Ethical crowdfunding: how to support impactful startups

Creating homes, producing eco-friendly products, fighting with hunger, and COVID-19 -just to name a few of ethical crowdfunding shapes.

Investments for “good” are taking the world and the souls of socially conscious investors. The motto of Ethis, a dedicated provider of socially conscious opportunities is “Circulate Good”, i.e. make your money work to benefit the global humanity.

Want to know how to join the squad of ethical angels? Start with the basics.

The ABC of ethical investing

Ethical investing is very similar to socially conscious crowdfunding, however, there is a difference.

The portfolio of socially conscious investments is built according to predefined guidelines while ethical investments include the subjective opinion of the backer.

Is this investment aligned with my morale and understanding of the good?

Ethical backers strive to support those companies who meet their moral personal principles.

Key characteristics of ethical investments:

- They do not guarantee financial returns, in most cases, social investing takes the form of volunteer crowdfunding and philanthropic donations;

- There’s a common practice to avoid sin stocks of companies involved in alcohol and tobacco production, gambling, entertainment or weapons;

- A company complies with the best practices of ethical investing if its current and projected activity is based on general principles of ethics and morale;

- Ethic beliefs of backers may be based on the religious, political, and environmental pillars like Halal investing.

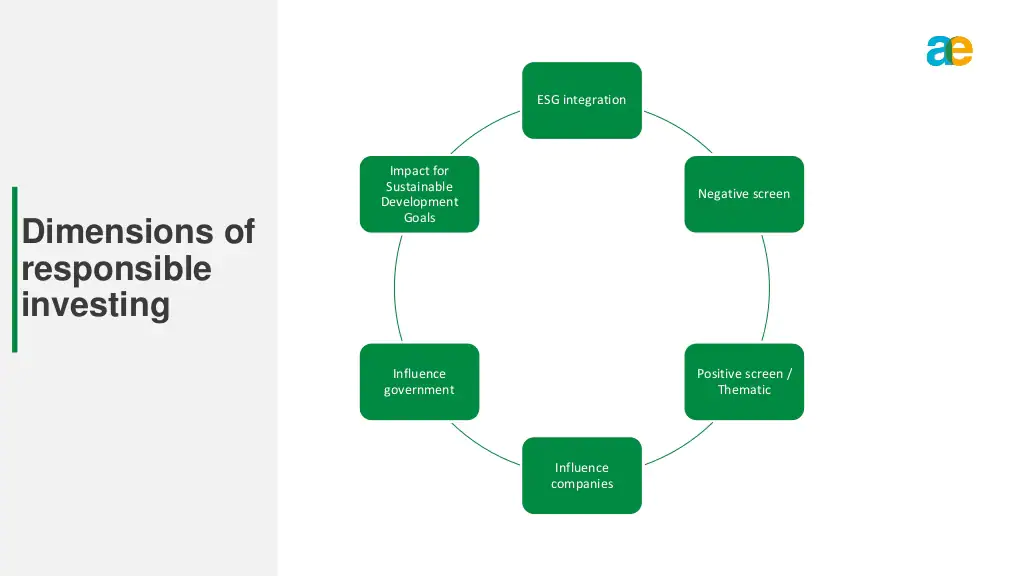

Types of ethical investments include Socially Responsible Investing Funds (SRI funds), Environmental, Social and Governance Funds (ESG Funds), Impact Funds, Faith-based Funds.

Crowdfunding for social good isn’t limited by green investments, it includes investing in women leaders, disability inclusion, supporting refugees, and investing against greenhouse gas emissions, deforestation, and fossil fuel producers.

Pros and cons of ethical investing

For investors, there’s a chance to contribute to global sustainable goals. The more backers will support ethical projects, the more boost impact investing will receive in the future.

Sometimes it’s hard to investigate the moral authority of the company fundraiser. The fees for socially conscious investing may be high due to this fact.

Given low/zero financial returns, crowdfunding for social deals/purposes may sometimes decrease the overall portfolio performance.

Top providers of socially conscious investment opportunities

Ellevest is a Fintech company founded by women to support women-led startups. Everyone can donate to solve females’ pay gaps, career breaks, and longer lifespans by the means of stocks, bonds, and alternative investment classes.

OpenInvest is a robo-advisor, a technological asset manager offering value-based ethical investing opportunities like cutting CO2 emissions and increasing the percentage of women in leadership.

EarthFolio is the first automated investing service dedicated to sustainable investing in projects promoting solutions for environment protection.

