Lendermarket 2.0: Journey to Becoming the Top P2P Lending Marketplace

In the dynamic world of peer-to-peer lending, Lendermarket has emerged as a significant player since its inception in 2019. Founded with the vision to bridge the gap between loan originators seeking funding and investors in search of high-yield opportunities, Lendermarket has steadily grown by offering innovative solutions and maintaining a user-centric approach.

In an interview with Crowdspace, Carles Federico, the CEO at Lendermarket, shared insights into their journey and how the platform developed over the years. Here’s a closer look at what makes Lendermarket a compelling choice for both investors and loan originators.

Company Background and Vision

Can you tell us about the founding story of Lendermarket and what inspired its creation?

Lendermarket was founded in 2019 with a vision to bridge the gap between loan originators seeking funding and investors looking for high-yield opportunities. The inspiration for its creation stemmed from the recognition of a significant market need for a platform that could facilitate seamless and transparent P2P lending. Our goal was to provide an innovative solution that offers loan originators an efficient way to fund their projects while giving investors access to attractive investment opportunities. We envisioned a marketplace that fosters trust, efficiency, and growth, benefiting all parties involved.

How has Lendermarket evolved since its inception? What have been some of the major milestones?

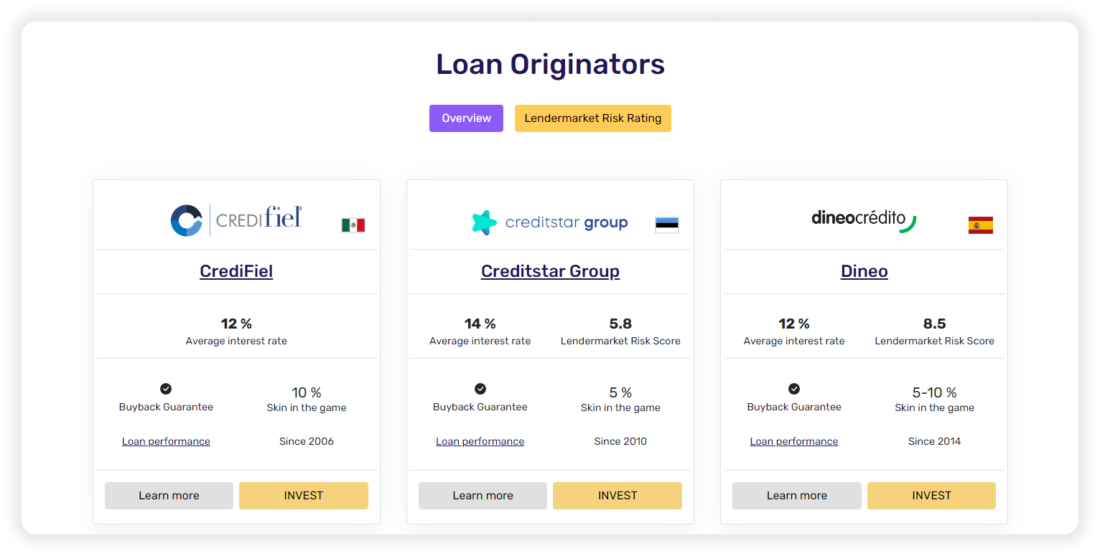

Lendermarket was launched in 2019, and we’ve achieved a lot since then. One of our most notable milestones was evolving into a marketplace at the beginning of 2022. Since then, we’ve welcomed several new loan originators who bring incredible value to our investors.

We are proud of the strong relationships we’ve built with our partners, which are integral to our success. Another recent milestone was the launch of the improved version of our platform, Lendermarket 2.0. The infrastructural changes introduced with this upgrade were designed to support our growing community and lay the foundation for a more robust and feature-rich platform in the future.

Product and Services

Lendermarket offers P2P loans for SMEs and personal loans. Can you explain the range of products you provide and their key features?

Lendermarket provides a diverse range of P2P loan products tailored to meet the needs of our investors. Recognizing the importance of diversification, we provide a wide range of consumer and business loans across Europe, LATAM, and Africa. We are continuously working to introduce new investment opportunities to our platform. Exciting developments on the horizon include new consumer loans in Bulgaria and additional countries in LATAM. Additionally, we are actively exploring opportunities in the Asian market.

How does Lendermarket ensure it stays competitive in a rapidly growing market?

At Lendermarket, we stay competitive by constantly innovating and keeping up with market trends. We invest in the latest technology to make sure our platform is user-friendly and efficient, we have recently launched the new version of our platform, which remains user-friendly and has the same features everyone loves, but improved. This also has given us the opportunity to aim for growth and be able to support all the new developments and features our investors would like to see in Lendermarket. Listening to our customers is a top priority, and their feedback helps us make smart improvements. Plus, we offer great returns to our investors, some of the highest in the market!

Technology and Innovation

How do you leverage data and analytics to improve the user experience on Lendermarket?

We like to use data and analytics to enhance our user experience in several ways. For example, we analyze our user’s behavior by tracking how they navigate our platform to identify and fix any challenges they face. We monitor the platform in real-time to quickly resolve technical issues. Additionally, we collect user feedback through surveys and customer support to guide our development and prioritize new features, as our main goal is to be the go to platform for our users.

Are there any upcoming technological advancements or features that Lendermarket plans to introduce?

Yes, we have several exciting technological advancements and features in the pipeline. As I have mentioned, we have just launched Lendermarket 2.0 which will allow us to develop new features to the platform, onboard new Loan Originators for a higher diversification and support the platform’s overall growth.

Risk Management and Security

How does Lendermarket ensure the security of transactions and data on its platform?

