- The project started development in April 2023 and is on schedule. The funds raised in this phase will be used to pay off the investors of the second phase and project development;

- The Group's activity is real estate construction, established in the market since 1997. The project owner is a professional in his field, having completed 7 real estate projects, including 2 reconstructions;

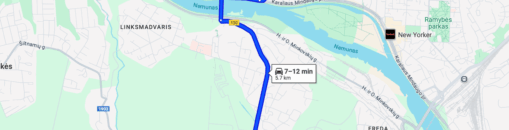

- The service premises under development in Kaunas have a very convenient location - J. Basanaviciaus al. Nearby surroundings - new residential and commercial buildings;

- This loan will be covered by the sales proceeds of the project in Vytėnai, which are expected to amount to EUR 2 235 372 excluding VAT.

About the project owner:

The project owner has experience in real estate development. The owner has experience in construction projects with a total area of 6 400 sq. m and has completed 7 different construction projects. The developer has financed 9 projects on the Profitus platform ("Elniu namas Viciunuose", "Paslaugu patalpos Basanaviciaus al.“, "Butas Vaidoto G192E–2“, "LOFT206”, "Savanoriu loftai”, "LOFT206B Savanoriuose”, "Loftai Savanoriuose”, "Savanoriu 206B”, "Basanaviciaus patalpos"). Interest is paid on time to investors. It has already repaid part of the funds in the projects "LOFT206" and "Basanaviciaus patalpos" and has repaid all the funds in the projects "Butas Sodu G66–33" and "Butas Vaidoto G192A–2“.

About the project:

The owner of the project is developing 453.14 sq. m of service premises in Kaunas. Currently, the building has already been modified, the slab, the ceiling raised, demolition works carried out, new spacious premises formed, new windows, doors, concrete floors, some of the premises have been painted, electricity has been installed and the facade has been insulated from the outside. A tenant(s) is (are) currently being sought for the premises and then, according to his/her needs, the fitting out will be carried out, i.e. electrical installation, heating, finishing of the interior finishing, partitioning. The expected rental income per month will be EUR 4 000 including VAT. The loan will be covered by the proceeds of the sale of the next property project and the interest will be paid to the investors out of the project owner's operating income.

The maximum financed amount: EUR 350 000 (EUR 297 600 already raised). The project is financed on the basis of the current valuation of the collateral until it reaches the established maximum loan-to-value ratio of 85% LTV. Once the maximum LTV has been reached, a new valuation of the property will have to be carried out and further rounds of financing for the Project will only be advertised and collected if the set maximum LTV is not exceeded. The project has a 12-month term, or until the end of the loan agreement, which is scheduled for 26 April 2025.

Interest by investment amount:

– From EUR 100 to EUR 349 – 11.50%

– From EUR 350 to EUR 699 – 12.0%

– From EUR 700 to EUR 2 999 – 12.50%

– From EUR 3 000 to EUR 7 499 – 13.0%

– From EUR 7 500 – 13.50%

Important: investments made separately are not aggregated and cannot be pooled.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.