- UAB Idile Estate Services group of companies has extensive experience in real estate. The funds for Phase IV will be used to extend the maturity of the existing loan;

- The mortgaged property is located in the very centre of Kaunas, in Laisves avenue;

- The owner of the project has already invested EUR 226 000 of his own money and provides a personal guarantee;

About the project owner:

The project owner has developed different property projects („Balsiu idile", „Loftai Vytenio g. 54", „Loftai Sevcenkos 16A“, „Loftai Vytenio g. 14“).

About the project:

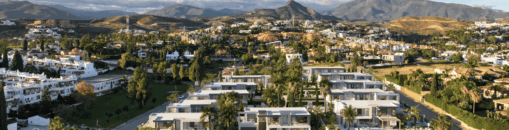

The owner of the project has analysed the hotel market in Kaunas and noticed that there is a lack of attractive places to stay in Kaunas. Currently there are only a few well-known brands in Kaunas, such as Park Inn, Ibis or Best Western, and no new market trends have emerged in the last five years. Therefore, it was decided to establish a new hotel in Kaunas.

Project objective:

The owner of the project is developing a new hotel in a prestigious part of Kaunas city. The hotel is a new development of a new hotel in a new location in a prime location of the city. The hotel is scheduled to start operations in August this year. According to the Centre of Registers, the hotel's registered completion rate is 100% and the actual completion rate is 80%. The developer will refinance with a bank or credit union within two years. The estimated annual rental income for all rooms is EUR 306 432. Interest to the investors will be paid by the shareholder loan and 7% by Invega UAB until the hotel is operational, and thereafter by the hotel's operating revenues.

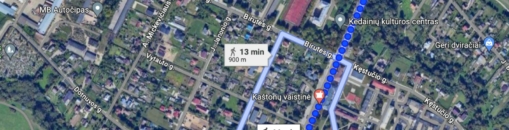

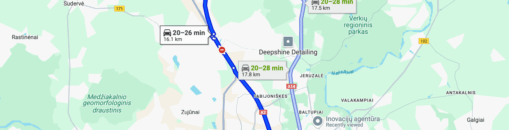

The hotel is located in a prestigious place of Kaunas - Laisves Avenue. As soon as you walk through the hotel's doors, you can see the heart of Kaunas, surrounded by cultural heritage buildings that house famous brand shops, cafes and other restaurants of various types. In terms of transport links, the hotel is in a very attractive location with several public transport stops nearby. A particular advantage is that a large part of the hotel's rooms have windows overlooking Laisves Avenue, so future guests can enjoy their morning coffee with a great view.

Kaunas hotel market has been experiencing very high occupancy rates (55-78%) for several years, which indicates a lack of hotel supply. The occupancy rates in Kaunas remain among the highest in the hotel market as of 2018, and only one larger 175-room „Moxy" hotel has been built in Kaunas in the last few years. The city continues to invest in attraction centres and develop international business centres.

Project progress:

The project owner will use the funds to refinance the existing loan and for working capital. The developer has signed an agreement with PROFITUS for a three-year project financing, refinancing the existing loan every year. The refinancing of the project has been foreseen and taken into account in the company's cash flow planning. The developer has already invested EUR 226 000 of its own funds in the project. With the funds mobilised in the last stages, the developer has installed the waste water and water supply systems. It has installed façade lighting and carried out roof reconstruction works. It has also paid for the works carried out in the previous phases and ordered new materials for the hotel rooms.

The maximum planned amount of financing for the Project: EUR 1 100 000 (EUR 511 000 existing active portfolio). The project is financed according to the current valuation of the mortgaged property until it reaches the set maximum LTV of 75%. Once the maximum LTV has been reached, a new valuation of the property will be carried out and further rounds of financing for the Project will only be advertised and collected if the maximum LTV is not exceeded. The loan-to-value (LTV) ratio without VAT at this stage is 49%.

Interest by investment amount:

– From EUR 100 to EUR 499 – 10.9%

– From EUR 500 to EUR 4 999 – 11.5%

– From EUR 5 000 to EUR 9 999 – 12%

– From EUR 10 000 to EUR 49 999 – 12.5%

– From EUR 50 000 – 13%

Important: Individual investments are not aggregated and cannot be combined.

We plan to raise the amount within 7 days, with the possibility of extending it to 21 days in the event of non-collection.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.