- D12 is an apartment project being developed in Kaunas Dainava district. The funds for Phase II will be used for real estate development;

- The project is expected to generate sales revenue of EUR 1 600 000;

- Pre-bookings start this spring;

About the project owner:

The project owner has experience in real estate. The property owner has experience in real estate projects with a total area of approximately 2 000 square metres. He has implemented a number of residential single-family development projects, and together with his partners he has developed and successfully implemented a single-family house project „Zagrados namai” (Ireniskes village, Kaunas district).

About the project:

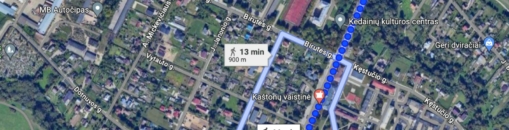

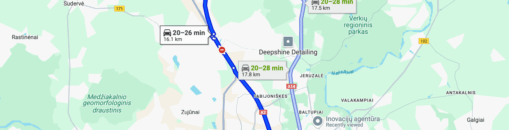

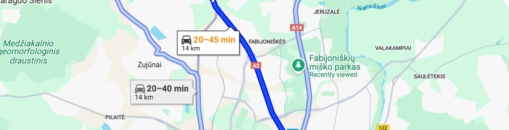

The owner of the project is developing an apartment building in a very convenient location in the city - Dubingiu Street, which borders Savanoriu Avenue, thus ensuring smooth access to the city centre and the surrounding districts. The Draugystes and Kalnieciu Parks are a 10-15 minute walk away. The apartment block will have three floors, 12 apartments in total. The average size of a two-room apartment will be 43 square metres, while a three-room apartment will be 62 square metres. The total area of the building is 659.30 square years and the useful floor area is 584.33 square metres. On the ground floor there are plans for warehouses and surface parking spaces.

Project objective:

The project owner has been working on this project for four years. In 2022, he obtained a building permit for the construction of an apartment building and a demolition permit for the demolition of the old structures on the land. Construction works started in Q4 2023. The development works are expected to be completed by the end of Q4 2024 and the sale of the apartments by the end of Q3 2025. The project is expected to generate sales revenues of approximately EUR 1 600 000.

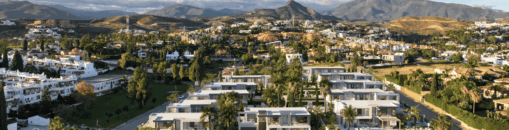

* Photos 1-3 show a visualisation of the project.

Project progress:

Up to this (first) stage of the project, the owner has purchased the land with his own funds, obtained all the necessary permits and paid the fees, demolished the old structures, levelled the land and installed the foundations. The project owner will use the funds raised in this phase for the construction of the walls and further co-construction works.

Maximum amount to be financed: EUR 810 950 (EUR 104 500 already raised). The project is financed on the basis of the current valuation of the collateral until it reaches the maximum LTV of 70%. Once the maximum LTV has been reached, a new appraisal will have to be carried out and further rounds of financing for the Project will only be advertised and collected if the set maximum LTV is not exceeded. The Loan to Value (LTV) with VAT for this stage is 47%.

Interest by investment amount:

– From EUR 100 to EUR 499 – 9.2%

– From EUR 500 to EUR 999 – 9.7%

– From EUR 1 000 to EUR 1 999 – 9.95%

– From EUR 2 000 to EUR 4 999 – 10.2%

– From 5 000 – 10.7%

Important: Individual investments are not aggregated and cannot be pooled.

We plan to raise the amount within 7 days, with the possibility of an extension to 21 days if the funds are not raised.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.