We present the second stage of the phased financing project "Sklypas Mozuriskiu g.". The project is being developed by one of the largest real estate development companies in Lithuania - "Citus". Most of the loan are given to the project owner (EUR 326 500) will be allocated to the refinancing of loans available to the project owner, the remaining amount of the loan will be allocated to the development of real estate. The amount to be raised at the second stage is EUR 150 000.

About the project:

In the part of the land plot belonging to the project owner, it is planned to build modern "stock-office" type commercial warehouses. This is a multi-purpose commercial project concept - three in one: commercial and administrative premises and a warehouse in one place. Projects of this type are rapidly becoming popular both in Western countries and in Lithuania. The "stock office" building is intended for companies that provide retail or wholesale trade services, service, storage, and at the same time have employees in the administration, who need office space.

About the owner of the project:

UAB "Citus Commercial" is a part of "Citus" group which has developed various real estate projects of 130 000 square meters in Vilnius and Kaunas

To secure the interests of investors, real estate is pledged with a primary mortgage:

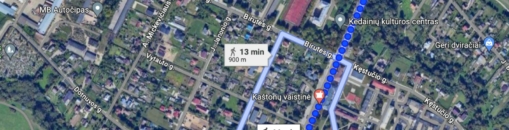

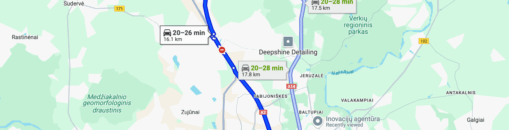

To protect the interests of investors, part of the land plot 10801/16617 is pledged, at the Mozuriskiu st. 55, Vilnius. The area of the pledged land is 1.0801 hectares. According to an independent real estate appraiser, the value of the property pledged to investors is EUR 866 000. In addition to this loan, the company UAB "Vanagas Asset Management" provides a surety.

Maximum planned amount of funding for the project: EUR 433 000. The project is funded based on the current mortgage valuation until it reaches the maximum LTV set. When maximum LTV is reached, a new valuation of the property will be required and further project funding stages will be announced and collected only if the maximum LTV set is not exceeded.

In order to operate transparently and honestly, we would like to inform you that "Citus Commercial" is one of the members of the Citus group of companies, whose shareholders are also the shareholders of UAB Sutelktinio financing platform Profitus. We draw your attention to the fact that the project developer is directly related to UAB Sutelktinio financing platform Profitus. We confirm that the financing of the project is carried out in accordance with the principles of transparency, impartiality, openness and equality.

Interest by investment amount:

- From EUR 100 to EUR 499 - 8%

- From EUR 500 to EUR 999 - 8,5%

- From EUR 1 000 to EUR 4 999 - 9%

- From EUR 5 000 to EUR 9 999 - 9,5%

- From EUR 10 000 - 10%

Important: investments made separately are not aggregated.

We plan to collect the accumulated amount within 7 days with the possibility to extend it to 21 days without raising funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.