Phase V of the project “Gintaro slenis”, a loan for real estate development. The company is developing a residential project in the Klaipeda district. Funds for this phase will be used to complete construction work.

During the previous stage, the construction works are was being completed in the houses of the project. Certain construction work was completed - underfloor heating inside the house, poured floors, plastered walls, electricity, closet. Construction works are being completed in the house - the facades are almost completed, the roof will be covered, which will provide 80% completion. Lazdyneliu st. 5 folded windows. The project itself will soon begin to lay new foundations. In total, sales contracts have been signed for 3 of the 4 houses built in the project, of which 2 houses have already been settled with investors. The sale of another house is planned for several months.

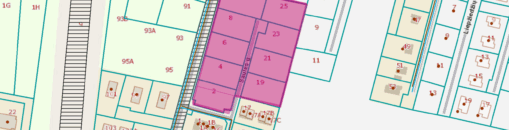

To protect the interests of investors plots of land and four residential houses under construction and registered on these plots are pledged. The total area of land plots 5,7583 ha, Lazdyneliu str., Baukstininku village, Klaipeda district. According to an independent real estate appraiser "Inreal" the value of the real estate pledged is EUR 439 050.

"Gintaro slenis" is a new construction project located just a few kilometres from Klaipeda city centre. It is an A + energy class, a modern design project focused on ecological solutions and an open settlement. The project is being developed with full infrastructure: convenient transportation, tidy well-being, parking lot. 74 residential houses (73.11 sq.m, 79.47 sq.m and 90.87 sq.m) are being developed, with partial finishing 85% or fully equipped. The house owns a plot of about 5 acres.

The developer has invested 320 thousand in this project. own funds. The planned sale price of one house starts from 88 thousand. euros. The planned profit of the whole project is more than 1,5 million euros.

The maximum amount to finance - EUR 1 042 200. The project is financed according to the current valuation of the mortgaged property until it reaches the set maximum LTV. Once the maximum LTV is reached, a new valuation of the property will have to be performed and further stages of the Project financing will be announced and collected only if the set maximum LTV of 60% is not exceeded. LTV at this stage - 43%.

Interest by investment amount:

- From EUR 100 to EUR 999 - 7%

- From EUR 1000 - 8%

Important: investments made separately are not aggregated.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.