We present the tenth stage of the staged financing project “Butai Kaune”. The project owner seeks to implement another real estate project in Kaunas faster, so he refinances the existing loan. The amount to be raised at this stage is EUR 100 000.

Project owner:

The project owner has 5 years of experience in the field of real estate and manages a strong real estate development company. The owner's company purchased 4 172,16 sq. meters area 2 administrative premises at Elektrenu 8N, Kaunas. In 2020, carried out the conversion of administrative premises and formed and fully equipped 151 apartments for rent, 149 apartments are for rent. Permanent rental occupancy 95%. In general, during the first three quarters of 2021, the rental income was EUR 479 830. This income will repaid the cost of the loan.

The aim of the project:

The project owner is developing a new real estate project in Kaunas, Zemaiciu st. 31. In a brick, 4-story building, 3 517,95 sq meters reconstruction works will be carried out in the premises with an area of one meter. All apartments will be rented and the planned cost of the whole project is EUR 1 000 000.

Progress of the project:

The main current works of the project, address: Zemaites st. The ground floor apartments have fully equipped bathrooms, connected heaters, semi-equipped kitchens. (Photos of mortgaged property are attached)

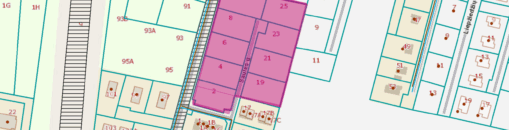

To protect the interests of investors, real estate is pledged:

Investors are pledged 151 apartments and 2 administrative premises in Elektrenu st. 8N, Kaune. The total area of the mortgaged premises is 4 172,16 sq. m. According to an independent real estate appraiser "Inreal" the value of the mortgaged property is EUR 3 807 300. All mortgaged apartments are fully finished and ready for life - they have all the necessary furniture and communications. The project is located in an infrastructurally convenient place in Kaunas - Petrasiunai, from which the main points of the city are easily accessible.

Important:

For new investors, the property will be temporarily pledged with a second mortgage, after refinancing all stages, all secondary mortgage holders - investors, will receive a pledge of the primary mortgage. The existing primary mortgage is administered by "Profitus", so all investments are protected.

Interest by investment amount:

- From EUR 100 to EUR 999 - 9%

- From EUR 1 000 to EUR 9 999 - 9,5%

- From EUR 10 000 - 10%

Important: investments made separately are not aggregated.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.