Crowdfunding vs angel investing: what’s the difference

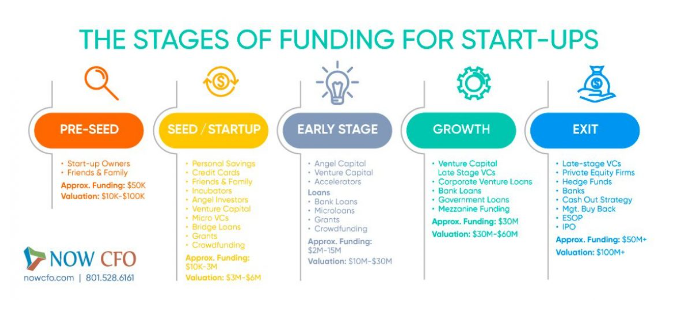

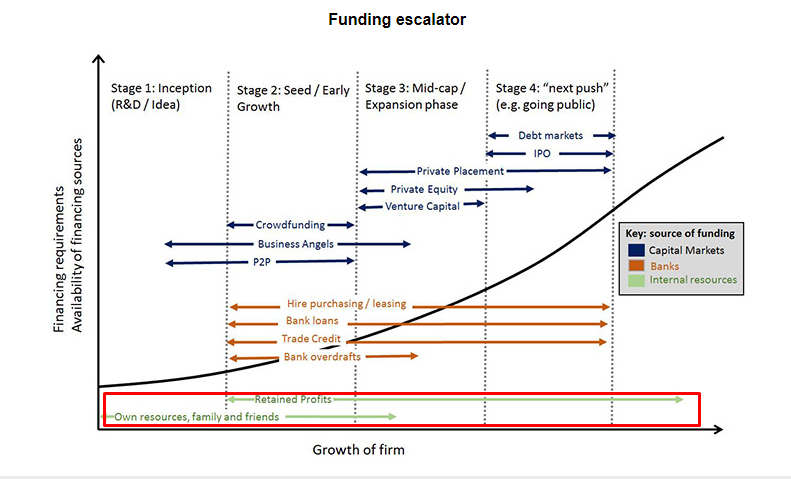

Raising funds is usually a major challenge for a business that wants to launch a new project or scale. Today companies have several options to get the required funds and in this article, we will discuss crowdfunding and angel investing in particular. Before we get straight to that, let’s refresh a bit on what investment sources there generally exist.

You can get funds from friends or family

Statistics show that this investing method is among the most popular ones. Friends or family invest approximately $150,000.

However, this resource is limited. Therefore, if a business needs more money than just a couple of thousands of dollars, a different way to get the resources shall be found. Normally, startups can use this source of raising funds at the very early stage of the company’s development.

A business can get a loan from a bank

The main drawback is that the loan shall be repaid with a fixed interest rate independently of whether the project succeeds or fails. The interest rates are usually prohibitively high for a company to get into a loan with a bank. Also, receiving a loan might be complicated if the company is a startup.

Angel investors are another source of getting funds for a company

Angel investors are high-net-worth individuals that provide funds for a share in a company.

Crowdfunding is a relatively new yet established way to raise funds

While launching a crowdfunding campaign has its cons, this way of raising funds is growing in popularity among startups.

Wrapping up, angel investing and crowdfunding are the most viable sources of funds. Which one is best to choose? It depends on many factors.

Angel investing or crowdfunding?

Legal Aspects

Angel investors are high net-worth individuals, thus, they are accredited investors. Very often, angel investors are successful entrepreneurs themselves, that’s why they know how to determine whether a project is promising enough to invest in it.

An angel investor always invests for a share in a company and will decide on how the company is going to develop. Therefore, by addressing its fundraising needs to angel investors, a startup shall be ready to sacrifice a part of its autonomy. On the other hand, such participation is a great opportunity for a business to get valuable advice from an experienced entrepreneur for free.

Crowdfunding investors don’t get an opportunity to decide how the business will evolve because usually, their equity in a company is too low.

Accredited investors can invest under Regulation D and Regulation A offerings. Participation in Regulation CF offerings is limited for both accredited and non-accredited investors depending on the limitations in the capital that can be raised by a startup during 12 months. While Reg CF imposes some limitations on selling shares on secondary markets, there are additional rules for angel investors that may limit the sale of the shares on secondary markets. For example, shares cannot be resold during an IPO lockup period, or the number of shares that can be sold is limited, etc.

Both accredited and non-accredited investors can participate in crowdfunding offerings. For accredited investors, the same rules work as for angel investors (in most cases, those are the same people). Non-accredited investors cannot invest under Regulation D offerings, and they are limited in how much they can invest under Regulation A offerings.

Both types of investors can invest in Reg CF offerings but for unaccredited investors, only a limitation of a minimum 1-year holding period works if they want to resell shares in secondary markets.

Deal flow and deals availability

An angel investor works either alone or in a group with other angel investors that can be accessed through an angel investing platform. They can make decisions fast and provide funds asap. If the funds are not sufficient but the project is promising, angel investors can decide on funding the project more intensively.

Angel investors have access to closed offers that delivers them a significant advantage. One of the clearest examples of how it works was the investment of Peter Thiel in Facebook in 2004. If Peter Thiel was not introduced to Mark Zuckerberg by Reid Hoffman, it would have never happened.

For an angel investor, it is crucial to have access to the best deals. For the hottest offers, founders are frequently the ones who choose angel investors, and not on the contrary. That’s why the angel investor’s reputation plays a significant role in whether he is going to access the deal or not.

In crowdfunding, all deals that are listed on a crowdfunding portal are available for anybody. The deal flow is equal to all investors within Regulation CF. That’s why access to the best deals doesn’t depend on the investor’s reputation and is not filtered based on the deal quality. Crowdfunding investors can choose any deal available, but at the same time, they may find it difficult to determine whether the deal is promising or not.

Information about the project

Angel investors can get all the details about the project they need to determine how profitable the investment may be.

It is expected that founders will meet angel investors in person to discuss the investment details and conditions.

In crowdfunding, the information published on a crowdfunding platform may be limited to the minimally required disclosure. It happens because businesses shall be careful with sensitive information about the project they are raising funds for, otherwise, competitors may benefit from it. That’s why crowdfunding investors often have limited access to the information about the project they are giving funds for. Therefore, their investment decisions may be not as well thought through as those made by angel investors.

Development stage

Crowdfunding investors are normally willing to invest in a project whose founders have a clear idea of where it is heading. To succeed in a crowdfunding campaign, project founders have to provide a detailed marketing plan, the project roadmap, and to have a clear vision of how they are going to proceed. Usually, these details are available when the R&D stage is over, and the project reaches a seed funding stage.

Angel investors are ready to provide funds at an earlier stage if they see that the project is promising. The funding can be extended throughout the seed stage and further throughout the expansion stage.

Angel investing through crowdfunding

Crowdfunding offers investors an opportunity to diversify their investments across many startups and invest in multiple companies in different locations. That’s why many wealthy investors consider crowdfunding platforms for angel investors such as AngelList. This option is also good for investors who don’t want to commit the capital needed to be an angel investor.

Bottom line

Even though there are significant differences between angel investing and crowdfunding, they both go hand in hand in providing funds to startups. We are already observing how these two ways of funding startup companies merge their efforts, and over time, this overlap will be increasing.

If this piece has been informative to you, drop by to explore the variety of crowdfunding platforms and the niches they represent.