How to automate your crowdfunding platform

In the “Back to the Future” film Marty wore Nike trainers without laces that automatically wrapped around his legs. In 1989, it seemed like a miracle.

After 30 years, Nike launched the Nike Air MAG self-lacing shoe that surpassed the expectations of fans of the cult adventure.

What are we talking about?

Modern technologies allow us to automate any processes, from laces to crowdfunding platforms, which will be discussed today.

According to the statistics, the global investment market will grow by 10% and reach $390M by 2023. Experts point out the automation of all systems, which simplifies investment processes and minimizes their costs, as one of the reasons for this growth.

In this article, we are going to tell you how to automate your crowdfunding business and give examples of tools that you can implement in your platform.

Well, the game is going to be hot!

How does automation affect your business?

This is a rhetorical question. In this section, we will not describe all the delights of automation. Everyone knows that the future lies in automation and the “evolution of robots” is not far off. While you were reading these lines, another Amazon warehouse was automated. =)

Let’s look together at these numbers:

- Consulting firm McKinsey found that 45% of tasks = $2T (in employee salaries) can be automated;

- 88% of marketers say the less time they take to prepare reports, the better marketing strategies they can develop;

- Thinkautomation reports that the digital process automation market is worth $6.76 billion, which will rise to $12.61 billion by 2023;

- 74% of organizations say they are ready for automation and are actively looking for new options;

- between 2017 and 2019, companies using automation grew from 16% to 50%;

- 85% of communication between customers and companies is already automated.

As you can see, the statistics say that the era of automation has already arrived, and if you still keep your notes in a notebook, you need to take action.

Automation crowdfunding platform. Where to begin?

You don’t have to jump straight at all the apps that offer to automate crowdfunding platforms. The investment market is developing rapidly, which means that many fintech companies are developing new features for this market.

Basically, automation is aimed at speeding up and improving the basic processes that already exist, for example, to quickly check the AML and KYC user. Some 10 years ago, you had to manually check each user, but today this is done with one click.

Moreover, automation help controls all transactions, compiles a risk, makes all payments faster, sends notifications and even offers 24/7 technical support.

5 the best way to automate your crowdfunding business

Due diligence checks

Safety comes first! Only verified investors and clients can conduct transactions in the investment market. We recommend that you draw your attention to applications that will automatically check both sides.

For example Sumsub.

In addition to standard KYC and AML checks, Sumsub determines the liveliness of a real human face in comparison with a hologram and works with Blockchain-Based Projects, which is a plus for the investment market.

This tool integrates seamlessly with web and mobile apps via API and SDK. The Sumsub developers claim that it will only take you an hour to install.

Well, if you have any questions, the 24/7 technical support is ready to answer all your questions.

Digital signatures

Yes, now you don’t have to go anywhere for the sake of one signature. A personalized check mark can be electronic, thanks to applications such as:

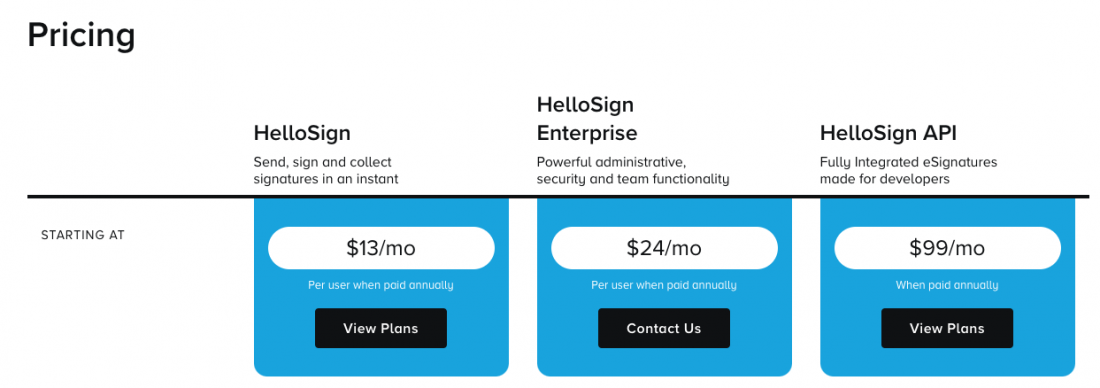

HelloSign is a major player in the digital signature world. Companies like Instacart and Climb Credit have long relied on HelloSign to speed up internal processes.

We recommend considering HelloSign to speed up the application processes for crowdfunding platforms.

