We present the tenth phase of a phased financing project "Faustinos namai". The raised funds will be used for the further development of the reale estate project. The amount to be raised at this stage is EUR 45 500.

The aim of the project:

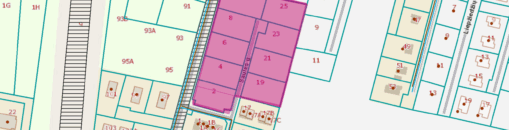

The owner of the project is developing the 15-apartment closed project "Faustina's House". In the first phase of construction, 3 semi-detached houses and 1 single-family house are being built. On the Profitus platform, the project owner finances the first stage of construction by pledging 4 plots of land with building permits where the project is being developed. The total buildable area of the first phase is 695.75 square metres, with apartment sizes ranging from 95 to 114 square metres, an average estimated selling price of EUR 1 550 per square metre, and a total projected sales revenue of EUR 1 090 000. More about the project here.

Progress of the project:

The houses currently under construction on the land plots Faustinos st. 13B, 13E and 13F are already registered, according to the data of the Centre of Registers, houses 13B and 13F are 51% complete and 13E is 48% complete. The house at Faustinos st. 13B has been completed after the last stage, with the rooms formed, the plaster rolled and the walls plastered. Wiring has been installed, floors concreted, plumbing laid and partial finishing has been achieved. At Faustinos st. 13F, the facade has been insulated, the roof has been insulated, the interior has been prepared for plastering, and the electrical wiring has been installed after the last stage. At Faustinos st 13E, the facade is halfway through, the materials for the roof insulation have been delivered to the semi-detached house, the interior is ready for plastering after the last stage, the exterior facade has started to be finished, all the communication networks have been installed, and the plastering has started. On plot Faustinos st. 13G, the foundations of the house have been poured, after the last stage the foundations have been poured, the exterior walls have been plastered and the roofing works have been finished.

To secure the interests of investors, real estate is pledged with a primary mortgage:

To secure the interests of investors, four plots of land with a total area of 41 acres and three semi-detached houses with a total area of 612.24 sq. m are pledged at Faustinos street, Skaidiskiu village, Vilnius district. According to an independent real estate appraiser, the value of the property pledged to investors is EUR 913 000.

Maximum planned amount of funding for the project: EUR 700 000. The project is funded based on the current mortgage valuation until it reaches the maximum LTV set. When maximum LTV is reached, a new valuation of the property will be required and further project funding stages will be announced and collected only if the maximum LTV set is not exceeded.

Interest by investment amount:

- From 100 EUR to 499 EUR – 8.5%

- From 500 EUR to 999 EUR – 9%

- From 1 000 EUR to 2 499 EUR – 9.5%

- From 2 500 EUR to 4 999 EUR – 10%

- From 5 000 EUR – 10.5%

Important: investments made separately are not aggregated.

We plan to collect the accumulated amount within 7 days with the possibility to extend it to 21 days without raising funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.