We introduce a new project "Misko ardai". A new construction apartment project is being developed in Vilnius, Bukiskiu street. Funds from this phase will be used to continue construction work. The project is being managed by one of the largest real estate development companies in Lithuania - "Citus". The amount to be raised is EUR 200 000.

About the project:

This is the third and final construction phase of the "Misko ardai" project. Thoughtful and effective technical solutions are implemented in the project: A+ energy efficiency, gas (underfloor) heating, recuperation, large 8 square meter balconies, video surveillance cameras, alarm system, fenced area, parking lot under the house. There is a 1-hectare private park in the inner yard of the forest ards, with 14 recreation and active leisure areas planned here.

This phase of the project consists of 62 apartments, 2 identical four-story apartment buildings with attics. The apartments will have 2-4 rooms, the areas of which will vary from 51 to 95 square meters. There will also be 103 parking spaces and 10 storerooms/bicycle storages. The average selling price of an apartment is EUR 3 300 per square meter, and the total planned sales income of the project is just over 12 million euros. Currently, the property is reserved for 1.64 million euros.

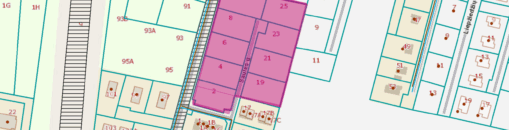

To secure the interests of investors, real estate is pledged with a primary mortgage:

To protect the interests of investors, a part of the land plot and the building - a multi-apartment residential building are pledged, at Burbiskiu st. 6, Vilnius. According to an independent real estate appraiser, the value of real estate pledged to investors is EUR 1 170 070.

Maximum planned amount of funding for the project: EUR 5 000 000. The project is funded based on the current mortgage valuation until it reaches the maximum LTV set. When maximum LTV is reached, a new valuation of the property will be required and further project funding stages will be announced and collected only if the maximum LTV set is not exceeded. LTV at this stage - 35%.

In order to act transparently and honestly, we would like to inform you that for informed investors, one of the beneficiaries of UAB investment company “Celijus” is also one of the beneficiaries of UAB Sutelktinio finansavimo plaforma Profitus. We draw your attention to the fact that the project developer is directly related to UAB Sutelktinio financing platform Profitus. We confirm that the financing of the project is carried out in accordance with the principles of transparency, impartiality, openness and equality.

Interest by investment amount:

- From 100 EUR to 999 EUR – 7%

- From 1 000 EUR to 2 499 EUR – 7.5%

- From 2 500 EUR to 4 999 EUR – 8%

- From 5 000 EUR to 19 999 EUR – 8.5%

- From 20 000 EUR – 9%

Important: investments made separately are not aggregated.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.