Maclear: empowering secure P2P investments in Switzerland

The financial landscape in crowd-investing keeps evolving, encouraging more P2P providers to enter the market. These positive dynamics boost competition, encouraging platforms to enhance their services and promise more lucrative returns to attract customers. Yet, only some crowdfunding providers can offer a bank-grade security level and its own risk assessment approach.

Maclear AG is a freshly launched crowdlending platform operating under Swiss regulations. It connects Swiss and EEA investors with EU-based companies engaged in manufacturing, retail and services, with demonstrated performance and looking for additional funding.

Foreword

Security and investor protection are the top priorities for the company’s leadership, and we had an opportunity to discuss it with Aleksandr Nikitin, CFO and Co-founder of Maclear AG.

In this extensive interview, we’ve discussed their rigorous focus on security and investor protection, client attraction approach, and the Swiss crowdfunding climate.

We are delighted to have you on CrowdSpace. How would you describe Maclear’s line of business, and what is the story behind the company?

Maclear connects Swiss and European crowd investors with Europe-based businesses seeking additional financing. We focus on real sector enterprises, providing trustworthy and secure customer journeys. As for prospective companies, we allow them to thrive with high service standards and maximum protection for all the parties involved.

In 2020 we bought the Maclear AG company from the previous owners. At that time, the company was developing complex GRC (governance, risk, and compliance) software solutions. We reprofiled it per our current profile representing unique software/IT products designed to include risk-assessment tools and scoring models. The platform is fully automated and flexible.

Basically, we restarted Maclear as a new venture, but more importantly, we staffed it with a highly skilled team.

Let me introduce the key members:

Denis Ustjev — Maclear’s CEO and one of the co-founders with multi-year experience in business consulting, capital investment and business loans management, the banking sector and various in-house senior management roles in multinational companies.

The second co-founder and CFO, Alexandr Nikitin, has experience in various foreign trade and industrial projects. The key responsibilities include project selection and careful risk assessment.

Our third director, Alexej Martin, is a professional lawyer capable of supporting our colleagues in banking and financial market law, including capital and licence requirements. Alexej is simultaneously holding a Relationship Manager position at MBaer Merchant Bank AG in Zürich and covers various important areas, including proper KYC, Due Diligence, Pre-Compliance checks and onboarding procedures for new clients.

Our Chief AML and Compliance Officer, Igor Bannikov. He ensures compliance with the industry standards, proper verification and full assessment of each borrowing project to be listed on the Platform. He approves Due Diligence reports and risk scoring prepared for each borrowing project.

Loan types and loan selection process at Maclear

What are the loan types available at Maclear, and what does the loan selection look like?

We organise loans for small- and medium-sized companies demonstrating sustainable business development.

First, all potential borrowers must complete our DD questionnaire and provide us with all the required and relevant documentation. Then, Maclear AG performs DD internally using external data sources to properly verify the UBO (Ultimate Beneficial Owner), the team behind the project, and their historical and financial background.

Next, Maclear performs a risk assessment and assigns a risk score to the potential borrowing projects. Based on the risk assessment and score, the platform discusses with the potential borrower the loan’s target amount, collaterals, and guarantees to be provided to secure the loan. Then, after IPAC (investment project acceptance and confirmation agreement) is finalised and signed by both the platform and borrowing project, it is listed on the platform for the fundraising campaign.

What countries are Maclear’s projects based in? Which market do you see as the most dynamic and promising?

We started with the projects that originated in Estonia, our home country.

We did this purposefully because we can personally assess and monitor them, permanently controlling their financial performance.

Later, we plan to expand our experience in neighbouring EU countries and onboard potential borrowing projects from Switzerland.

Currently, we select only performance-proven projects we can easily verify in Estonia: inquire about their reporting and financial data, visit physical production facilities, and meet with the teams.

This is the only way to guarantee the confidence and trust of our crowd investors. The Baltic states’ SMEs are very competitive and promising due to the lower labour costs.

What’s your impression of the Swiss crowd-investing market?

