We present the fifth stage of the project "Bendoriu panoramos". The money raised will be used for the development of the RE project. The amount to raised at this stage is EUR 90 000.

The aim of the project:

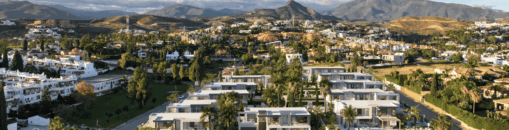

The owner of the project is developing 5 semi-detached houses on 5 plots of land with a total area of 52.36 acres. The area of four semi-detached houses, each apartment is planned to be 120 square meters, and the area of the remaining semi-detached house, each apartment is 145 square meters with a garage. The planned completion of construction works is 2022. IV quarter. The planned income from the sale of all duplexes is EUR 1 718 750.

Project progress:

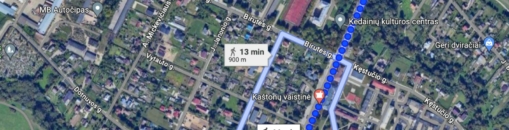

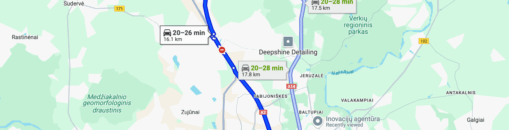

Currently, all plots of land have building permits, and the plots of land on Žirgyno g. 11, 13 and 13A have houses built and registered. According to the records centre, their registered completion rates are 54%, 52% and 54%. In the near future, the registration and evaluation of another built house will be carried out. The owner of the project intends to complete most of the construction work, build and register all the houses until winter, and during the winter carry out the construction and installation of the interior premises.

To ensure the interests of investors, real estate is pledged with a primary mortgage:

As a means of security, 5 plots of land with a total area of 52.36 acres are pledged to the investors at the address Zirgyno st. 7, 9, 11, 13, 13A, Vilnius district, as well as the house registered on land plot 13A and the houses under construction on plots 7, 9, 11 and 13 are mortgaged with a conditional mortgage. According to an independent real estate appraiser, the value of the mortgaged real estate is EUR 57 100.

The maximum amount we finance for the project is EUR 990 000. The project is financed according to the current valuation of the mortgaged property until it reaches the set maximum LTV of 70%. Once the maximum LTV is reached, a new valuation of the property will have to be carried out and the further stages of financing of the Project will be announced and collected only if the set maximum LTV is not exceeded. The loan-to-mortgage value ratio (LTV) at this stage is 59%.

Interest by investment amount:

- From EUR 100 to EUR 499 - 10%

- From EUR 500 to EUR 999 - 10,5%

- From EUR 1 000 to EUR 4 999 - 11%

- From EUR 5 000 to EUR 9 999 -11.5%

- From EUR 10 000 - 12%

Important: individual investments are not cumulative.

We plan to collect the collected amount within 7 days with the possibility of extending it until the 21st. without fundraising.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.