Debitum Investments: Post-Acquisition Growth, Vision, and Commitment to Regulated P2P Lending Success

Debitum Investments is a European licensed peer-to-peer investment platform based in Latvia. It focuses on enabling individuals to invest in sustainable business loans while offering investor protection and attractive returns.

Company background

In 2023, Debitum was acquired by new owners and became Debitum Investments, so today we have the opportunity to speak with the new platform leaders and learn more about the mission, vision, current achievements and future plans of the platform.

Why was Debitum acquired by new owners? Why was the platform available for acquisition so soon after its start, and how did that process unfold?

Ēriks Reņģītis and Ingus Salmiņš acquired Debitum Investments in mid-2023, driven by their shared vision to address financing gaps in the Baltic market. With Ingus’ extensive banking expertise and Ēriks’ background in M&A and corporate finance, they identified the platform’s potential to bridge the funding needs of strong companies that require alternative financing solutions beyond traditional banks.

In the Baltics, banks often lend conservatively, and the capital markets are underdeveloped, leaving many businesses underserved. They saw an opportunity to connect these businesses with investors looking for secure and attractive returns. The acquisition of Debitum aligned with their goal of providing tailored financing options, such as mezzanine loans, while offering competitive rates to investors.

The acquisition opportunity arose when Debitum’s original founders decided to focus on other ventures. Recognizing the platform’s untapped potential, Ēriks and Ingus stepped in to take over. By mid-2024, operational management transitioned under Ēriks’ leadership, enabling strategic enhancements to the platform, expanding the loan portfolio, and positioning Debitum for significant growth.

In what ways does Debitum’s vision correspond with the broader trends in European peer-to-peer investing, particularly in relation to supporting small and medium-sized enterprises (SMEs)?

Debitum’s vision is deeply aligned with the broader trends in European peer-to-peer (P2P) investing, particularly the growing emphasis on supporting small and medium-sized enterprises (SMEs). Unlike many platforms that diversify across payday loans or real estate financing, Debitum focuses exclusively on business loans, specifically targeting SMEs in countries like the UK, Estonia, and Latvia.

What sets Debitum apart is its commitment to quality over quantity. With a relatively small number of carefully selected loan originators, the platform prioritizes businesses that are almost bank-ready but fall just short of traditional financing criteria. This allows Debitum to serve an important niche, supporting stable, lower-risk SMEs that might otherwise struggle to secure funding in Europe’s conservative lending environment.

Additionally, Debitum emphasizes secured loans, where borrowers provide collateral to minimize risk for investors. By avoiding early-stage or high-risk companies, the platform caters to investors seeking safer, consistent returns, while aligning with the broader European push toward more sustainable and responsible P2P investment opportunities for SMEs. This approach ensures that Debitum remains a trusted partner for both investors and the businesses it supports.

Investment products and returns

Let’s talk about Debitum’s approach to investment products and performance. We’ll explore how the platform manages risks, maintains consistent returns, and ensures quality in the businesses it supports.

With reported average return rates between 10% and 14%, what risk management strategies does Debitum employ to maintain consistent performance and minimize defaults?

Debitum focuses heavily on risk management to maintain consistent returns of 10% to 14%. It starts with working only with trusted, carefully selected loan originators and borrowers.

The screening process is strict—most loan applications don’t even make it through. We prioritize businesses with strong fundamentals and clear reasons for not qualifying for traditional bank funding.

We also avoid high-risk early-stage companies, instead supporting established SMEs with proven track records. Plus, most loans are backed by collateral, adding an extra layer of security. Funding is done gradually—we start small and increase only if a borrower demonstrates reliability.

This thorough, hands-on approach is what helps us deliver strong, stable returns while keeping default rates low.

Can you elaborate on the criteria and processes Debitum utilizes to select and evaluate SMEs for loan offerings to ensure alignment with your platform’s standards?

Debitum uses a thorough process to select and evaluate SMEs, ensuring they meet the platform’s high standards. It starts with a detailed financial analysis — looking at their financial history, performance, and key ratios. We also set covenants that are monitored regularly to keep everything on track.

Collateral is another key focus, so we prioritize loans that are backed by assets and carefully evaluate recovery scenarios to minimize risk if something goes wrong.

Lastly, we make sure businesses can be effectively monitored, both financially and operationally, and that legal agreements tied to the collateral are enforceable in practice. This combination of careful analysis, security, and monitoring helps us maintain the high standards of our platform.

Challenges and controversies

Challenges and controversies are an important aspect to consider. This includes understanding the criticisms Debitum has faced over time and how the company has responded, as well as how it navigates potential conflicts of interest within its P2P lending model.

What have been the most significant criticisms or controversies Debitum has faced since its inception, and how has the company addressed them?

One notable challenge has been the assets in Ukraine, impacted by the war. Despite the circumstances being beyond Debitum’s control, the company took swift action to restructure these loans. Currently, an external investor has been found to acquire claim rights, ensuring investors won’t have to wait until the end of the war to recover their funds.