It is very dynamic and, at the same time, rather conservative.

Switzerland has a well-developed and sophisticated financial market, providing access to diverse investors, including high-net-worth individuals, institutional investors, and family offices. Crowd-lending platforms operating in Switzerland can tap into this investor base to attract capital for lending purposes.

Swiss financial markets regulations prioritise investor protection, requiring crowdlending platforms to implement measures to safeguard the interests of investors. This includes disclosure requirements, due diligence processes, and risk management practices to minimise potential risks.

Switzerland has a longstanding reputation as a global financial hub known for its reliability, stability, and adherence to high regulatory standards. Operating within Swiss jurisdiction can enhance the credibility and trustworthiness of a crowdlending platform, attracting investors and borrowers.

Security and investor protection at Maclear

Does Maclear offer buy-back guarantees?

We don’t have the buy-back guarantee option, but we have another efficient tool, the provision fund. It is funded by 2%, coming from all successfully funded projects, which is deducted from the platform’s commission.

The provision fund provides additional security for our investors when borrowing projects may experience temporary repayment difficulties.

What are the security measures Maclear uses to protect its investors?

We are a new player in this field, and it is crucial for us to gain the trust of our potential investors’ audience. This is definitely a question of our survivability.

This is why we implemented a careful risk assessment methodology and scoring system into our platform. The qualified and experienced in-house personnel, including risk managers, our AML and compliance officers, are in charge.

They are regularly trained and certified according to the Swiss requirements to ensure high standards in the industry.

What’s the biggest challenge of working in the P2P sector as a provider?

In our opinion, the biggest challenge is to gain long-lasting trust and confidence from both counterparties – crowd-investors and borrowing projects. We attract investors to our platform by providing our customers with solid, transparent and reliable services.

Is Maclear a licensed crowd-investing platform?

We are a Swiss company regulated by Swiss financial regulation and Swiss legislation. The essence of the regulatory framework is very similar to the EU normative.

As a member of PolyReg SRO, we are regulated and monitored by Swiss Financial Authorities and can act as a financial intermediary of the non-banking sector in Switzerland. It equals the European Crowdfunding Service Provider License but with some specific limitations imposed by Swiss regulation. Our compliance concept and internal client’s policy describe these limitations.

They include a 1 million threshold and 60 days limitation for the investors’ funds to be held in Maclear’s bank accounts at any time.

We plan to open a subsidiary company for Maclear to be established in the EU during the next year. It is going to take some time and effort because at the moment we are fully concentrated on our Swiss company development.

Competitive advantage and future plans for Maclear

What makes Maclear stand out from the competitors?

Maclear AG is registered and regulated in Switzerland, known for its strong and stable financial system. It offers several advantages for crowdlending platforms regulated by a Self-Regulatory Organization (SRO) as a financial intermediary of the non-banking sector.

Crowdlending platforms regulated by SROs are subject to specific rules and regulations, ensuring investor protection and transparency. Maclear AG has successfully passed the examination and external audit performed by Grant Thornton, ensuring its ability to serve as a CH-based financial intermediary of the non-banking sector.

What also sets Maclear AG apart is its focus on real sector businesses such as production/fabrication, retail sector, and various services in demand, which focus on sustainable performance capable of generating stable revenues.

What’s coming up next for Maclear?