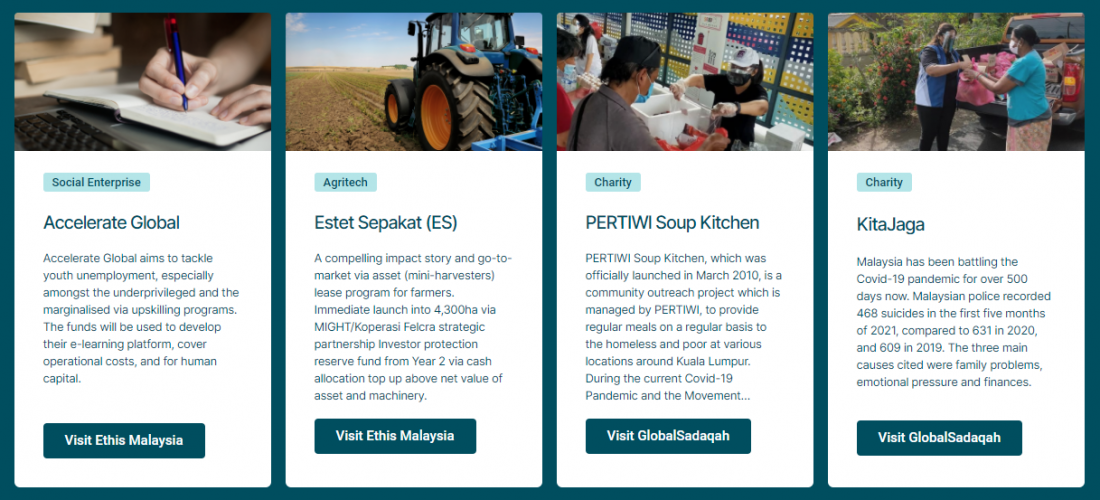

Ethis combines shariah-compliant crowdfunding and impact investing in a variety of sustainable projects on youth unemployment, lease programs for farmers, helping homeless, poor, and those suffering from COVID-19.

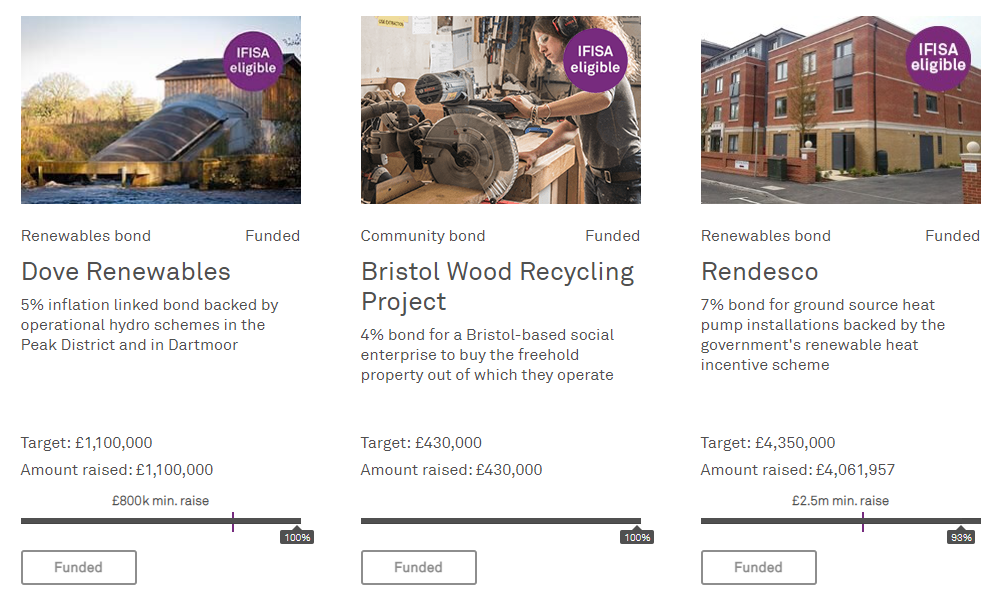

Triodos Bank, a global pioneer of sustainable banking, was the first to launch its crowdfunding platform helping enthusiasts all over the globe to build a strong and sustainable society. Offerings at Triodos Bank vary from sustainable baby items production to financing the relocation and redesign of local facilities.

Ethical considerations in crowdfunding: hot trends

This is Millennials who force the global shift to social capital. According to Australian Ethical Investment, 75% of Millennials prefer responsible investments rather than those delivering high financial returns.

