- The money raised will be used for working capital and real estate development;

- The developer has already acquired the Corner Hotel;

- The mortgaged property is located in the heart of the New Town. The Old Town of Vilnius is 850 metres away;

- The owner of the project has developed more than 15 000 square meters of real estate projects;

- The owner of the project plans to form separate property units (for acquisition/rental).

About the project owner:

The owner of the project has extensive experience in the real estate sector, having developed more than 15 000 square metres of real estate projects („Smilciu namai", „Palanga Dreams", „Nidos banga", „Loft factory"). Currently developing the „Basanaviciaus 28" project.

About the project:

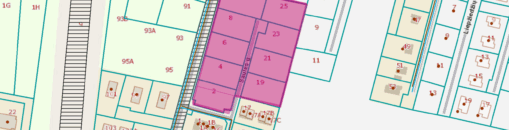

The owner of the project acquired the Corner Hotel. The project owner is currently seeking funding of EUR 994 800 for the development of the property. The developer will carry out renovation works on the building. The entire project includes a change of the hotel concept, refurbishment of the interior, introduction of a new business model, transformation of the property into a hybrid model, where part of the hotel rooms would operate as a hotel and part as a co-living project. Buyers will be able to purchase the property both for their own use and for rent. The restaurant will also be transformed into a gallery, restaurant and co-working space. The developer has similar experience and has developed a similar hotel concept in the project „Nidos banga". More about the project can be found here. The project is financed together with financial partner „NuCapital" (code I080), a closed-end investment fund for informed investors.

Competitive environment:

Naujamiestis remains one of the most popular districts for new construction and conversion projects. The recently opened business centres are home to Vinted, Nord Security, Tesonet and other IT technology companies, whose employees are not only from Lithuania. Seeing the demand for rental housing, new apartment buildings are being built in the district (sales prices EUR 2 900/4 750/sqm) and old factories and administrative premises are being converted (sales prices EUR 1 850/2 300/sqm).

Also, there is ~15% of supply for long and short term rentals in this district. After the reconstruction, it is planned that the project under development will also be adapted to co-living type premises. This housing model means that the tenant pays a fixed rent (utilities are already included). The corridor (gallery) room system of former hotels is very suitable for this segment, as tenants have both a private space (a room with amenities) and a common space (gym, kitchen, library, co-working centre, cinema). The cost of renting a room depends on the size of the room and the number of occupants, but is usually no less than EUR 26/sqm/month (or from EUR 500/month). The average rental price for a typical one-room apartment (26-36 sqm) in 2023 was ~450 euro/month (excluding utilities).

The maximum financed amount: EUR 1 550 000 (EUR 1 350 000 already raised). The loan-to-value ratio of the loan to the mortgaged property (4 704 square metres) is EUR 1 339.12/square metres, while the market value of the property according to Newsec's valuation is EUR 1 600.57/square metres. The price of the property to be sold after the development will be substantially higher than the maximum amount of the loan granted. The loan-to-value (LTV) without VAT ratio will not exceed 60% at this stage and 61% after the maximum loan has been granted.

Interest by investment amount:

– From EUR 100 to EUR 999 – 10.5%

– From EUR 1 000 to EUR 9 999 – 10.75%

– From EUR 10 000 to EUR 49 999 – 11%

– From EUR 50 000 – 11.25%

Important: investments made separately are not aggregated and cannot be pooled.

We plan to raise the amount within 7 days, with the option of extending it if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.