- Years of experience and professionalism: The project owner has implemented over 10 residential projects. This wide range of projects demonstrates the project owner's long-standing experience and professionalism in the real estate sector.

- Guarantee: The company director provides a personal guarantee for the entire loan amount.

- Equity: The project owner has invested approximately EUR 298,512 of their own funds in the project development, which clearly demonstrates their strong commitment and confidence in the project's success.

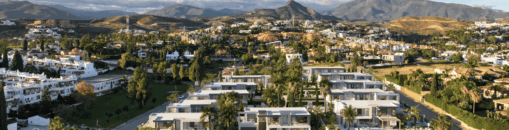

- High liquidity: Due to its attractive location and the growing Kaunas real estate market, this property has high liquidity.

Interest by investment amount:

– From 100 EUR to 299 EUR – 8.00%

– From 300 EUR to 749 EUR – 8.50%

– From 750 EUR to 3 499 EUR – 9.00%

– From 3 500 EUR to 11 999 EUR – 9.50%

– From 12 000 EUR – 10.00%

Important: investments made separately are not aggregated and cannot be pooled.

About the Project:

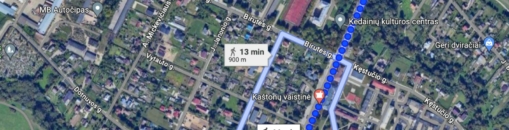

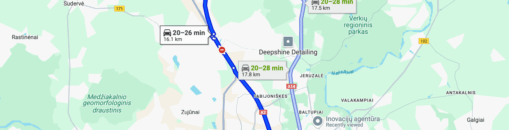

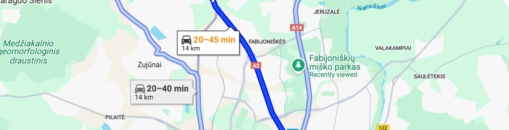

The project owner will allocate a portion of the collected funds to the company's working capital and the refinancing of an existing loan due to lower borrowing costs, while the remaining portion will be invested in the development of a 190.26 m² cottage (2 apartments) located at Uznerio st., Kaunas. Currently, the two apartments have a registered completion level of over 90% according to the data from the Register Centre. The project owner intends to furnish the apartments with modern appliances and furniture. Once these works are completed, the apartments will be put up for sale.

Loan Information:

This loan will be covered by the proceeds from the sale of the mortgaged property, which is estimated to reach EUR 550,000 including VAT. The interest to investors will be paid from the company's operating income.

The maximum planned project financing amount is EUR 346,000. The project is financed based on the current valuation of the mortgaged property until it reaches the specified maximum loan-to-value (LTV) ratio. Upon reaching the maximum LTV, a new property valuation will have to be performed, and further project financing stages will be announced and collected only if the specified maximum LTV is not exceeded.

We plan to raise the required amount within 7 days with the possibility of extending the term to 30 days if the funds are not raised.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.