We introduce a new project – "Namai Zubiskiu g. IV", the funds of which will be used to refinance an existing loan. The amount to be raised is EUR 72 600.

The aim of the project:

The project owner will use the raised amount to refinance an existing loan. This loan will be repaid from the proceeds of the sale of the real estate. The houses are already reserved, so this decision will give the project owner time to arrange the documentation for handing over the houses and prepare for a notarial transaction.

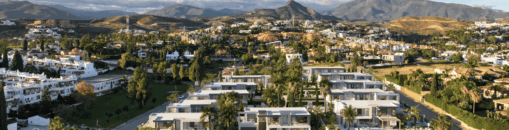

The "BALTAI" quarter is a unique residential quarter. Much attention is paid to architectural elements that tastefully use Baltic symbols. Modern architecture has been chosen due to rational construction solutions and possibilities to expand the possibilities of the house by installing terraces on the roofs, adapting the roofs for cars to garages. Technologies implemented in construction and living environments are compatible with ecology, allow efficient use of energy resources and protect nature.

To secure the interests of investors, real estate is pledged with a primary mortgage:

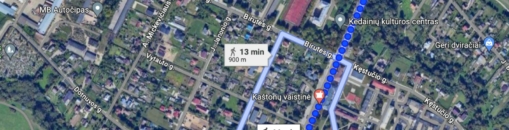

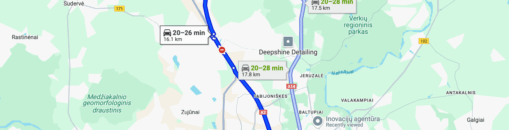

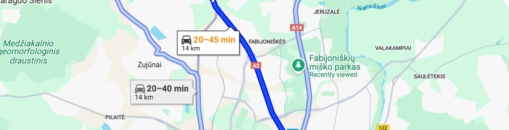

To secure the interests of investors, 5 plots of land are mortgaged with 20 buildings (farm purposes) on them, which actually consist of 7 houses. The purpose of the farm buildings will be changed to residential use in the near future. According to an independent real estate appraiser, the value of the mortgaged property is EUR 703 000.

The maximum planned amount of project financing: EUR 420 000. The project is financed according to the current valuation of the mortgaged property until it reaches the set maximum LTV. Once the maximum LTV is reached, a new valuation of the property will have to be performed and further stages of the Project financing will be announced and collected only if the set maximum LTV of 60% is not exceeded. LTV at this stage - 49%.

Interest by investment amount:

- From EUR 100 to EUR 499 – 12%

- From EUR 500 to EUR 4 999 – 12,5%

- From EUR 5 000 – 13%

Important: investments made separately are not aggregated.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.