- The project owner will use the pooled funds to refinance an existing loan;

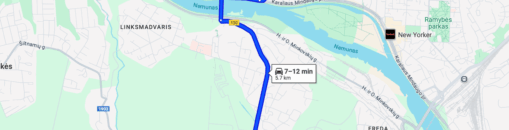

- The development is located in a relatively active part of the island of Tenerife and the mortgaged property is located in Lithuania;

- The owner of the project has extensive experience in the real estate sector and has developed approximately 8 000 square metres of residential projects;

- The developer has already repaid part of the loan from its own funds.

About the project owner:

The project owner has experience in the residential segment. Since 2005, the property owner has been active in the real estate market. He has developed a block of 20 detached houses in Pilaite and a block of 30 townhouses in Pusje street. More about the project owner can be found here.

About the project:

The owner of the project has acquired and adapted apartments for short-term rentals located near Tenerife, in the Los Cristianos region. The apartments are close to the sea and some of the rooms have excellent sea views. A total of 19 apartments will be built at an average price of around EUR 120 per night and the developer expects 70% occupancy in all seasons, resulting in a monthly income of EUR 27 720. 7 of the 8 apartments on the ground floor have already been rented out and have made a profit of around EUR 6 000 in the winter season. The rest are being renovated and prepared for rental.

Project progress:

Repair and installation works are continuing with the funds mobilised in the last phases, and the technical design of the plots has been obtained.

The maximum financed amount: EUR 1 600 000 (EUR 800 000 mobilised, of which EUR 350 000 have been repaid, with an existing active portfolio of EUR 450 000). The project is financed according to the current valuation of the mortgaged property until it reaches the set maximum LTV of 70%. Once the maximum LTV is reached, a new valuation of the property will have to be carried out, and the further stages of financing the project will be announced and collected only if the set maximum LTV is not exceeded. The loan-to-value ratio (LTV) with VAT at this stage is 30%.

Interest by investment amount:

– From EUR 100 to EUR 749 – 7.75%

– From EUR 750 to EUR 1 999 – 8%

– From EUR 2 000 to EUR 7 499 – 8.25%

– From EUR 7 500 – 9%

Important: investments made separately are not aggregated and cannot be pooled.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.