Lendermarket has taken a comprehensive approach to ensure the platform’s security of transactions and data. This is achieved by combining robust data encryption, managed user authentication, continuous monitoring, regular audits, and compliance with GDPR and PCI DSS regulations.

What measures are in place to mitigate the risks associated with P2P lending for investors?

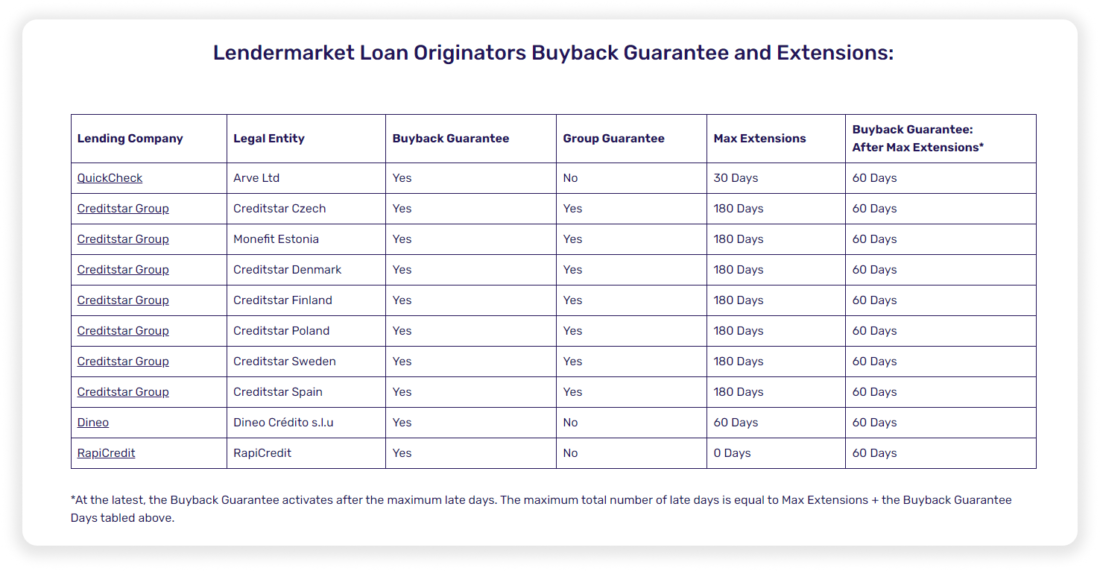

To mitigate the risks associated with P2P lending, Lendermarket implements comprehensive due diligence and credit assessment processes for all loan originators. We also diversify the investment opportunities available on our platform, allowing investors to spread their risk across multiple loans and sectors. Furthermore, we provide detailed information and risk ratings for each loan, enabling investors to make informed decisions, additionally, all of our investors are obligated to fulfill a questionnaire so that we can assess their investor profile and make sure they are investing responsibly. Our platform also includes a buyback guarantee feature on all loans, offering an additional layer of security for investors.

Market and Growth

How has the market for P2P lending evolved in recent years, and what trends are you observing?

The market for P2P lending has seen significant growth and evolution in recent years. There has been an increasing acceptance of alternative lending solutions, driven by the need for more flexible and accessible financing options. Key trends we are observing include a rise in demand for SME financing, increased investor interest in higher-yield opportunities, and a growing emphasis on regulatory compliance and security enhancing efficiency and transparency.

What are your strategies for growth and market expansion in the next five years?

Over the next five years, our growth strategy focuses on expanding our product offerings, enhancing our technological capabilities, and entering new markets. We plan to introduce new types of loans and investment products to cater to a broader audience.

Geographically, we are looking to expand our presence in key European markets and explore opportunities in other regions. Additionally, we will continue to build strategic partnerships and strengthen our marketing efforts to attract more investors and appealing loan originators.

User Experience and Feedback

Do you gather user feedback to improve the platform and services, and if so, what channels or methods do you use?

Yes, gathering user feedback is a crucial part of our continuous improvement process. We use various channels to collect feedback, including customer surveys and regular interaction with our customer support team. We also engage with our community through social media and online forums. This feedback is meticulously analyzed to identify areas for improvement and to guide the development of new features and services that align with our users’ needs.

Regulation and Compliance

How does Lendermarket navigate the regulatory landscape of P2P lending, and what challenges have you encountered?

Lendermarket is currently in the process of seeking regulatory approval. The platform ensures that all of our staff are provided with sufficient training to ensure they are fully aware of the firms Regulatory obligations and additionally our Compliance and Legal function works to support the Firm’s efforts to achieve excellence standards in these regards.

Investors care

What support and resources are available to new investors on Lendermarket?

Lendermarket is dedicated to supporting new investors by providing a range of resources and assistance. We offer comprehensive educational materials, including guides and webinars, to help investors understand the P2P lending process and make informed decisions and our customer support team is readily available to answer any questions and provide personalized assistance.

Additionally, our platform features detailed information and analytics on each loan, allowing investors to assess risks and opportunities effectively. We also ensure that our user interface is intuitive and user-friendly, making it easy for new investors to navigate and invest with confidence.

Bottom line

As Lendermarket continues to navigate the evolving P2P lending landscape, its commitment to innovation, security, and user satisfaction remains unwavering. With a clear strategy for growth and expansion, and a robust platform bolstered by technological advancements, Lendermarket is well-positioned to capitalize on emerging trends and opportunities.

By fostering trust and offering high returns, Lendermarket not only meets the needs of its current users but also attracts a broader audience.

The company’s dedication to continuous improvement and regulatory compliance underscores its role as a trusted and forward-thinking platform in the P2P lending market.