- Construction progress: Construction of the Ristla Stockoffice is advancing steadily. The foundation is completed and metal frameworks currently being established.

- Experienced developer: The project owner has over 8 000 m² of experience in implementing similar projects.

- Planned leasing agreements: The first rental agreements are planned to be signed by the end of 2024.

- Flexibility and profitability: The project is designed to remain profitable even if construction costs increase, ensuring positive cash flow. This flexibility enhances the project's financial resilience.

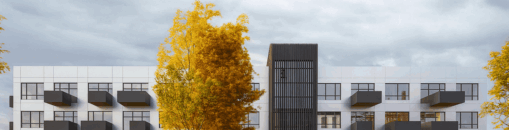

About the project:

The project owner is developing a commercial rental property called "Ristla Stockoffice". The project involves the development of a two-storey building for commercial activities with a total leasable area of 2 929.8 m², and business premises (including office space) ranging from 120 to 332 m². The target group for renting premises in the completed project is medium-sized manufacturing companies and/or investors. Estimated monthly rental income EUR 25 000. This loan will be refinanced with a long-term loan from another credit institution.

Project progress:

The project is progressing smoothly with the detailed plan, including the building permit, now in place. Essential groundwork has been completed, including communications infrastructure and asphalt roads. Construction officially commenced in July 2024, and the project is on track for timely completion. The funds raised in this phase will be used to continue further construction work.

Maximum planned project financing amount: EUR 1 500 000 (already raised EUR 260 000). Please note that the project, from the next stage, will be financed based on the LTC ratio. The LTC ratio (Loan-to-cost) indicates the ratio of the loan to the total project estimate. Project financing will be provided based on the submitted construction work acceptance acts, to the general contractor's account, not exceeding the maximum LTC of 70% and the maximum loan amount. A new property valuation will not be performed between financing stages, the decision to finance is made based on the approved Construction Supervisor's work acceptance act and proof of payment of the Client's equity.

Interest by investment amount:

– From 100 EUR to 249 EUR – 9.90%

– From 250 EUR to 749 EUR – 9.40%

– From 750 EUR to 4 999 EUR – 10.90%

– From 5 000 EUR to 14 999 EUR – 11.40%

– From 15 000 EUR – 11.90%

Important: investments made separately are not accumulated.

We plan to collect the target amount within 7 days with the possibility to extend it to 30 days if the target is not reached.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.