How does Debitum manage potential conflicts of interest in the P2P lending model, particularly in loan selection and underwriting processes?

Debitum ensures transparency by fully disclosing all risks and potential conflicts of interest in its prospectuses. This allows investors to make informed decisions based on clear and comprehensive information.

Additionally, Debitum shareholders hold stakes in only one loan originator, which is also disclosed to all parties. This eliminates conflicting interests in the underwriting and loan selection processes. For the Sandbox Funding model, the setup is intentionally designed to test new potential loan originators through a controlled and transparent process before onboarding them as long-term partners. This ensures thorough vetting while maintaining integrity in loan selection.

Regulatory compliance

Let’s talk about the role of regulatory compliance in Debitum’s operations. This includes the importance of obtaining a license from the Financial and Capital Market Commission (FCMC), the impact of regulation on investor confidence, and how it sets Debitum apart in the European market.

Why was obtaining a regulatory license from the Financial and Capital Market Commission (FCMC) a priority for Debitum Investments, and in what ways has this enhanced investor confidence?

At Debitum Investments, we see regulation as the future of the P2P lending industry. Obtaining a license from the FCMC was a crucial step to ensure we meet the highest standards of transparency, security, and operational integrity.

While the license itself adds credibility, it’s the stringent requirements from the regulator that truly elevate investor confidence. Regular audits, robust AML procedures, and well-defined operational checks and balances ensure we operate responsibly.

Our investors benefit from tangible protections like the €20,000 deposit guarantee and segregated accounts, which provide an extra layer of safety. This structured oversight and commitment to transparency reinforce trust and align with our vision of sustainable growth.

How does operating as a regulated platform distinguish Debitum from other peer-to-peer lending platforms within the European market?

Operating as a regulated platform sets Debitum apart by prioritizing transparency and investor protection. All financial instruments offered are issued under a regulator-approved prospectus, ensuring comprehensive disclosure of borrower and asset information.

Regular audits provide additional confidence, verifying that investor funds in segregated accounts are never mixed with operational funds. Debitum’s owners have a flawless reputation and maintain sufficient capital reserves to ensure the platform’s sustainability — something not all platforms can guarantee.

Debitum focuses exclusively on established businesses rather than startups or high-risk ventures, further reducing investor exposure to unnecessary risks. These measures position Debitum as a trusted, stable, and secure investment platform within the European market.

Could you detail the key compliance measures Debitum implements under the Markets in Financial Instruments Directive II (MiFID II) to safeguard retail investors?

Debitum follows MiFID II standards to ensure strong investor protection. For starters, every investor undergoes a suitability and appropriateness assessment during onboarding. This ensures they understand the risks and complexities of their investments.

We also provide comprehensive reporting — detailed updates on transactions, portfolio changes, and other important data are shared with both regulators and investors. It’s a level of transparency that’s often missing on unregulated platforms.

We’re upfront about any potential conflicts of interest or transactions involving related parties. Full disclosure is key to maintaining trust.

Our policies ensure that investor orders are handled under the best market conditions, protecting against unfair practices, like misuse of the secondary market.

These measures collectively make Debitum a highly transparent and secure platform, standing out from non-regulated options.

What specific challenges did Debitum encounter during the regulatory transition, and how were these addressed?

The regulatory transition brought a few key challenges for Debitum, but we tackled them head-on.

One major area was AML compliance. We had to develop and implement a comprehensive AML policy, which meant investing heavily in processes and systems. To ensure everything was up to standard, we also brought in a specialized compliance team with regulator-approved expertise.

Another challenge was meeting capital adequacy requirements. This involved ensuring we had sufficient capital reserves, which required strategic financial planning and careful resource allocation.

It was a demanding process, but these steps were essential to align with regulatory expectations and strengthen the platform for long-term growth.

Can you explain the “Suitability and Appropriateness Assessment” and its role in enhancing the investment experience?

The Suitability and Appropriateness Assessment is a critical step to ensure investments match an investor’s knowledge and experience, offering multiple layers of protection.

First, investors complete a questionnaire that evaluates their financial knowledge and understanding of potential risks. If someone doesn’t have the required qualifications or experience, we issue clear risk warnings to make sure they’re fully informed.

For added protection, features like Auto Invest are restricted from accessing higher-risk assets for investors who don’t meet the necessary criteria. Additionally, every transaction is accompanied by a Key Information Document (KID), which provides a clear and concise summary of the associated risks.

This approach not only safeguards investors but also helps them make more confident, informed decisions while keeping everything aligned with regulatory requirements.

Growth in assets under management (AUM)

Let’s have a look at Debitum’s growth in assets under management, explore the major sectors and how Debitum manages to sustain the growth trajectory.

What strategic decisions have been most instrumental in contributing to Debitum’s threefold growth in AUM?

We believe that these decisions and offers affected Debitum’s growth:

- Higher Interest Rates: Competitive returns ranging from 10-15% p.a. have attracted a broader investor base, enhancing platform appeal.