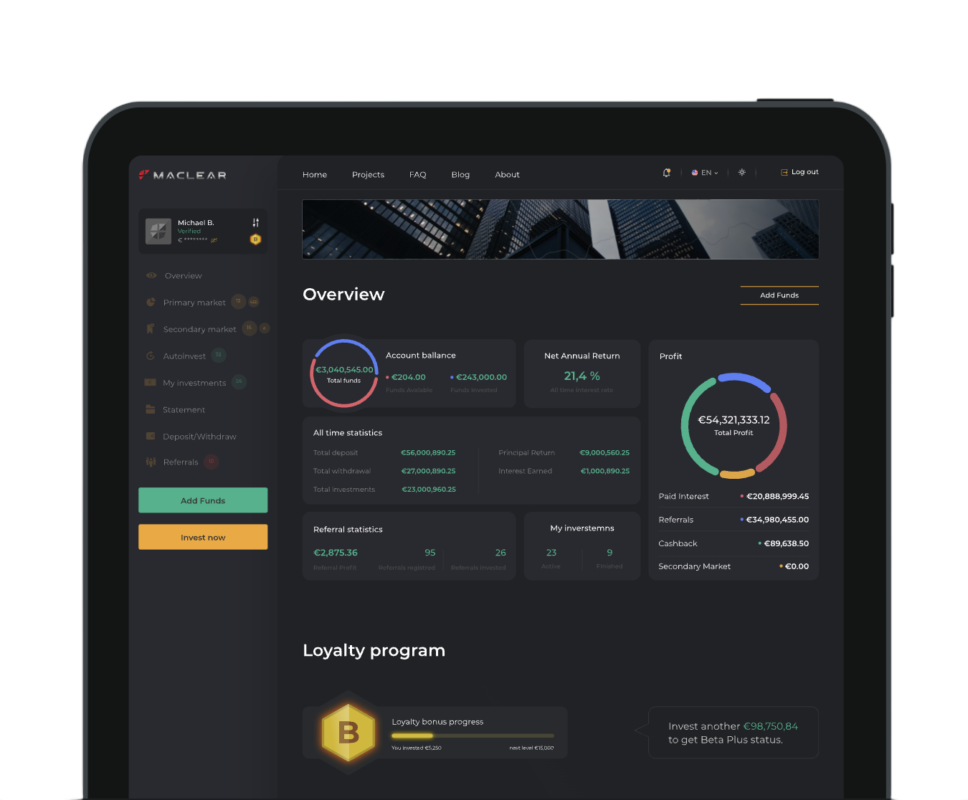

We plan to implement a secondary market option for our investors to provide more flexibility and ensure claims liquidity. On top of it, we plan to introduce an auto-invest function. The mobile application is also in our pipeline. As mentioned, our plans also include opening a subsidiary company within the EU jurisdiction.

And finally, our ambitious plan is to target a fintech licence from the Swiss Financial Market Supervisory Authority FINMA.

It would enable us to become a neo-bank and a payment services provider, so we will be capable of processing clients’ funds ourselves instead of using third parties as payment service providers.

Tips for choosing reliable P2P loans and providers

Our advice is very obvious and simple: before considering investing through some online platform, it’s essential to investigate as closely as possible the chosen platform for investment purposes.

Special attention should be paid to its regulation and licensing, the owners and the team standing behind (including their professional background), operational legal and contractual base, reflected in model contracts and internal policies.

The investor should clearly understand the structure, how the loan is organised and the platform’s role. We strongly suggest paying precise attention to the risk assessment and mitigation, how this block is realised on a certain platform, and how deep in detail each potential borrowing project is assessed.

Also, remember a very simple rule: the higher the yields, the higher the risks. The task is to find a comfortable balance between them. Another key point is diversification: invest small amounts and diversify geographically and across industry sectors.

How do you envision the future for the P2P sector?

Crowd-lending/crowd-financing will become a more common financial instrument for small- and medium-sized businesses. This also goes for startups currently experiencing a lack of access to traditional banking financing due to complex reasons.

Stricter regulation will dramatically increase the set of requirements and level of qualification for participating players, but at the same time, will bring more confidence to the investor’s community.

We also assume that investors can hardly expect yield growth. Because soon, this segment will become highly competitive when all well-established institutional investors try to get their portion of the market.

Security measures should be improved in the industry, prioritising investors’ protection and awareness of potential risks. But in general, we clearly see the new era of alternative financing opportunities realised through crowdlending tools. We would call this “decentralised financing”, where the role of traditional banking will decrease seriously.

We look forward to Maclear’s ambitious plans coming to life and reshaping the P2P lending landscape towards a more secure and transparent ecosystem!