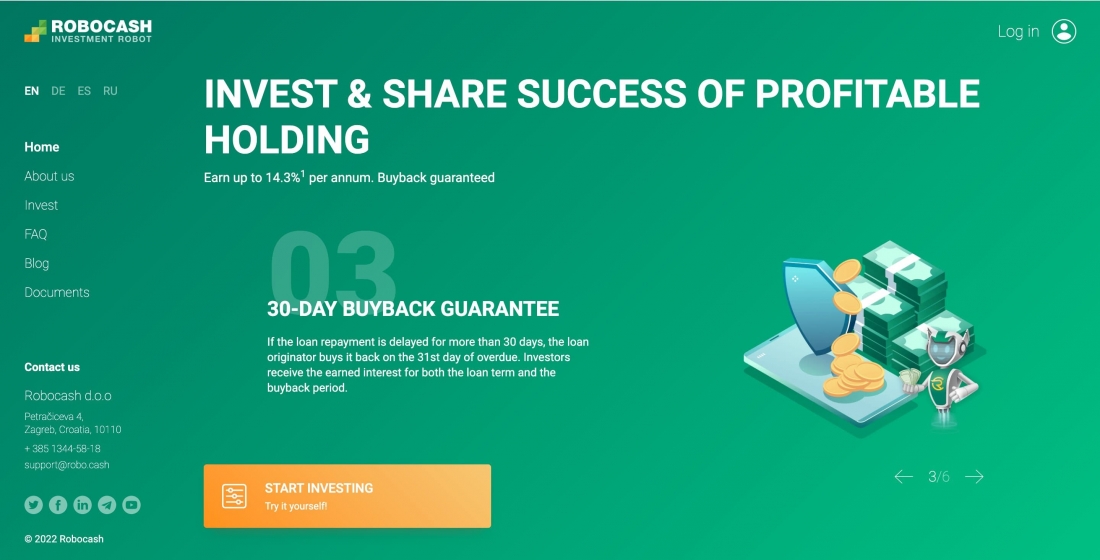

Robocash

Robocash is a Croatia-based P2P lending platform that deals mainly with short-term consumer loans.

While many P2P providers operate with 60-day buyback guarantees, Robocash returns the investment within 30 days.

Average annual return: 10% – 14%

Min investment amount: €10

Loan markets: Spain, Singapore, Kazakhstan, the Philippines.

Buyback guarantees: yes

Instant liquidity: no

Diversification opportunities: yes

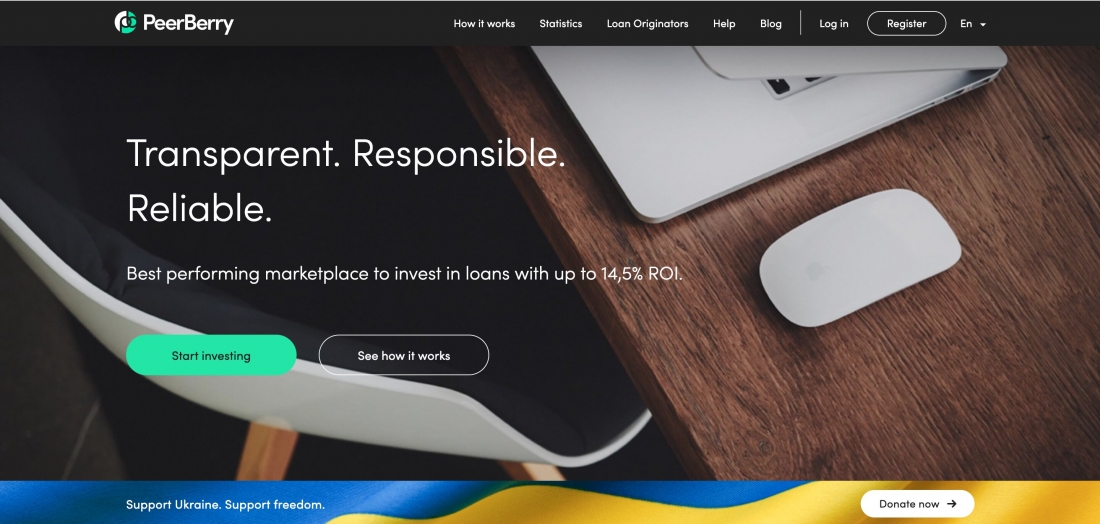

PeerBerry

PeerBerry is claimed to be one of the best P2P lending platforms for short-term loans, offering auto-invest options. The provider is also known for its responsive support and overall transparency. To maintain this reputation, PeerBerry disclose their financial reports and statistics.