- Shorter Maturities: Introducing assets with 3, 6, and 9-month terms alongside traditional 12+ month options has increased flexibility and catered to diverse investor preferences.

- Enhanced Marketing Efforts: Expanding the marketing team with seasoned professionals has amplified outreach and improved lead conversion rates.

- Zero Default Rate: Maintaining a 0% default rate has solidified trust and confidence among investors, making the platform a reliable choice for stable returns.

How does Debitum plan to sustain this growth trajectory, especially in the context of market volatility and economic fluctuations?

Debitum’s growth strategy is built on a foundation of careful procedures and disciplined practices.

We’re very selective about the loan originators (LOs) we onboard. Each one goes through a rigorous vetting process to ensure they’re high-quality and reliable. We also prioritize collateralized investments, reducing risk by focusing on loans backed by tangible assets.

Instead of expanding our list of LOs indiscriminately, we maintain a short, curated group of trusted partners. This allows us to closely monitor their performance and maintain strict quality control.

Our team of analysts actively tracks these LOs to ensure compliance with covenants. When issues arise, we address them early through open and proactive communication.

This disciplined approach enables us to sustain growth while safeguarding investor trust.

Which sectors, such as manufacturing or forestry, have attracted the highest investor interest, and what impact do they have on AUM?

The forestry industry has garnered significant investor interest on the Debitum platform. This sector is particularly appealing because it involves hard assets as collateral, such as forest lands and timber stock, providing a tangible layer of security for investments.

User base expansion post-acquisition

Let’s take a look at how Debitum’s user base has evolved following the company’s acquisition and what that means for its growth and development.

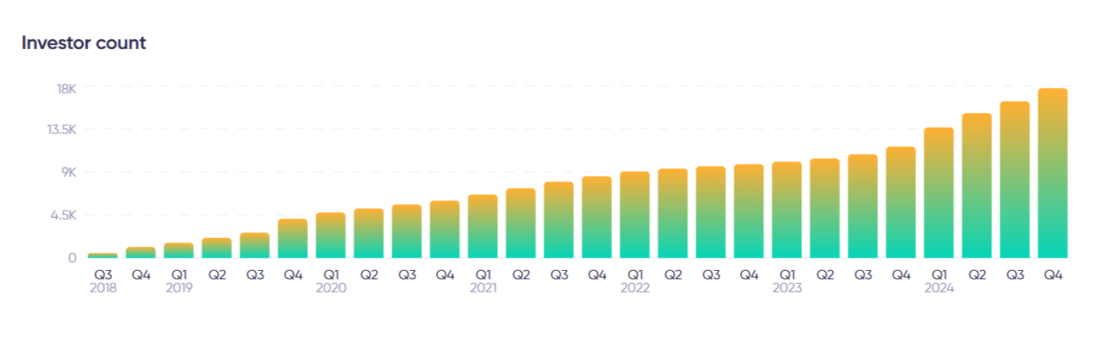

How has Debitum’s user base evolved since the acquisition by new owners, and could you share specific growth figures or trends?

Over the past 12 months, Debitum has more than doubled its Assets Under Management (AUM) and the number of active investors, showcasing the platform’s strong growth trajectory under the new ownership.

What initiatives or platform features introduced post-acquisition have been effective in attracting new investors?

Debitum has introduced several key features and improvements to attract new investors, including:

- The Auto-Invest feature for streamlined investing.

- Multiple payment options, such as card payments, Apple Pay, Google Pay, and Banklink payments.

- Enhanced Anti-Money Laundering (AML) procedures for added security.

- A revamped onboarding process to improve the user experience.

- Diversification of financial instruments, adding Bonds alongside the previously available ABS (Asset-Backed Securities).

What strategies does Debitum employ to ensure user retention and satisfaction amid rapid growth?

Debitum prioritizes user retention and satisfaction through active engagement with its investor community, fostering trust and communication.

We also provide highly accessible and responsive customer support to address user needs promptly and effectively.

Debitum’s future projections

Let’s discuss Debitum’s key goals and future plans, and how the P2P lending platform aims to grow in the coming years.

What are Debitum’s primary objectives for the next five years, particularly concerning regulatory compliance and technological advancements?

Debitum’s primary objectives for the next five years include:

- Expanding our product portfolio, with a focus on introducing a secondary market to provide more flexibility for investors.

- Enhancing transaction monitoring and Anti-Money Laundering (AML) measures to ensure the highest standards of compliance.

- Streamlining the onboarding process to make it faster and more user-friendly.

- Broadening our geographic reach by onboarding more loan originators (LOs) and attracting investors from new regions.

Final thoughts

We’re excited to have the chance to speak with Eriks Rengitis, CEO of Debitum Investments, and gain insights into the platform’s growth, challenges, opportunities, and offerings.

This interview provides a valuable opportunity for readers to explore the platform and gain an in-depth understanding of its operations, products, and services.

If you are interested in joining the Debitum Investments community, please visit their website at debitum.investments.

Also, if you are looking for similar P2P lending platforms in Europe and want to explore more offers from various service providers, check out our crowdfunding platform directory.