- According to the Centre of Registers, the apartments are 85% complete: The owner of the project is developing 3 apartments to be sold with full finishing, terraces and landscaped grounds. Estimated sales revenue of EUR 1 139 205 including VAT.

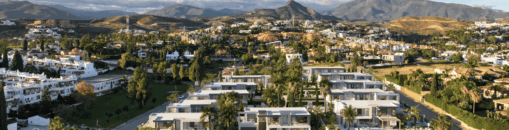

- The owner of the project plans to build a terrace for each apartment, adjacent to the Salotes Lake: A terrace overlooking Lake Salote will give each apartment a unique and exclusive feel. And enjoy the greenery, with parks, squares and other green areas in the vicinity, ideal for relaxation and leisure.

- Surety: The full amount of the loan is guaranteed by UAB Denerus, which has developed 4 residential projects in two years of operation.

About the project owner:

The company was founded in 2022, the main activity of the company is real estate development, development, construction, sales. The shareholder of the company has developed about 25 residential projects in Vilnius. The total area of the projects is about 20 000 m2.

About the project:

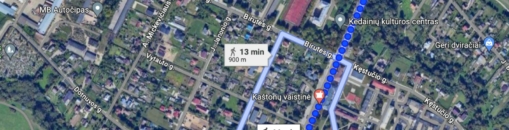

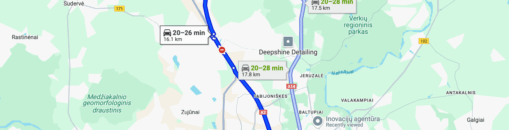

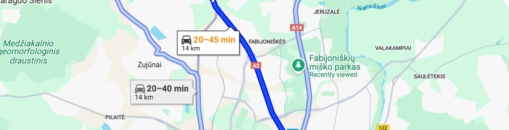

Project Objective to refinance an existing loan from another lender to secure lower interest rates and continue project development activities. The owner of the project is developing 3 apartments in the village of Raisiu. The apartments are 109.48 m2, 114.48 m2 and 186.93 m2. According to the data of the Centre of Registers, the registered completion rate of the three apartments is 85%. The developer intends to furnish the apartments to full completion and landscaping and sell them. This loan will be reimbursed from the proceeds of the sale of the mortgaged property and the interest will be paid to the investors from the operating income of the project owner.

The maximum amount to be financed: EUR 450 000. The project is financed on the basis of the current valuation of the collateral until it reaches the established maximum loan-to-value ratio of 70% LTV. Once the maximum LTV has been reached, a new valuation of the property will have to be carried out and further rounds of financing for the Project will only be advertised and collected if the set maximum LTV is not exceeded

Interest by investment amount:

– From EUR 100 to EUR 249 – 9.00%

– From EUR 250 to EUR 699 – 9.40%

– From EUR 700 to EUR 2 999 – 9.80%

– From EUR 3 000 to EUR 2 999 – 10.20%

– From EUR 10 000 to EUR 19 999 – 10.60%

– From EUR 20 000 – 11.00%

Important: investments made separately are not aggregated and cannot be pooled.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.