Average annual return: 11% – 14%

Min investment amount: €10

Loan markets: Poland, Kazakhstan, Moldova, Romania, Lithuania, Vietnam.

Buyback guarantees: yes

Instant liquidity: no

Diversification opportunities: yes

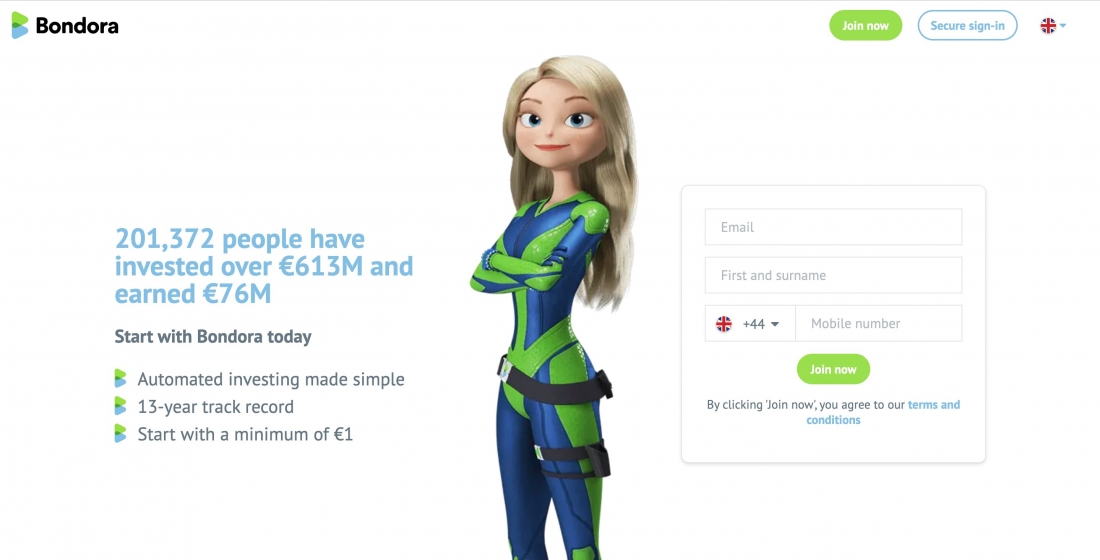

Bondora

Bondora is one of the oldest P2P lending platforms based in Estonia, with advanced tools helping investors to automate their strategies.

Bondora Go & Grow is one of such popular investment products, especially handy for beginners.

Here is how it works: you create your Go & Grow account, set the initial investment amount, and loan period. Then the tool immediately evaluates the settings and gives a potential estimate of your returns.

Finally, the Go & Grow will spread the investment across 90,000 loans, which is an outstanding diversification example.

Average annual return: 6% – 27%

Min investment amount: €1

Loan markets: Estonia, Spain, Finland.

Buyback guarantees: no.

Instant liquidity: yes.

Diversification opportunities: yes

Final thoughts

All factors considered, passive income isn’t that passive after all.

It takes time and effort to educate oneself about all the best practices and risks involved, inquire about the P2P platform’s history, security guarantees, etc.

The platforms listed above are the big players that have been on the market for some time, and can be a good place either to overcome a learning curve, or get fresh ideas to expand your portfolio.

Ultimately, it all comes down to the ratio between the risks and the yield you feel comfortable with.

Exploring various P2P platforms may help you understand better what platform features make a difference to you and figure out what passive income strategies work best.