Supporting women-led startups

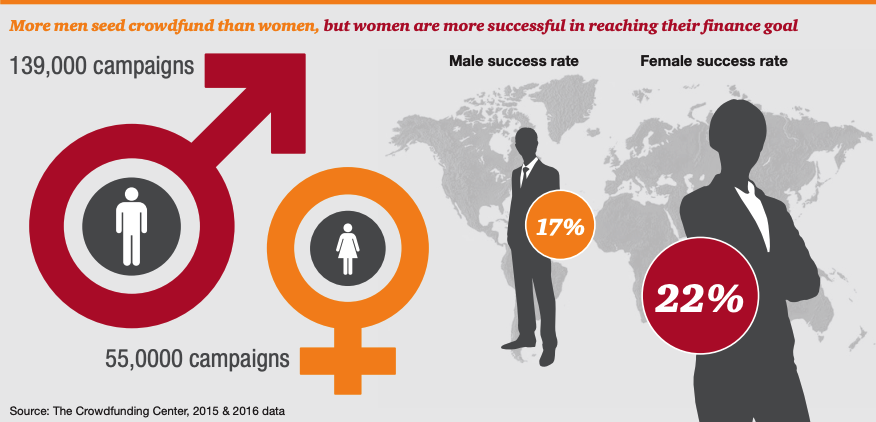

Traditionally, men-owned startups win over women-led campaigns due to the bias that women are also very conservative and show less potential for scaling up.

In addition, the majority of decision-makers are men who tend to support their male counterparts.

Actually, women outperform men when it comes to raising seed capital through the crowd as they create more appealing, emotionally-driven pitches.

A bit of stats:

- in the US 24% of women-led campaigns reached their goals, in the UK – 26%;

- it’s interesting, but the regions with emerging crowdfunding like Africa 11% of female-led campaigns hit the goal and outperformed 3% of male-led campaigns;

- In the E7 countries, 10% of women-led campaigns were more successful than 4% of campaigns created by men.

Crowdfunding is here to fill in the investment gap women-led startups experience due to common bias.

Fundraising for women-owned companies can contribute to national and global economic growth, sustainable development, and solve gender inequality in business.

Crowdfunding for social purposes under COVID-19

In its annual report on impact investing, Triodos Bank gives statistics on impact investments during the COVID-19 pandemic:

- Now the public awareness of impact investing among Britons is way higher than it was in previous years;

- The coronavirus has spurred over 22% of backers to turn to sustainable investing;

- 39% of Brits believe that investments in environmental projects can prevent the global society from future pandemics;

- The issue of investment transparency still remains: 11% of backers don’t have a clue where their donations come to;

- Climate change and the global pandemic are key drivers for the development of socially conscious investments.

