We present the new phase of the phased financing of the project – „P00001060-5". The funds raised will be used for the expansion of the tunnel car wash. The amount to be raised in this phase is EUR 225 000.

About the project owner:

The project owner's group of companies has the status of a reliable developer, has been operating for more than 13 years and is well known in the Lithuanian market. Its subsidiaries have developed more than 20 mixed use real estate projects with a total area of 20 000 square metres. In the last 4 years, in cooperation with the „PRO BRO", they have completed or are currently implementing 12 built-to-suit tunnel car wash projects and are building the „PRO BRO" headquarters.

About the project:

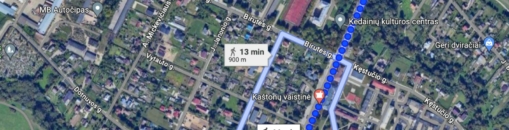

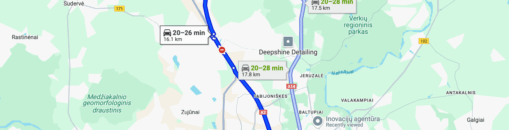

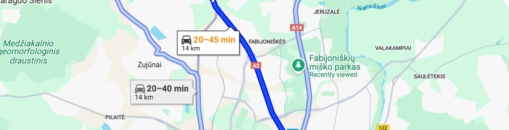

PRO BRO, a long-time leader in car cleaning services in Lithuania's major cities, is expanding its network abroad: in Riga (100 Mūkusalas Street), it is going to set up a MAXI tunnel car wash, which will serve up to 220 cars per hour, with entrances on both sides.

The aim of the project:

The project owner intends to develop a ProBro Maxi tunnel washing plant on part of the land (36 acres). It will be built to 100% completion and leased for 36 months, after which the shares in the company building the car wash will be sold. The construction works are planned to be completed by 2024 Q3. The sale price of the tunnel car wash is EUR 5 500 000.

Progress of the project:

Currently there is a 50-year non-cancellable lease agreement with PRO BRO Operations LV SIA and a 7-year lease guarantee with Svaros broliai UAB. Also, KNVP LV3 SIA has signed a preliminary sale of the company's shares with Plovyklos LT, 36 months after the start of the operation of the tunnel washing plant.

For pooling funds SIA KNVP LV 3 refinanced EUR 760 000 of the EUR 800 000 loan granted to SIA Payray. The remainder of the loan was repaid by the client itself. The amount mobilised by the platform is always verifiable as the client has to pay the contractor's invoices by the 15th of the following month. Also, once the development loan amount of EUR 864 000 has been reached, a construction inspection will be carried out in order to determine the quality of the work carried out and to oblige the correction of any defects in the work, should they occur. The lease agreement is currently signed and will be indexed annually to the Latvian CPI (inflation). There is no ceiling for indexation. The agreement shall enter into force after the handover of the premises to the tenant.

Please note that the project will be financed in subsequent phases on the basis of the LTC indicator. The LTC ratio (Loan-to-cost) refers to the ratio between the loan and the total project cost. According to an estimate provided by Colliers, an independent real estate valuer, the total cost of the project, including the acquisition cost of the land, is EUR 5 206 000. The project will be financed on the basis of the submitted deeds of completion, within the maximum LTC of 64% and the maximum loan amount. No new asset valuation will be carried out between funding rounds, and the funding decision will be based on the invoices and the fact that the work has been done.

After construction works, client is planning to refinance the loan in platform. In 2025 Q3 client ir planning to repay the loan, refinancing the property in bank.

Interest by investment amount:

– From EUR 100 to EUR 499 – 8.6%

– From EUR 500 to EUR 999 – 9.1%

– From EUR 1 000 to EUR 1 999 – 9.4%

– From EUR 2 000 to EUR 7 499 – 9.6%

– From EUR 7 500 to EUR 14 999 – 10.1%

– From EUR 15 000 – 10.6%

Important: investments made separately are not aggregated and cannot be pooled.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.