With HelloSign, any processes that require client signatures will take less than 2 minutes. To be convinced of this, we recommend you try the trial period and decide on one of the plans that start at $13 / month.

Non stop CRM system

If you have reached the level of an advanced user of Excel, you are several years late. Today all successful companies use CRM systems that help to store information about each user, set up marketing processes, analyze data and set up sales channels.

In most cases, a CRM system is a customizable set of tools that adapts to the clients needs.

There are many CRM systems on the market like Salesforce, Pipedrive, Copper, Zoho and others.

We would like to keep your attention on Monday.com.

This CRM offers to automate, plan and track the work of your team, and even do it remotely, which is very convenient during the COVID-19 pandemic time.

Monday board is a fully customizable spreadsheet for project management. Your team will be able to customize the application on their own, since installing Monday does not require knowledge of the code.

Monday’s cost depends on the number of users and the plan. For example, a team of up to 5 people in the basic plan will cost you $39 per month. There is also a free trial period that does not require linking to a bank card.

Reliable payment gateway provider

If you still haven’t chosen a reliable payment gateway provider, then it’s time to hurry up. There are a huge number of providers on the market that attract new customers.

According to a study by Capgemini and BNP Paribas, by 2020, people around the world will have made 726 billion digital transactions, including your customers.

Builtin emphasize the top 10 fintech payment gateway providers:

- Circle

- Remitly

- Stripe

- Braintree

- Aeropay

- DailyPay

- Bolt

- PayPal

- Ripple

- Affirm

You can choose any platform from this list that meet the needs of your crowdfunding platform. We would like to supplement this list with another payment gateway — Lemonway.

Lemonway has been on the market since 2007 and has managed to prove itself as a reliable partner. Moreover, Lemonway has 1,400 sites across Europe, including 200 crowdfunding platforms.

Main advantages:

- Compliance guarantee

- High-performing API

- Secure payment

- Instantaneous KYC

- Simplified management

- Technical support and personalized account management

SMS verification

In order to always stay in touch with your customers, as well as verify their identity during registration, we recommend implementing SMS verification services in the crowdfunding platform. They are easily integrated via the API.

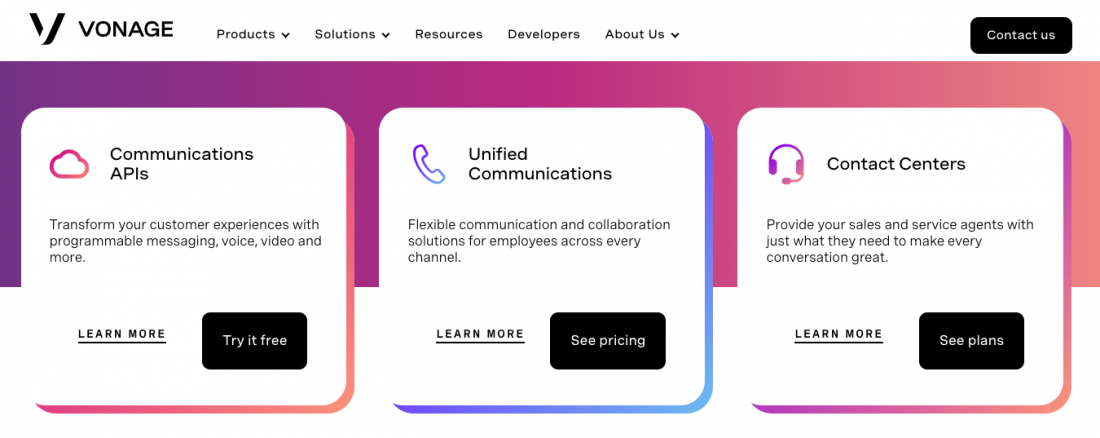

We would like to draw your attention to Vonage.

The service provides:

- two-factor authentication using SMS or voice;

- real-time recognition of any telephone number in the world;

- the ability to create interactive videos on the platform;

- attracting customers using SMS and social networks;

- the Sandbox API messages function.

Vonage claims that you will pay just for successful checks, the price of which is from €0.0500.

On a final note

Automation has actively hijacked the investment market. Today, you can implement everything into a crowdfunding platform: from a CRM system to SMS notifications or chatbots.

3 main ideas of this article:

- Automation is an integral part of any investment business, which reduces the cost of employee salaries and increases customer growth.

- KYC / AML, electronic signatures, SMS authorisation, payment gateways are must-have set for any crowdfunding platform.

- You always have a choice to choose an app that meets both your needs and wallet.

If you want to find out more information about automation or share ideas with our team — email us.