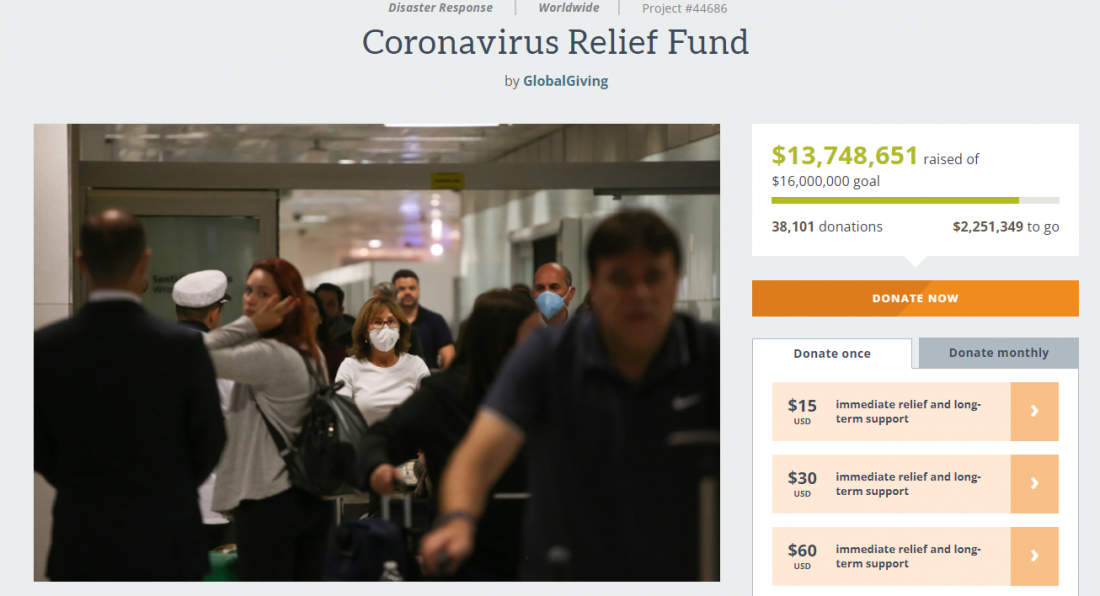

GoFundMe has launched the COVID-19 Relief Fund to help those impacted. A similar initiative was taken by GlobalGiving. Their relief fund has already raised $13m to make vaccines more accessible and affordable, equip communities with the necessary tools and medical stuff, deliver essentials to individuals and families in need, etc.

On CrowdFunder, you may become a supporter of the campaign aimed at helping CHRI fight modern slavery during COVID-19. Now more than ever vulnerable people suffer from working in inappropriate conditions and are cut off from medical aid, undergo violence.

Also read how to invest with the help of crowdfunding or P2P lending platforms in our article “How to invest in startups through crowdfunding platforms.”

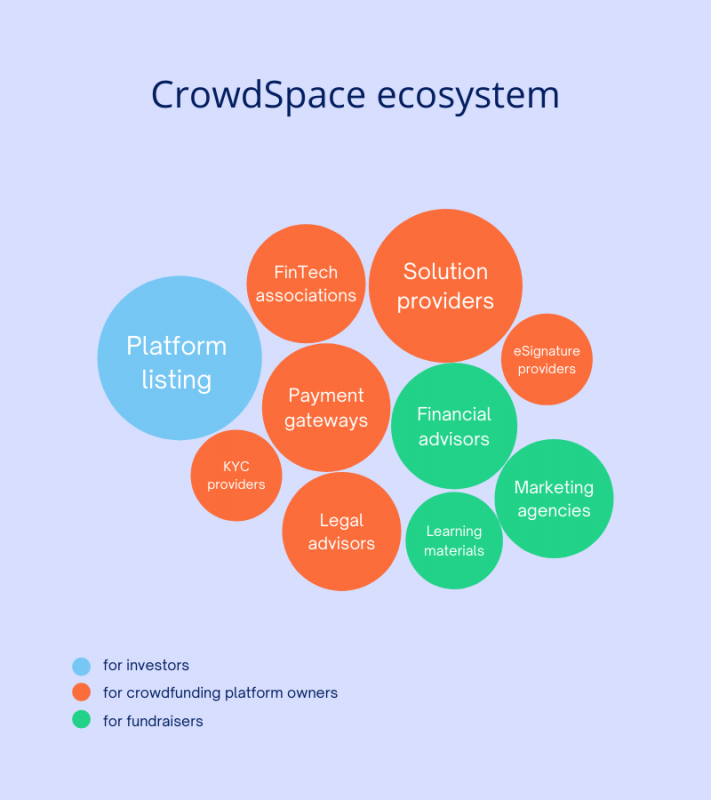

Start your ethical investment journey with CrowdSpace

CrowdSpace, a side project of JustCoded, is a global directory of investment-based and non-investment-based platforms.

Its goal is to help all parties find each other, educate fundraisers, borrowers, and platform owners, serve as a marketing channel for market players.

How to find your middleman in socially conscious investing?

Go to CrowdSpace and start the search. Configure filters: country, investment type, industry, years on market. Choose “Social impact” under the industry category and view the list of results.

Herein, we’ve gathered platforms creating a positive social impact for local associations, communities, and doing volunteer crowdfunding.

Among the vendors are Sparkasse, Energy4Impact, Betterplace, Babyloan and others.

On the platform pages, you may find the major details about each platform: features, interest rates, and similar platforms, which may be of much help for fundraisers and backers as well as business owners.

On a side note

Contributing to social capital is a standalone investment strategy that involves not only personal funds but also individual values ( moral, religious, political, environmental).

Today ethical investing is gaining momentum thanks to the active civil position of Millennials and those who are conscious about the destiny of humanity and individuals.

Ethical investing is about supporting projects that solve social, economic and cultural problems. Projects vary from green energy and eco-friendly products to business gender inequality, fight feminine and COVID-19 consequences.

With CrowdSpace, a directory of crowdfunding platforms, you can select your investment middleman and change the world for the better today.