Equity crowdfunding vs venture capital: which is better?

If you are an established business owner or startup entrepreneur, you must know how your choices can shape your business’s success or failure. One crucial decision is developing your capital-raising strategy.

There are enough ways to raise business capital today, but in this article, we’ll explore equity crowdfunding and venture capital. Comparing the two capital-raising sources can help one better understand both and make better business decisions.

What is venture capital?

Venture capital is an investment alternative that can fund companies at different stages of their development. Yet, as a rule, those are startups or early-stage businesses with some potential aiming to grow and scale. They sell their companies’ stakes in exchange for funding, management, and tech expertise.

VC investors pooling their capital often guide emerging companies and actively participate in their management. So, apart from financing, businesses that opt for venture capital are also seeking expertise. What’s important, only accredited and institutional investors can invest in VC funds.

Winning venture capital is a challenging and not quick process. Entrepreneurs need to submit a high-level detailed business plan for the venture firm to consider the business model, history, and the product. The due diligence process is rather extensive and also involves looking into the company’s values and principles. Once it’s done, the VC firm provides capital in a few rounds and helps run the company in exchange for stakes.

Venture capital pros

- Access to more considerable sums of capital in a shorter amount of time.

- Powerful and valuable network since VC investors can connect with strong experts.

- Chance to leverage the VCs’ deep management experience in guiding high-profile companies.

- Credibility and good reputations that companies gain from a long-established and secure capital form.

Venture capital cons

- Per builtin.com, only 1% of the applying companies receive VC funding.

- VC investors get to control the company’s decisions which can be both good and bad. You may have to approve decisions that you would like to avoid.

- Investors seeking quick returns may push startups to grow at an accelerated pace which may be too much.

What is equity crowdfunding?

Unlike venture capital, equity crowdfunding usually involves a more significant number of investors donating different sums of money in exchange for the company’s equity ownership. The entire process is facilitated by equity crowdfunding platforms. Some of them may have requirements allowing only experienced investors, however, it’s still a far more affordable alternative enabling more people to participate. So, the bigger the network, the more you spread the word about the campaign, the more chances there are to hit the target amount.

Essentially, the equity crowdfunding approach resembles the more traditional capital raising strategies, with one exception: it aims to attract more people by democratising the process and enhancing it with recent tech advances.

What stays the same, though, is the fact that you need to have your legal papers and business plan in order. A compelling presentation along with decent PR and marketing are also a must.

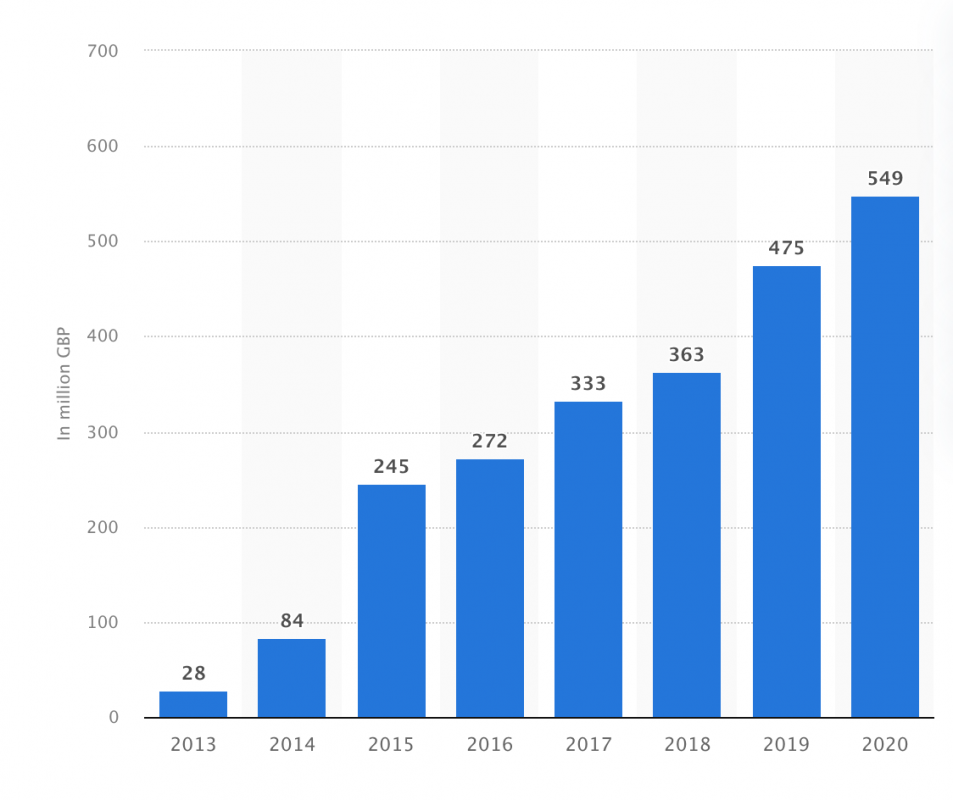

Over the past few years, equity crowdfunding has been gaining momentum. With digitalisation well underway and more areas switching to online, it’s been a streamlined process. The accelerating component here has surely been the pandemic.

On the one hand, it impacted the venture capital landscape, where venture capital firms tend to take less risk and prefer to distribute their investments across their portfolio rather than considering new investments.

On the other hand, the pandemic, isolation, and rise of the online have benefitted equity crowdfunding area.

Lastly, tax reliefs have undoubtedly been a significant factor. For instance, the UK has implemented one of the most generous tax cuts for investors funding small early-stage businesses. Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) offer up to 30% and 50% income tax reliefs. Under the EIS program only, around 33,000 small businesses have already received financing, which adds up to £24bn.

Equity crowdfunding pros

- Access to a larger investor pool which increases the chance of getting the target funding.

- While distributing the shares, you still get to control the company’s development since equity crowdfunding typically offers common non-voting equity.

- An efficient way to grow your target audience, grow the potential customers’ base and gain brain ambassadors.

Equity crowdfunding cons

- No guarantees that you’ll hit the target. Compared to venture capital firms that secure the needed amount, crowdfunding may only collect some of the funds you need.

- From the investor’s standpoint, it may take some time to see profit.

Bottom line

Both venture capital and equity crowdfunding have proven to be working solutions to raise capital. Which one is the right one for you, depends on many business aspects.

Venture capital offers access to substantial funding and valuable expertise, but securing it can be arduous: only 1% of applicants receive funding. Additionally, relinquishing control over certain decisions and pressure for rapid growth are inherent risks.

On the other hand, equity crowdfunding provides broader access to capital, empowering businesses to engage a larger investor base. However, there are no guarantees of hitting funding targets, and returns may take time to materialize from an investor’s perspective.

Ultimately, businesses must carefully weigh the pros and cons of each approach, considering their goals, resources, and risk tolerance.

Take your time to explore the existing equity crowdfunding platforms and venture capital opportunities to make the right call for your business idea.